3.5% Hollywood Florida FHA Mortgage Lenders – Hollywood FL FHA Mortgage Lenders

4 C’S HOLLYWOOD FLORIDA FHA MORTGAGE LENDER REQUIRMENTS CHECKLIST

1-Collateral/FHA Approved Property Types Include- Single family homes, Townhomes, villas, 1-4 family multi Unit Homes, and FHA Approved Condos!

2-FHA Minimum Cash/Down payment Or Equity -FHA 3.5% Down Payment Cash or 20% Equity/ 80% LTV for cash out or 96.75% Rate term Refinance- Verity the borrower has the down payment from acceptable source on a purchase or enough equity to cover payoffs and closing cost to include taxes insurance on a refinance.

3-FHA Minimum Credit 500+ Credit Score – Does the borrower have the minimum credit score to meet the loan program? Does the borrower have collections that have to be paid off that will reflect the cash needed to close? Do student loans that are deferred need to be added to the monthly obligations? Does the lender require %1 cumulative student loans or 5% of the cumulative collections accounts over +$2000 added back to the debt to income ratios.

4-Capacity-56.9% FHA Maximum- Does the FHA mortgage applicants debt to income ratio meet the loan program requirements or no more debt than 56.9% of the total housing + all monthly payments reflected on the FHA mortgage applicants credit report.

FLORIDA HOME BUYERS ASK EVERY DAY, “WHAT IS THE MINIMUM CREDIT SCORE FOR AN FHA MORTGAGE”?

The FHA mortgage applicant is not eligible for FHA-insured financing if the Minimum Credit Score is less than 500. If the Minimum FHA Mortgage Credit Score is between 500 and 579, the FHA mortgage applicant is limited to a maximum loan-to-value (LTV) of 90 percent. If the Minimum FHA Mortgage Credit Score is at or above 580+ the FHA mortgage applicant is eligible for maximum financing.

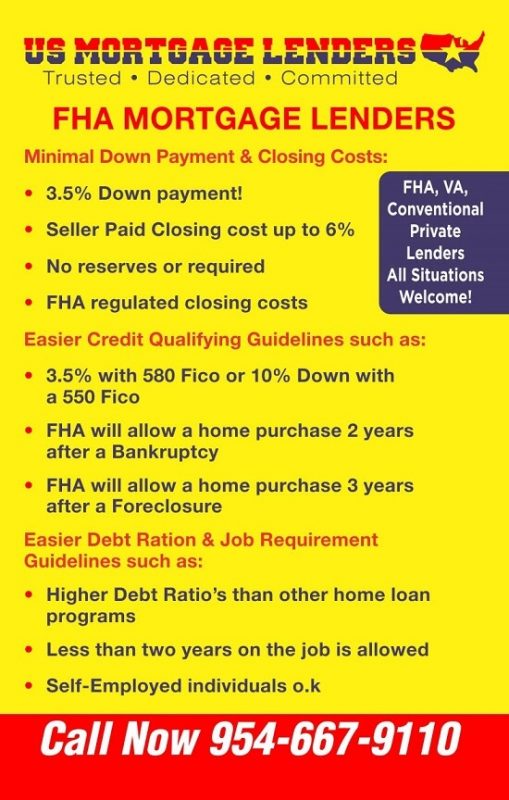

FLORIDA FHA MORTGAGE LOANS HAVE MINIMAL DOWNPAYMENT AND CLOSING FEES:

- The down payment is only 3.5% of the purchase price.

- Gifts from family or Grants for down payment assistance and closing costs are OK!

- The seller can credit HOLLYWOOD Fl buyers up to 6% of sales price towards buyers’ costs.

- No reserves or future payments in the account are required.

- FHA regulated closing costs.

FLORIDA FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN:

- Purchase a Florida home 12 months after a chapter 13 Bankruptcy

- Purchase a Florida 24 months after a chapter 7 Bankruptcy.

- FHA will allow an FHA mortgage 3 years after a Foreclosure.

- Minimum FICO credit score of 580 is required for 96.5% financing.

- Bad credit Florida minimum FICO credit score of 500 is required for 90% FHA financing.

- No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

FLORIDA FHA MORTGAGE LOANS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any other Florida home loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify for FHA.

- Check Florida FHA Mortgage Articles for more information.

• LOWEST DOWN PAYMENT OPTION

The Federal government insures Florida FHA mortgage lenders against losses, therefore the FHA mortgage applicants has very minimal down payment and closing cost. FHA mortgages require a minimum 3.5% financial commitment from the applicant. FHA mortgage lenders allow for the home seller to pay all your closing cost up to 6% of the sale price enough to cover 100% of your FHA mortgage closing cost!

• EASIER TO QUALIFY

Prequalifying with a Florida FHA mortgage lender is rather easy. The result of the FHA mortgage insurance guarantee educes Florida FHA mortgage lenders to make it feasible for just about anybody with a decent 12-month payment history to qualify. The primary components of an FHA mortgage include down payment, credit, and debt to income-ratio.

• FIXED 30-YEAR RATES WITH NO PREPAYMENT PENALTIES

One of the big advantages of using a Florida FHA mortgage lenders is the benefit of having a fixed 30 year interest rate with 0 NO prepayment penalty. In comparison to other conventional Fannie Mae and Freddie mac mortgage loans in which you risk the possibility of a mortgage rate that could change. The FHA mortgage is typically for 30 years. The result of this FHA mortgage provision FHA mortgage applicants can budget their predetermined installment FHA mortgage payment in advance.

• NO RESERVES ARE REQUIRED

In contrast to most conventional home loan programs, Florida’s FHA home loan is a very tempting option for Florida first time buyers that have a little saved for down payment let alone future mortgage payments.

Florida First Time buyers should click apply now at the top of this website to learn what to expect with the FHA mortgage process. Being prepared will always boost your chances in getting your FHA mortgage approved.

CATEGORY: GUIDELINES Hollywood FL FHA Mortgage Lenders

Hollywood FL FHA Mortgage Lenders Compensating Factors

FHA COMPENSATING FACTORS What are FHA compensating factors? (FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application) but it’s more complicated than that. Different FHA Lenders manage the consideration of compensating factors in different ways. FHA’s written guidelines outline specific examples of what FHA compensating factors…

Hollywood FL FHA Mortgage Lenders Manual Underwriting Approvals

FHA Manual Underwrite Lenders Specifications CREDIT SCORE RANGE MAXIMUM QUALIFYING RATIOS APPLICABLE GUIDELINE 500 – 579 ·31/43 ·Energy Efficient Homes may stretch ratios to 33/45 ·Max LTV 90% unless cash out (80%) ·No gifts ·No down payment assistance ·No streamlines ·One month in reserves for 1-2-unit Properties, three months in reserves for 3-4-unit properties (cannot be a…

Hollywood FL FHA Mortgage Lenders Allow Non Occupant Co Borrowers

Hollywood FL FHA Mortgage Lenders Non-Occupant co borrower 1-Unit properties only. Max mortgage is limited to 75% LTV unless non-occupying co- borrower’s meet FHA definition of ‘family member’. Seller cannot be non-occupant co-borrower. Non-occupant co-borrowers may be added to improve ratios. Non-occupant co-borrowers cannot be used to overcome or offset borrower’s derogatory credit. The non-occupying borrower arrangement…

Hollywood FL FHA Mortgage Lenders Source Of Down Payment And Reserves

Assets Minimum cash investment from borrowers own funds and/or gift (no cash on hand allowed when borrower uses traditional banking sources and has traditional credit history). Any deposit 1 % and greater of the sales price must be sourced and seasoned. An aggregate of deposits 1 °/o and greater of the sales price must be…

Hollywood FL FHA Mortgage Lenders Can Use Non Taxable Income To Qualify

Non-Taxable Income Nontaxable income such as Social Security, Pension, Workers Comp and Disability Retirement income may be grossed up 115%. Unacceptable Sources of Income Include: The following income sources are not acceptable for purposes of qualifying the borrower: Any unverified source of income, Income Income determined to be temporary or one-time in nature, Retained earnings…

Hollywood FL FHA Mortgage Lenders Debt To Income Ratios

Debt Ratio – Loans with AUS Approve/Eligible – follow AUS decision. Credit scores of 640 and under and DTI greater than 43% regardless of AUS decision require explanation for derogatory credit and a VOR or rent free letter (if applicable). Manually underwritten loans with FICO score> 580 may exceed 31°/o/43°/o ratios with acceptable compensating factors…

Hollywood FL FHA Mortgage Lenders Cash-Out Refinance Payment History

Hollywood FL FHA Mortgage Lenders Mortgage/Rental History Payment History All Cash Out Refinance Transactions and Manually Underwritten Rate Term Refinance Transactions: No 30 Day late payments within the last 12 months of case number assignment. Rate and Term Refinance Transactions: AUS Accept – follow AUS.

Hollywood FL FHA Mortgage Lenders Minimum Trade Line Requirement

Minimum Tradelines Hollywood FL FHA Mortgage applicants must have sufficient credit history to generate a valid FICO score, or Hollywood FL FHA Mortgage applicants must meet the non-traditional Hollywood FL FHA Mortgage lenders guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Authorized tradelines are not acceptable for establishing a…

Hollywood FL FHA Mortgage Lenders With Student Loans

How Do Hollywood FL FHA Mortgage Lenders treat Student Loans? Student Loan Payments – Student loan(s) would be calculated as follows, regardless of the payment status. Hollywood FL FHA Mortgage lenders must use either the greater of: 1% of the outstanding balance on the loan; or the monthly payment reported on the Hollywood FL FHA Mortgage applicants credit report; or the…

Hollywood FL FHA Mortgage Lenders Approval With Disputed Accounts

Hollywood FL FHA Mortgage Lenders Approval With Disputed Accounts derogatory accounts >= $1,000 cumulative must be downgraded to “Refer” manual underwrite. Medical and accounts resulting from identity and credit card theft or unauthorized use are excluded. A letter from the creditor, police report, etc. is required. Disputed non-derogatory accounts are excluded from the $1000 cumulative total which…

Hollywood FL FHA Mortgage Lenders Approval With Loan Modifications

Hollywood FL FHA Mortgage Lenders Approval After A Loan Modifications Hollywood FL FHA Mortgage Lenders Automated Underwriting System required to follow guidance for acceptable mortgage history. Manual Underwrite -follow manual mortgage requirements (Ox30 for most recent 12 months and 2×30 for the most recent 24 months on the modified mortgage.) Payment history is evaluated based upon the modification agreement…

Hollywood FL FHA Mortgage Lenders Qualifying Requirements After A Short Sale

Hollywood FL FHA Mortgage Qualifying After A Short Sale Any Short Sale within three (3) years of the case assignment requires a manual underwrite. An Hollywood FL FHA Mortgage applicant who is in default at the time of short sale/restructure or pre-foreclosure or late on any mortgage or installment obligations within 12 months of the short sale is not…

Hollywood FL FHA Mortgage Lenders After Foreclosure or Deed In Lieu of Foreclosure

What are the guidelines for Hollywood FL FHA Mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure? A Hollywood FL FHA Mortgage applicants is generally NOT eligible for a new FHA-insured mortgage if the Borrower had a foreclosure or a deed-in-lieu of foreclosure in the last 3 three-year period prior to the date of case number assignment. This…

Hollywood FL FHA Mortgage Lenders DoNot Consider Timeshares A Housing Obligation

Is a foreclosure on a timeshare considered a mortgage foreclosure or installment loan? A loan secured by an interest in a timeshare must be considered an Installment Loan and not a housing obligation, even in the event of a foreclosure. For additional information see Handbook 4000.1 II.A.4.b.iv(I); II.A.5.a.iv(H) at https://www.hud.gov/program_offices/administration/hudclips/handbooks/hsgh

Hollywood FL FHA Mortgage Lenders With Judgements And Liens

Judgments/Liens All outstanding judgments and liens must be paid prior to or at closing except when the Hollywood FL FHA Mortgage applicant has an agreement with the creditor to make regular and timely payments. Copy of the agreement and a minimum of three (3) monthly scheduled payments prior to closing. This includes non-purchasing spouses and registered domestic…

Hollywood FL FHA Mortgage Lenders Disputed Credit Accounts

How are disputed credit accounts considered with Hollywood FL FHA Mortgage lenders? Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report indicates that the Borrower is disputing derogatory credit accounts, the Borrower must provide a letter of…

Hollywood FL FHA Mortgage Lenders Approval With Collection Accounts

Hollywood FL FHA Mortgage Lenders Approval W Collection Accounts Collections AUS Approve/Eligible – The Hollywood FL FHA Mortgage Lenders Approval with Collection accounts must complete a capacity analysis off collection accounts with an aggregate balance>= $2,000. Non-purchasing spouse’s or registered domestic partner’s collections are included in the combined balances for community property states. Monthly payments must be included in…

Hollywood FL FHA Mortgage Lenders Credit Score For Hollywood FL FHA Mortgage Qualifying

Does FHA require a minimum credit score and how is it determined? The Hollywood FL FHA Mortgage applicant is not eligible for FHA-insured financing if the Minimum Credit Score is less than 500. If the Minimum Hollywood FL FHA Mortgage Credit Score is between 500 and 579, the Hollywood FL FHA Mortgage applicant is limited to a maximum loan-to-value (LTV) of…

Hollywood FL FHA Mortgage Lenders For DACA Status Recipients

FHA to Permit DACA Status Recipients to Apply for FHA Insured Mortgages Effective January 19, 2021, the Federal Housing Administration (FHA) is permitting DACA Hollywood FL FHA Mortgage applicants classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the U.S. Citizenship & Immigration Service (USCIS) and are legally permitted to work in the U.S. are…

Hollywood FL FHA Mortgage Lenders While In Consumer Credit Counseling

How long do Hollywood FL FHA Mortgage require to qualify for an Hollywood FL FHA Mortgage after consumer Credit concealing? Qualify for an Hollywood FL FHA Mortgage after consumer Credit counseling? 1 year of the pay-out has elapsed under the plan, borrower’s payment performance has been satisfactory with all required payments made timely and borrower has received written permission from the…

Hollywood FL FHA Mortgage Lenders Approval After Bankruptcy

For Hollywood FL FHA Mortgage Lenders Approval After Bankruptcy How does a bankruptcy affect a Hollywood FL FHA Mortgage applicants eligibility for an Hollywood FL FHA Mortgage? A Chapter 7 bankruptcy (liquidation) does not disqualify a Hollywood FL FHA Mortgage applicants from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least 2 years have past since the date…

Hollywood FL FHA Mortgage Lenders Lead Based Paint Disclosure

Lead based Paid Disclosure Required for Defective Paint Surfaces An automatic correction is required to all defective paint surfaces in or on structures and/or property improvements built before January 1, 1978. Contractors who perform the repair must be certified and must follow specific work practices to prevent lead contamination. A copy of the EPA or…

Hollywood FL FHA Mortgage Lenders To Purchase Foreclosures

Hollywood FL FHA Mortgage lenders require FHA appraisals to be performed only by FHA licensed appraiser listed on the FHA roster. Obtain an “as-is” appraisal and the appraisal must be HUD REO Appraisal and Property Requirements marked as “Insurable”. HU D’s Foreclosure REO appraisal may be available at no charge. If the original HUD REO appraisal is…

Hollywood FL FHA Mortgage Lenders For Homes For Sale Within 90 Days

Does FHA have requirements for homes sold within 90 days? Property Flipping is a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value Property Flipping refers to the purchase and resale of a property in a short period of time. The eligibility of a property for a Mortgage…

Hollywood FL FHA Mortgage Lenders For Manufactured Homes

Hollywood FL FHA Mortgage Lenders For Manufactured Homes Hollywood FL FHA Mortgage Lenders accepts manufactured homes permanently affixed to the foundation, built on or after June 15, 1976, and meet all Hollywood FL FHA Mortgage Lenders For Manufactured Homes requirements. Single-wide manufactured homes are not eligible. Manufactured homes with acceptable alterations or additions must have marketability, “like” comparable, gross living area…

Hollywood FL FHA Mortgage Lenders For Condos

FHA Condo Mortgage Lenders – Condo Hollywood FL FHA Mortgage Lenders Must be current FHA-approved condominium complex and meet all HUD requirements (51 occupancy, 15% delinquencies). All condos and attached PUD’s require 100% ‘walls-in’ H06 coverage. Stick-built site condos do not require FHA HRAP/DELRAP approval. Manufactured condos must have FHA HRAP approval. Where can I find the…

Hollywood FL FHA Mortgage Lenders Ineligible Property Types

Ineligible Collateral -Hollywood FL FHA Mortgage Lenders Ineligible Property Types to include some built before June 15, 1976 single wide Mobile homes, co-ops, Single-wide manufactured homes, houseboats, commercial or industrial zoned properties, mixed-use with residential building use less than 51%, properties encumbered with Property Assessed Clean Energy (PACE) or Home Energy Renovation Opportunity (HERO) obligations, State-approved medical…

Hollywood FL FHA Mortgage Lenders Eligible Property Types

Owner Occupied Only Home Only To Include. 1-4 Units. Villas including FHA approved PUD’s, FHA approved condominiums projects, land contracts, FHA approved manufactured , modular homes (minimum double Eligible Collateral wide) that follow manufactured housing requirements below.

Hollywood FL FHA Mortgage Lenders Maximum Loan Amounts

Hollywood FL FHA Mortgage Lenders Maximum Hollywood FL FHA Mortgage amounts. # of Units Lowest Maximum Floor for All Hollywood FL FHA Mortgage Amounts Highest Maximum Ceiling for All Hollywood FL FHA Mortgage Highest FHA Maximum Ceiling for all FHA. 1 Unit 356,362 548,250 822,375 2 Units 456,275 702,000 1,053,000 3 Units 551,500 848,500 1,272,750 4 Units 685,400 1,054,500 1,571,750 FHA Max Base…

Hollywood FL FHA Mortgage Lenders Loan To Value Based On Credit Scores

Hollywood FL FHA Mortgage Lenders to Purchase A home Hollywood FL FHA Mortgage LENDERS PURCHASE MINIMUM FICO 500 = 90.00% 1-4 UNITS. PER FHA MAX COUNTY LIMITS FOR STANDARD PROGRAM. AUS Accept: Per AUS; Manual max Debt To Income Ratios:31%/43% Evaluated by **Hollywood FL FHA Mortgage Lenders Automated Underwriting System** Hollywood FL FHA Mortgage LENDERS MINIMUM FICO 580 = 96.50% 1-4 UNITS. PER…

- Hollywood FL FHA Mortgage Lenders Compensating Factors

- Hollywood FL FHA Mortgage Lenders Manual Underwriting Approvals

- Hollywood FL FHA Mortgage Lenders Allow Non Occupant Co Borrowers

- Hollywood FL FHA Mortgage Lenders Source Of Down Payment And Reserves

- Hollywood FL FHA Mortgage Lenders Can Use Non Taxable Income To Qualify

- Hollywood FL FHA Mortgage Lenders Debt To Income Ratios

- Hollywood FL FHA Mortgage Lenders Cash-Out Refinance Payment History

- Hollywood FL FHA Mortgage Lenders Minimum Trade Line Requirement

- Hollywood FL FHA Mortgage Lenders With Student Loans

- Hollywood FL FHA Mortgage Lenders Approval With Disputed Accounts