Short-Term Florida Investment Condo Lenders

We get this question all the time, What Is A Condotel?

Condotels are like condominiums that operate more like a hotel. Unit owners also have the option to place their unit in the hotel’s rental property where the unit is rented out like any other hotel room individuals own each unit, although the complex shares amenities like a registration desk, lobby registration, and cleaning services. When owners are away, they have the option to make income by renting their condotel as a short-term lease for vacation stays. Condotel owners have the option to rent the units out while not occupying them in order to generate income. Florida Condotels are often treated like second homes and or investments and are quickly growing among Florida vacationers looking for shorter rental income investments in Florida real estate.

Condotel Florida Mortgage Lenders Requirements:

- FULL Doc Or DSCR use the condotel short-term rental income to qualify!

- Minimum 25% Downpayment or Max 75% LTV

- Always treated as Investments

- Minimum 100k+ Loan amounts!

- Minimum FICO 680

- 30 Year-Fixed Options are available

- Purchase, Rate Term, and Cash-Out Refinance options are available

- Condotels must have a min 500sq feet and have a full kitchen with a full stove

- Homeowners Association must not limit the days the unit can be accessed

Ineligible Florida Condotel Projects

- Projects that contain the word hotel or motel in the name.

- Projects that restrict the owner’s ability to occupy the unit

- Projects with mandatory pooling agreements require owners to either rent their units or give management firm control over the unit occupancy.

- Project with non-incidental business operations operated by the owners association such as a restaurant, spa, health club etc.

- Common interest apartments

- Timeshare or segmented ownership objected.

Short Term Florida Condotel Income Calculation

● Average 12 to 24 months deposits. Take 75% of the total income, Then Subtract – Taxes, Subtract – Insurance – HOA = Total income used for mortgage qualifying! NO Tax Returns are Needed to Qualify!

● No below-average properties

● Minimum $50,000 equity required

Florida Condotel Mortgage Terms

● 30-Year Fixed

● All loans require impounds for tax and insurance

AIRBNB SHORT-TERM LEASE LOAN AMOUNTS:

● $100,000—$3,000,000

Condotel Housing Credit Events

● Housing history—0x30. For housing delinquency, see pricing adjustments.

● Bankruptcy/Foreclosure—2-year seasoning. For less than 2 years, see

pricing adjustments.

● Short Sale/Deed-in-Lieu/Modification—2-year seasoning. For less than 2

years, see pricing adjustments.

● Forbearance <1 Year—

Condotel Income and DTI Events

● Max of 50% DTI, 55% allowed with LTV up to 75%

No Income Verification Florida Condotel Mortgage Lenders

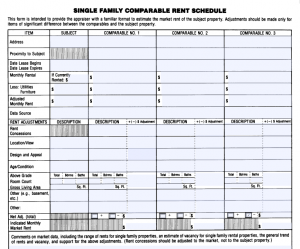

Our No Income Verification Florida Investor DSCR Lenders, No Ratio Lenders allow Florida investors to qualify based on their rental income. No personal income or Tax returns are needed to qualify. The lender uses the current rent schedule if available or will order a 1007 rental comparable appraisal. This saves you from submitting complicated income statements and tax returns.US Mortgage Lenders LLC offers Alternative Options for Florida Real Estate Investors.

Popular Florida Mortgage Options Include:

-

Bank Statement Florida Mortgage Lenders– Use bank statement deposits to qualify.

-

1099 Mortgage Lenders: Use 1099 use Income up to 100% deposits for income.

-

Florida Condo Mortgage Lenders:: Non-Warrantable: Condotel:: Co-op

-

FHA Mortgage loans have easier qualifications / FHA Refinance down to 500+ Credit

-

Self Employed Mortgage: If you write off too much of your income.

-

VA 100% Mortgage loans for Qualified Veterans with No PMI -VA Loan Limits 806,500

-

Conventional: Fannie Mae or Freddie Mac – Conforming Loan Limit 806,500

-

Jumbo: Mortgages and Alt doc super jumbo loans over $806,500 up to $50 Million

-

USDA Rural Florida 100% Mortgage options.

-

No Income: No doc, stated Florida no Income verification Mortgage Lender

-

NO tax return: Non-QM and private lenders offer alternative documentation.

-

VOE: Allow your VOE to disregard your tax return write-offs.

-

Bank Statement: Use 12 or 24 average bank deposits for mortgage income.

-

Pledged Assets: Assets in your account to qualify.

-

P&L Only: Use Your licensed Tax preparer Profit and Loss to qualify.

-

DSCR NO Income Investor: Use the subject property’s income for your next investment.

-

Foreign National: Nonresidents can invest purchase or cash out.

-

Commercial: Options for Florida office buildings, shopping centers, and warehouses.

-

Reverse Mortgage Condo: 55+ Florida Condo mortgages with no monthly payments.

-

Bad Credit: Bad Credit mortgage approvals based on payment history.

-

Non-warrantable Florida Condos: That don’t meet Fannie Mae or Freddie Mac specifications.

-

Condotel Mortgage Options: Unit owners can rent out their units to short-term guests

-

Cross Collateral: – Up to 90% financing when pledging more than one property for collateral.

-

Bridge-to-Sale – Help clients access their listed property’s equity before its sale.

-

Foreign National – Non-Resident– Jumbo Super Jumbo refinance up to 15 MM with CPA letter.

-

Asset Depletion– Increase client purchasing power by calculating assets into qualifying income.

-

Cross-Collateralization- Access Jumbo home equity without having to sell first.

-

Condo Condotel – Super Jumbo Condo and Condotel Florida mortgage lenders for Unique properties.

-

Pledged Asset – Jumbo cashouts up to 90%(stocks, mutual funds, etc.) without liquidating.

-

Refinance Florida Home While Listed For Sale – Cashout refinance a Florida home while listed on the MLS.

-

3.5% Down Self-Employed, ITIN, Florida Owner Financing Mortgage Program