Bad Credit Florida FHA, VA, Private FL Mortgage Lenders

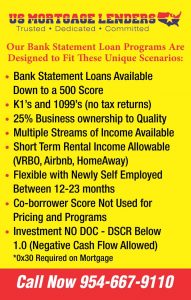

How Do I Get a Bad Credit Florida Mortgage No Tax Returns? Read More »

No Tax Return Florida Bad Credit Mortgage Lenders

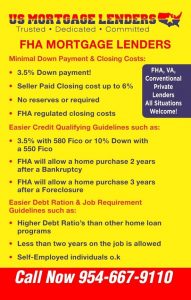

Bad Credit Florida FHA Mortgage Lenders

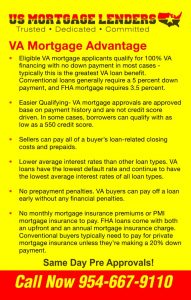

500+ Credit Bad Credit VA Mortgage Lenders

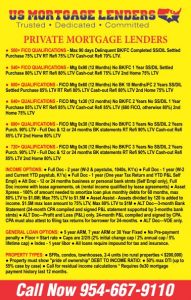

Bad Credit Florida Private Mortgage Lenders

Bad Credit Florida Cashout Refinance Mortgage Lenders

Florida Mortgage Approvals fter a Bankruptcy or Foreclosure, with 30,60,90,120 days late payments?

What Is The Best Mortgage For Bad Credit?

FHA, VA government-insured, and backed mortgage loans have the best interest rates saving those with bad credit the most money. FHA/VA requires a minimum 580 credit score and a decent payment history for the last most recent 12 to 24 months with exceptions for extenuating circumstances. These government bad credit loans require full documentation including most recent tax returns, pay stubs, and bank statements and in some cases can be manually underwritten. Even if you have a previous Chapter 13 Bankruptcy you could qualify after 12 months of payment history and a chapter 7 Bankruptcy requires a 24-month waiting time with reestablished credit.

What Would Disqualify Someone For A Bad Credit Mortgage?

The truth is if you can NOT show the willingness and ability to repay you will not get approved for a bad credit mortgage. Most bad credit mortgage lenders want to see at least 12 to 24 monthly timely payment history before you will qualify for a bad credit mortgage.

What Is A Bad Credit Mortgage Lender?

Bad credit refers to a person’s history of failing to pay bills on time, a bad credit Florida mortgage lender knows that there is a higher risk based on the borrower’s past payment history that there is a higher risk that they will make timely payments. Bad credit is often reflected in a low credit score.

Florida bad credit mortgage applicants will find it difficult to borrow money, especially at competitive interest rates, because they are considered riskier than other borrowers with timely payment history. This is true of all types of loans, including both secured and unsecured varieties, though there are options available for the latter.

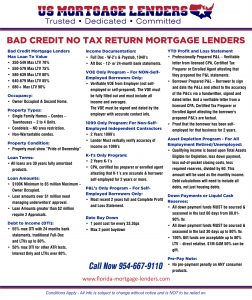

BAD CREDIT MORTGAGE LENDERS PROGRAMS INCLUDE:

- Bank Statement Only Bad Credit Florida Mortgage Lenders

- FHA Bad Credit Mortgage Lenders

- VA Bad Credit Florida Mortgage Lenders

- USDA Bad Credit Florida Mortgage Lenders

- Jumbo Bad Credit Florida Mortgage Lenders

- Hard Money Bad Credit Hard Money Lenders

- No Credit Score – Previous Bad Credit Florida Mortgage Lenders

- Condominium Florida Bad Credit Mortgage Lenders

- Town House Florida Bad Credit Mortgage Lenders

- Modular Home Florida Bad Credit Mortgage Lenders

- Chapter 13 FHA Mortgage Lenders

- Non-Warrant-able Condo Florida Bad Credit Mortgage Lenders

Bad Credit Florida Mortgage Lenders Serving All Florida Areas Including:

| All Florida | Manasota Key | Timber Pines | Stuart |

| Jacksonville | Crooked Lake Park | Flagler Beach | Southchase |

| Miami | Navarre Beach | Belleview | Auburndale |

| Tampa | Taft | Hutchinson Island South | Zephyrhills |

| Orlando | Punta Rassa | Samsula-Spruce Creek | Opa-locka |

| St. Petersburg | Baldwin | Lochmoor Waterway Estates | Warrington |

| Hialeah | Roseland | St. Augustine South | Lady Lake |

| Port St. Lucie | Franklin Park | South Sarasota | Niceville |

| Tallahassee | Yalaha | June Park | Longwood |

| Cape Coral | Bokeelia | Brookridge | Azalea Park |

| Fort Lauderdale | Mayo Florida | Connerton | Three Lakes |

| Pembroke Pines | Lake Hamilton | Plantation |

Bellair-Meadowbrook Terrace

|

| Hollywood | Rainbow Park | Ridge Wood Heights | Groveland |

| Miramar | Cypress Quarters | Big Pine Key | St. Augustine |

| Gainesville | Ocklawaha | Pea Ridge | West Park |

| Coral Springs | Hawthorne | Bay Hill | Lockhart |

| Lehigh Acres | Lake Butler | Butler Beach | Sunset Florida |

| Clearwater | Pierson | Mount Plymouth | Oldsmar |

| Brandon | Keystone Heights | Wauchula | Hobe Sound |

| Palm Bay | Old Miakka | Nassau Village-Ratliff | Callaway |

| Spring Hill | East Bronson | Fussels Corner | Homosassa Springs |

| Pompano Beach | Belleair Beach | Suncoast Estates | Thonotosassa |

| West Palm Beach | Buckhead Ridge | Dundee | Destin |

| Miami Gardens | Babson Park | Samoset | Villas |

| Lakeland | Glencoe | Lower Grand Lagoon | East Milton |

| Davie | Midway | Rainbow Springs and Stock Island | West Lealman |

| Boca Raton | Callahan | Clarcona | Olympia Heights |

| Riverview | DeLand Southwest | Charlotte Harbor | Gonzalez Florida |

| Sunrise | Mexico Beach | Pine Manor | Lakewood Park |

| Plantation city | Molino | Ridge Manor | Viera West |

| Deltona | Harlem Heights | Daytona Beach Shores | Mount Dora |

| Alafaya | Greenville | Gifford | Fruitville |

| Town ‘n’ Country | Solana | Fort Pierce South | Miami Springs |

| Miami Beach | Hastings | Parker | Atlantic Beach |

| Palm Coast | Paisley | Whitfield CDP | Palmer Ranch |

| Largo | Verandah | Mary Esther | Palmetto |

| Fort Myers | St. Leo | Taylor Creek |

Jensen Beach and Forest City

|

| Melbourne | Five Points | Madeira Beach | Iona |

| The Villages | Heritage Bay | Holmes Beach | Gladeview |

| Pine Hills | North Redington Beach | Laguna Beach | Yulee |

| Deerfield Beach | Astor | Indian Rocks Beach and Buckingham | Conway Florida |

| Boynton Beach | Redington Beach | Indian River Shores | South Daytona |

| Kendall | Indian Shores | Grant-Valkaria | North Palm Beach |

| Kissimmee | Juno Ridge | Moon Lake | Sarasota Springs |

| Lauderhill | Fanning Springs | Orangetree | Jupiter Farms |

| Weston | Pomona Park | Belleair | Elfers |

| Homestead | San Antonio | Jasper | Key Biscayne |

| Delray Beach | Gretna | Lake Sarasota | Cypress Lake |

| North Port | Kenwood Estates | Mulberry | Trinity Florida |

| Daytona Beach | Desoto Acres and Weeki Wachee Gardens | Crawfordville | Panama City Beach |

| Poinciana | Palm Beach Shores | Ave Maria | Fernandina Beach |

| Tamarac | Chokoloskee | Sawgrass | Wilton Manors |

| Jupiter | Webster | Nokomis | Middleburg |

| Wellington | Pine Lakes | Woodville | Goldenrod |

| Port Charlotte | North DeLand | San Castle | Gulfport |

| Port Orange | Black Diamond | Lake Panasoffkee | Viera East Florida |

| The Hammocks | Archer | Tierra Verde | Naranja |

| North Miami | Bronson | Wahneta | Holly Hill |

| Doral | Gun Club Estates | Balm | Orange City |

| Palm Harbor | Anna Maria | High Point | Minneola |

| Coconut Creek | Crescent Beach | Highland Beach | Lake City |

| Wesley Chapel | Black Hammock | Goulding | Laurel |

| Sanford | Harold | North River Shores | Shady Hills |

| Ocala | Bristol | Ridgecrest | Port Salerno |

| Fountainebleau | Lawtey | Harbour Heights | Cheval |

| Margate | Medley | Umatilla | Fuller Heights |

| Sarasota | Silver Springs Shores East | Alturas | South Miami and Lantana |

| Bonita Springs | Masaryktown | West Bradenton | Westview |

| Bradenton | Center Hill | Watergate | Florida City |

| Palm Beach Gardens | Garden Grove | Bagdad | Cocoa Beach |

| Tamiami | St. George Island | Zephyrhills North | Mango |

| Kendale Lakes | White Springs | Lake Clarke Shores | Lakeland Highlands |

| Westchester | Chumuckla | Juno Beach | Pine Castle |

| Pinellas Park Florida | Welaka Florida | Chipley Florida | Highland City |

| St. Cloud | Andrews | Rainbow Lakes Estates | Medulla |

| Pensacola | Waldo | Loxahatchee Groves | Pasadena Hills |

| Apopka | Coleman | Lely | Hudson |

| Country Club | Seville | Tiger Point | Lighthouse Point |

| Coral Gables | Bradenton Beach | Montura | Goulds |

| University CDP | Raleigh | St. James City | Pebble Creek |

| Ocoee | Gulf Stream | Holden Heights | Westwood Lakes |

| Titusville | North Key Largo | Port St. Joe | Celebration |

| Horizon West | Westlake | Cedar Grove | Doctor Phillips |

| Four Corners | Crystal Springs | Windermere | Satellite Beach |

| Fort Pierce | Scottsmoor | Kensington Park | On Top of the World |

| Oakland Park | Branford | Venice Gardens | Asbury Lake |

| Winter Garden Florida | Jupiter Island | Feather Sound | Union Park |

| North Lauderdale | Fort Braden | Ocala Estates | Memphis |

| Altamonte Springs | Matlacha | Vineyards | New Port Richey East |

| Cutler Bay | Cedar Key | Winter Beach | Gateway |

| Ormond Beach | Shalimar | Silver Springs | Avon Park |

| Winter Haven | Melbourne Village | Flagler Estates | West Vero Corridor |

| North Miami Beach | Cottondale | South Beach | Sebring |

| North Fort Myers | Grand Ridge | Woodlawn Beach | Sugarmill Woods |

| Greenacres | Wiscon | Blountstown | Cape Canaveral |

| Oviedo | Allentown | Ponce Inlet | Palatka |

| Valrico | Jennings | West DeLand | Progress Village |

| The Acreage | St. Lucie Village | Melbourne Beach | Miami Shores |

| Hallandale Beach | Duck Key | North Brooksville | Fairview Shores |

| Royal Palm Beach | Palmona Park | Frostproof | Bee Ridge |

| Plant City | Panacea | Hilliard | Milton |

| Meadow Woods | Briny Breezes | Bushnell | Rotonda |

| Land O’ Lakes | Lake Kathryn | Geneva | Bithlo |

| Lake Worth Beach | Waverly | Crystal River | Cypress Gardens |

| Kendall West | Homestead Base | Midway city and Hill ‘n Dale | Westgate |

| Egypt Lake-Leto | Marco Shores-Hammock Bay | Chattahoochee | Wimauma |

| Navarre | Rio | Malabar | Alachua |

| Aventura Florida | Bradley Junction and Fort White | Harbor Bluffs | St. Augustine Shores |

| Richmond West | Greensboro | Dover | Key Largo |

| Winter Springs | Wabasso | Biscayne Park | West Perrine |

| Clermont | Ponce de Leon | Grenelefe | Bardmoor |

| University | Indian Lake Estates | Point Baker | Richmond Heights |

| Dunedin | Cinco Bayou | Oakland | St. Pete Beach |

| Lauderdale Lakes | Glen St. Mary | Alva | Pine Ridge CDP |

| Panama City | Roeville | De Leon Springs | Beverly Hills |

| Cooper City | Paxton | Bal Harbour | Fruitland Park |

| South Miami Heights | Ona | Edgewood | Citrus Springs |

| Princeton | Penney Farms | Seminole Manor | Springfield |

| Carrollwood | Acacia Villas | Tangerine | Micco |

| Buenaventura Lakes | Vernon | Bowling Green | Hernando |

| Riviera Beach | Hosford | Pretty Bayou | Southeast Arcadia |

| Merritt Island | Hillsboro Pines | Port Richey | Miramar Beach |

| Golden Glades | Whitfield | Tangelo Park | Palm Beach |

| DeLand | Page Park | Indialantic | Orange Park |

| Estero | Stacey Street | Zellwood | Marathon |

| Fruit Cove | Greenwood | Bunnell | Fern Park |

| Parkland | Lake Mystic | Meadow Oaks | Lake Park |

| East Lake | Pinecraft | Island Walk | Gulf Gate |

| West Little River | Avalon | Hypoluxo | Indian Harbour Beach |

| Lake Magdalene | Schall Circle | Quail Ridge | Brooksville |

| Dania Beach Florida | Golden Beach | Madison Florida | North Merritt Island |

| Ferry Pass | Laurel Hill | Lake Helen | Green Cove Springs |

| Lakeside | Yankeetown | Olga Florida | Seffner |

| Miami Lakes | Bell and Lee | Greenbriar | Arcadia |

| Winter Park | Alford Florida | Eagle Lake | Broadview Park |

| Fleming Island | Beverly Beach | Bay Pines | West Miami |

| Golden Gate | Steinhatchee | Sharpes | North Bay Village |

| East Lake-Orient Park | Paradise Heights | Inverness Highlands North | Southwest Ranches |

| Vero Beach South | Fort Green Springs | Williston | Clewiston |

| Casselberry | Key Colony Beach | Harlem | McGregor |

| Oakleaf Plantation | Hampton | Bonifay | Odessa |

| Immokalee | Jay | Cleveland | Citrus Hills |

| Rockledge | Sea Ranch Lakes | Carrabelle | Wedgefield |

| Citrus Park | Ferndale | Vamo | North Weeki Wachee |

| New Smyrna Beach | Reddick | Cabana Colony | Williamsburg |

| Temple Terrace | Spring Lake | Big Coppitt Key | Lake Lorraine |

| Leisure City | Garcon Point | Wallace | Orlovista |

| Bayonet Point | Micanopy | Verona Walk | Inverness |

| Lakewood Ranch | Lemon Grove | Cross City | Sanibel |

| Sun City Center | Sopchoppy | Apalachicola | Wildwood |

| Ruskin Florida | Altha Florida | Dade City North | Longboat Key |

| Sebastian | Orchid | Eastpoint | Dade City |

| Coral Terrace | Lisbon | Florida Gulf Coast University | Quincy |

| Tarpon Springs | Canal Point | Hernando Beach | South Apopka |

| Keystone | Jupiter Inlet Colony | Pine Air | Lecanto |

| Haines City | East Williston | Hurlburt Field | Neptune Beach |

| Palm Springs | Chaires | Berkshire Lakes | Sky Lake |

| Bloomingdale | Winding Cypress | Vilano Beach | Fort Pierce North |

| Palm City | Cloud Lake | Eglin AFB | Inwood |

| Silver Springs Shores | Wausau | Freeport | West Samoset |

| South Bradenton | Lake Hart | Haverhill | Willow Oak |

| Ives Estates | Windsor and Pioneer | Lake Mack-Forest Hills | Mims |

| Crestview | Brownsdale | Williston Highlands | Belle Isle and River Park |

| Wright | Gardner | Polk City | Indiantown |

| Northdale | Fisher Island | Eatonville | South Patrick Shores |

| Palm River-Clair Mel | Wacissa | Watertown | Inverness Highlands South |

| Key West Florida | La Crosse | Dunnellon | Fort Myers Beach |

| Palmetto Bay | St. Marks | Virginia Gardens | Beacon Square |

| Wekiwa Springs | McIntosh and Matlacha Isles-Matlacha Shores | Chiefland | St. Augustine Beach |

| Port St. John | Westville | Belleair Bluffs | Ormond-by-the-Sea |

| Edgewater Florida | Manalapan | Lake Placid Florida | Vero Lake Estates |

| Oak Ridge | Limestone | Moore Haven | Live Oak |

| Venice | Brooker | North Sarasota | Treasure Island |

| Jacksonville Beach | Floridatown | Astatula | Heathrow |

| Fish Hawk | Hillcrest Heights | Campbell | Perry Florida |

| Hialeah Gardens | Miccosukee | Monticello | Loughman |

| Apollo Beach | Esto | Pelican Marsh | Fort Myers Shores |

| West Melbourne | Capitola | Pine Island Center | Macclenny |

| Westchase | Spring Ridge | Mangonia Park | Gulf Breeze |

| Leesburg | Worthington Springs and Munson | Silver Lake | Pembroke Park |

| The Crossings | Trilby | Holley | Lauderdale-by-the-Sea |

| Lutz | Noma | Havana | DeFuniak Springs |

| Jasmine Estates | Ocean Breeze | Graceville | South Bay |

| West Pensacola | Golf | Cudjoe Key | Southgate |

| Fort Walton Beach | Waukeenah | Zolfo Springs | Marianna |

| Pace | Pineland | Sewall’s Point | Lely Resort |

| Sunny Isles Beach | Jacob City | Burnt Store Marina | Indian River Estates |

| Brent | Caryville | Sneads | Kathleen |

| Naples | Pittman | Redington Shores | Naples Manor |

| Lealman | Yeehaw Junction | Bear Creek |

Islamorada, Village of Islands

|

| Ensley | Homeland | Manatee Road | Pahokee |

| Bellview | Everglades | Malone | Pelican Bay |

| Florida Ridge | Ebro | Lake Belvedere Estates | Osprey |

| DeBary | Raiford | Tyndall AFB | Crystal Lake |

| Eustis | Goodland | Roosevelt Gardens | Jan Phyl Village |

| Holiday | Campbellton | El Portal | Combee Settlement |

| Liberty Triangle | Glen Ridge and Highland Park | Tropical Park | Fort Meade |

| Lynn Haven | Nobleton | Trenton | Naples Park |

| Sweetwater | Fort Green | Oak Hill | Tequesta |

| Palm Valley | Berrydale | Washington Park | South Gate Ridge |

| Bayshore Gardens | Fidelis | Gotha | Newberry |

| Cocoa | Captiva | Fort Denaud | Mascotte |

| Punta Gorda | Aucilla | Grove City | Lake Alfred |

| Hunters Creek | Charleston Park | Century | Ocean City |

| Belle Glade | Morriston | Tavernier | Cocoa West |

| Bartow | Day | Hillsboro Beach | High Springs |

| Englewood | Aripeka | Chuluota | South Highpoint |

| Midway CDP | Okahumpka | Lake Mary Jane and Montverde | Bay Harbor Islands |

| Bradfordville | Sorrento | Desoto Lakes | Ellenton |

| Pinecrest | Mount Carmel | Atlantis | Palm Springs North |

| Marion Oaks | Otter Creek | Charlotte Park | Fellsmere |

| World Golf Village | West Canaveral Groves | Wabasso Beach | Valparaiso |

| Seminole | Pine Level | South Palm Beach | Surfside |

| Country Walk | Lloyd | Lake Kerr | Rio Pinar |

| San Carlos Park | Mulat | Interlachen | Siesta Key |

| Upper Grand Lagoon | Sumatra | Howey-in-the-Hills | Okeechobee |

| Gibsonton | Layton | Homosassa | Whiskey Creek |

| Marco Island | Bascom | Heritage Pines | Davenport |

| Safety Harbor | Belleair Shore | Pine Ridge | Starke |

| Maitland | Springhill | Inglis | Zephyrhills West |

| Lake Butler CDP | Horseshoe Beach | Wewahitchka | Tice |

| Glenvar Heights | Altoona Florida | Crescent City and Limestone Creek | Three Oaks and River Ridge |

| Brownsville | Dickerson City | Lacoochee | Warm Mineral Springs |

| Tavares | Istachatta Florida | Oriole Beach | Zephyrhills South |

| Vero Beach | Lake Harbor Florida | Key Vista Florida | The Meadows |

| Myrtle Grove | Pine Island | Plantation Mobile Home Park | Port LaBelle |

| Pinewood | Cobbtown | Boulevard Gardens | LaBelle |

| Lake Mary | Tildenville and Bay Lake | Patrick AFB and Ocean Ridge | Floral City |

| Ojus | Indian Creek and Dixonville | East Palatka | Pensacola Station |

| Nocatee | Lamont | Palm Shores | Kenneth City |

| South Venice | Lazy Lake | Royal Palm Estates | South Brooksville |

| New Port Richey | Plantation Island | Christmas | White City |

| Lake Wales | Marineland | Timber Pines | South Pasadena |

| Palmetto Estates | Lake Buena Vista | Flagler Beach | Cortez |

| Hollywood Florida | Weeki Wachee Florida | Belleview | Stuart Florida |