Bad Credit Florida FHA Mortgage Lenders Requirments

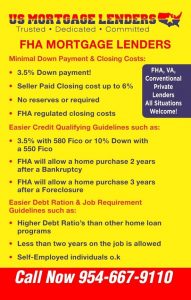

Cash – Minimum 3.5% Down with 580+ Credit Score and seller paid closing cost up to 6%.

Credit – Minimum 500+ Bad Credit score w 10% down or 3.5% down with min 580+ Credit score.

Capacity – Maximum Debt to income ratio with FHA is 46.9 front end and 56.9% back end with AUS approval.

Collateral – Single-family homes, Townhomes, Villas, Doublewide Manufactured Homes, FHA Approved Condos.

FLORIDA BAD CREDIT MORTGAGE APPLICANTS ASK EVERYDAY

“WHAT IS THE MINIMUM CREDIT SCORE FOR AN FHA MORTGAGE”?

- FHA Mortgage Credit Score is 580+ the borrower is eligible for 96.5% Financing.

- FHA Mortgage Credit Score is between 500 and 579, the FHA mortgage applicant is eligible for 90 percent financing.

More Bad Credit Florida Mortgage Options Include:

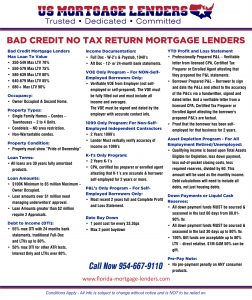

Bad Credit Florida No Tax Return Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were

Bad Credit Florida FHA Mortgage Loans Have Minimal Down Payment & Fees:

- The down payment is only 3.5% of the purchase price.

- The seller can credit buyers up to 6% of the sales price towards buyers’ costs.

- Gifts from family or Grants for down payment assistance and closing costs are OK!

- No reserves or future payments in the account are required.

- FHA regulated closing costs.

Bad Credit Florida FHA Mortgage Lenders Make it Easier To Qualify Because:

- Purchase a Florida home 12 months after a chapter 13 Bankruptcy

- Purchase a Florida 24 months after a chapter 7 Bankruptcy.

- FHA will allow an FHA mortgage 3 years after a Foreclosure.

- A minimum FICO credit score of 580 is required for 96.5% financing.

- Bad credit Florida minimum FICO credit score of 500 is required for 90% FHA financing.

- No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

Bad Credit FHA Allows A Higher Debt To Income and Flexible Job Qualifying:

- FHA allows higher debt ratios than any other Florida home loan program.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify for FHA.

- Check Florida FHA Mortgage Lenders Guidelines and Requirements for more information.

Learn About 100% Florida FHA Bad Credit Mortgage Lenders

100% Florida FHA Bad Credit Mortgage Lenders – 100% Florida Mortgage Lenders 100% Florida Home Loans – One Hundred Percent Florida mortgage financing US Mortgage Lenders 100% Read More »

Bad Credit Florida Mortgage Requirments

- FHA Minimum Cash/Down payment Or Equity -FHA 3.5% Down Payment Cash or 20% Equity/ 80% LTV for cash out or 96.75% Rate term Refinance- Verity the borrower has the down payment from an acceptable source on a purchase or enough equity to cover payoffs and closing cost to include taxes insurance on a refinance.

- FHA Minimum Credit 500+ Credit Score – Does the borrower have the minimum credit score to meet the loan program? Does the borrower have collections that have to be paid off that will reflect the cash needed to close? Do student loans that are deferred need to be added to the monthly obligations? Does the lender require %1 cumulative student loan or 5% of the cumulative collections accounts over +$2000 added back to the debt to income ratios?

- Capacity-56.9% FHA Maximum- Does the borrower’s debt to income ratio meet the loan program requirements or no more debt than 56.9% of the total housing + all obligations reflected on the borrower’s credit report?

- Collateral/FHA Approved Property Types Include- Single-family homes, townhomes, villas, 1-4 family multi Unit Homes, and FHA Approved Florida Condos!

What is an FHA Mortgage and How Do I get one?

The purpose of the FHA is to provide government mortgage insurance for loans made by FHA-approved Florida mortgage lenders, banks, and other mortgage companies. The sole purpose of the FHA is to increase homeownership by making FHA mortgage loans more affordable and easier to qualify for. The FHA itself is not a direct mortgage lender but rather FHA is a government entity that provides the FHA mortgage insurance needed for private Florida FHA mortgage lenders. FHA mortgage insurance protects the mortgage lender or bank from losses with the FHA mortgage insurance the borrower pays. FHA mortgage loans bridge the gap between approved lenders and homebuyers by providing a new financing option to bridge the gap where bank loans do not serve the public.

Can you explain FHA Mortgage Insurance Premiums?

FHA requires that FHA mortgage applicants pay (2) two types of mortgage insurance premiums! 1) an Upfront Mortgage Insurance Premium (UFMIP) and 2. an Annual MIP (charged monthly). 1. The Upfront MIP is equal to 1.75% of the base loan amount. The UFMIP is paid at the time of closing and is added to the total loan amount. If the FHA home loan for $400,000, for example, you’ll pay an UFMIP of 1.75% x $400,000 = $7000. The payments are deposited into the FHA trust account set up by the U.S. Treasury Department, and the funds are used to make mortgage payments in case you default on the loan. The 2nd FHA mortgage insurance is This monthly mortgage Insurance is paid monthly as part of the monthly mortgage payment Monthly MI is paid for the life of the FHA loan. It will never disappear or fall off the loan. This is an important consideration when deciding whether to elect for a traditional conventional mortgage with MI or an FHA loan. With the FHA loan borrowers will always have mortgage insurance no matter how much equity they accumulate in the property either by appreciation or by paying the loan amount down. Whereas with a conventional mortgage the Mortgage insurance falls off once the loan amount is paid down to 78% or the original purchase price on a Primary Residence.

How Do FHA Mortgage Lenders Work?

FHA mortgage lenders provide government-backed insurance that can help you buy a home with lower credit scores and downpayment. You can even qualify for an FHA Mortgage with previous Foreclosure, Bankruptcy, or an IRS lien and or collection accounts. Within this page, we will go over the Cash, Credit, Capacity, and Collateral requirements for an FHA mortgage.

FHA Mortgage Lenders For Borrowers With Bad Credit

How Do I know if an FHA Mortgage with work for me? FHA mortgage loans are one of the most popular and are used by many of the buyers we serve. FHA mortgage lenders are the best option for borrowers with less-than-perfect credit and lower credit scores. The FHA mortgage is NOT for investors or vacation home buyers. FHA mortgage applicants can finance a 1-4 owner-occupied primary residence property with an FHA mortgage. FHA Mortgage guidelines allow credit scores as low as 500 credit scores with 10% down or 580 credit scores with a 3.5% down payment.

What exactly is an FHA Mortgage?

- The Minimum credit score for an FHA mortgage is 10% down with a 500+ credit score or 3.5% down if your credit score is over 580!

- The downpayment can come from a family member as a gift or a grant from down payment assistance.

- You could still qualify for an FHA loan 2 years after bankruptcy and 3 years after the foreclosure.

- You Can negotiate seller pay closing costs of up to 6% for closing costs and prepaid taxes and insurance also known as prepaid closing costs.

How Does FHA Mortgage Insurance Work?

FHA mortgage loans are backed by the Federal Housing Administration, a subordinate to the Housing and Urban Development (HUD). Because Florida FHA-approved mortgage lenders take on more risk due to low credit scores down to +500 and minimal 3.5% down payment Florida FHA mortgage applicants are responsible for paying FHA mortgage insurance. With an FHA mortgage, you are responsible for FHA’s MIP for the life of your loan and you must refinance to remove FHA mortgage insurance. FHA mortgage applicants have to pay (2) types of mortgage insurance premiums: upfront and annual. The upfront mortgage insurance premium (UFMIP) is charged at your mortgage closing totals 1.75% of the loan amount, and the annual premium of .85% is an ongoing obligation you pay monthly included in your mortgage payment. The FHA mortgage insurance premiums (MIP) protect the FHA mortgage lender in the event of mortgage default.

1. Cash – FHA Mortgage Lenders Minimum Cash Downpayment Requirments

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 – 579 range. With an FHA mortgage, the seller can credit you up to 6% to cover all your closing costs. If the seller is paying closing costs must be in writing on your sales contract.

2. Credit – FHA Mortgage Lenders Credit Scores

There are a lot of factors that can help increase your credit score, including:

- The type of credit you have (whether you have credit cards, loans, etc.)

- Credit card utilization, the lower the balance compared to the limit the higher your credit score.

- 35% of your credit score is based on timely payment history, if you have any 30-day late payments ask for a 1-time exception.

- Settlement or Payment for deletion of collection accounts. Make sure to get the settlement agreement in writing.

If you have a higher mid-credit score over 620, you might be able to qualify with a higher debt-to-income ratio up to 50-56%. DTI is short for Debt-To-Income and refers to the percentage of your monthly gross income that goes toward your housing payments + plus all payments reflected on your credit reports. Your DTI DEBT TO INCOME RATION is your total monthly debt payments divided by your before-tax monthly gross income.

3. Capacity – How To Calculate FHA Mortgage Lenders Income Ratios!

FHA mortgage lenders’ standard debt-to-income ratio is 31/ 43. This means 31% of your before-tax income for housing and no more than 43% includes the 31% for housing (+) plus all minimum monthly payments on your credit report up to 43% of your total monthly income. For example, if you bring in $6000 per month then no more than 31% or $1860 for housing and 43% or no more than $2580 per month for the new housing payment (+) plus all other monthly payments on your credit report. Alimony payments are also included in your debt-to-income ratio but they are treated differently. Lenders have the option to either subtract the alimony payment from your monthly gross income usually if taken out of your employment check or include it as a payment in your debt-to-income ratio

4. Collateral – Property Types Eligible for an FHA Mortgage.

The following property types are eligible for FHA mortgage loans:

- Single Family Homes

- Townhomes

- Florida FHA approved Condominium unit link

- Manufactured Homes built after 1976.

FHA Mortgage Lenders Minimum Credit and Debt To Income Ratios!

FHA mortgage lenders require you to have better credit scores for a higher debt-to-income ratio allowance.

The Lowest Minimum Credit Score for FHA mortgage approval is 500-579 and the No Credit Score for Maximum Debt to income of 31/43

1. 31/43 For the 3.5% Downpayment Option The Lowest Possible Minimum Credit Score is 580. And your DTI must be under 31/43.

2. 37/47 – For DTI Debt To Income Of 37/47 You Must Have At Least 1 Compensating Factor:

• Verified/documented 3 months cash reserves equal to or exceeding total monthly mortgage payments.

• Minimal Increase in Housing Payment meaning the new total monthly FHA mortgage payment doesn’t exceed the current total monthly housing payment by more than $100 or 5% (whichever is less); and

– There is a documented 12-month housing payment history with no more than (1) one 30-day late rent payment. For cash-out refinance transactions, all monthly mortgage payments on the mortgage being refinanced were made within 0 Zero 30-day late payments for the previous 12 months.

– May not be used as a compensating factor if the borrower has no current housing payment.

3. 40/40 – No Discretionary Debt:

• The borrower’s housing payment is the only open account with an outstanding balance not paid off monthly; and

• The credit report shows established credit lines in the borrower’s name open for at least 6 months; and

• The borrower can document these accounts have been paid off in full monthly for at least the past 6 months.

4. 40/50 – Requires 2 Compensating Factors Including:

• 3 months Verified/documented cash reserves equal to or exceeding 3 total monthly mortgage payments.

• Minimal Increase in Housing Payment NO more than $100 or 5% (whichever is less);

– There is a documented 12-month housing payment history with no more than one 30-day late payment. In cash-out transactions, all payments on the mortgage being refinanced were made within the month due for the previous 12 months. – May not be used as a compensating factor if the borrower has no current housing payment.

• Significant Additional Income (Overtime, Bonuses, Part-Time or Seasonal Employment) Not Reflected in Effective Income

– If it were included in gross effective income, is sufficient to reduce the qualifying ratios to not more than 37/47.

What are FHA Mortgage Lenders’ qualifying requirements?

- New FHA loans are only available for primary residence occupancy

- Must have a stable predictable income history or worked for the same line of work fast at least 2+ years.

- Must have a valid Social Security number, lawful residency in the U.S., and be of legal age to sign a mortgage in your state

- Must have the minimum down payment of 3.5 percent + closing cost, FHA allows seller paid closing cost.

- Must have a property appraisal from an FHA-approved appraiser.

- Your front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, home insurance) needs to be less than 31 percent of your gross income, typically. You may be able to get approved with as high a percentage as 45 percent. FHA mortgage lenders will be required to document why they believe the mortgage presents an acceptable risk. FHA mortgage lenders must include any compensating factors used for loan approval.

- Your back-end ratio (your FHA mortgage payment plus all your monthly debt, i.e., credit card payment, car payment, student loans, etc.) needs to be less than 43 percent of your gross income, typically. You may be able to get approved with as high a percentage as 56 percent. FHA mortgage lenders are required to document compensating factors as to why they believe the mortgage presents an acceptable risk.

- Typically you must be two years out of chapter 7 bankruptcy and have re-established good credit. Chapter 13 approval can be made if you are out of bankruptcy for more than one year with reestablished credit history.

- You could qualify for an FHA mortgage 3 years out of foreclosure and have re-established good credit.

How do FHA Appraisals work if I purchase a home to flip using an FHA mortgage?

Property Flipping occurs whereby recently acquired property is resold for a considerable profit with an artificially inflated value. The term Property Flipping refers to the purchase and subsequent resale of a property in a short period of time. The eligibility of a property for an FHA Mortgage is determined by the time that has elapsed between the date the seller acquired title to the property and the date of execution of the sales contract that will result in the FHA-insured Mortgage. FHA defines the seller’s date of acquisition by the title transfer date. FHA defines the resale date as the date of execution of the sales contract by all parties intending to finance the Property with an FHA-insured Mortgage Lender.

FHA Mortgage Resales Occurring within 90 Days or Fewer After Acquisition:

A property that is being resold within 90 days or fewer following the current owner’s date of acquisition is not eligible for an FHA-insured Mortgage.

FHA Mortgage Resales Occurring Between 91-180 Days After Acquisition:

FHA mortgage lenders must obtain a second appraisal by another appraiser if:

- the resale date of a property is between 91 and 180 days following the acquisition of the property by the seller’s; and

- the re-sale price is 100 percent “over the purchase price” paid by the seller to acquire the property.

The required second appraisal from a different appraiser must include documentation to support the increased value.

Exceptions to FHA Flipping Rules are made for the following situations:

- sales of properties by local and state government agencies; and

- sales of properties within Presidentially Declared Major Disaster Areas (PDMDA), only upon issuance of a notice of an exception from HUD.

- The restrictions listed above and those in 24 CFR 203.37a do not apply to a builder selling a newly built house or building a house for a borrower planning to use FHA-insured financing.

- properties acquired by an employer or relocation agency in connection with the relocation of an employee;

- resales by HUD under its real estate owned (REO) program;

- sales by other U.S. government agencies of Single-Family Properties pursuant to programs operated by these agencies;

- sales of properties by nonprofits approved to purchase HUD-owned Single Family properties at a discount with resale restrictions;

- sales of properties that are acquired by the seller by inheritance;

- sales of properties by state and federally-chartered financial institutions and Government-Sponsored Enterprises (GSE);

FHA Mortgage Lenders’ Questions and Answers

Florida FHA Mortgage Lenders Loan Limits

The one notable limitation with an FHA mortgage is that they have outside limits on how much you can borrow. These FHA loan limits set by the region in which you live, with low-cost areas having a lower limit (the “floor”) and high-cost areas having a higher figure (the “ceiling”). Then there are “special exception” areas that include Alaska, Hawaii, Guam, and the U.S. Virgin Islands where very high construction costs make the FHA loan limits even higher. Everywhere else, the FHA Mortgage loan limit is set at 115% of the median home price for the county, as determined by the U.S. Dept. of Housing and Urban Development. The FHA/HUD website provides FHA mortgage lenders loan limits search tools.

UNDER-620 FICO – FHA MORTGAGE LENDERS

Under the new FHA mortgage lenders guidelines that are outlined in the FHA Guide 4001. FHA Mortgage Lenders underwriting and loan approval criteria. FHA bad credit mortgage and No Credit mortgage applicants can qualify to purchase or refinance an FHA mortgage with credit score as low as 500 FICO with a maximum of 31% DTI front end debt to income ratios, which is called the housing ratios, and the maximum debt to income ratio is 43% DTI on the back end debt to income ratio. Click here to read more about debt-to-income ratios and FHA mortgage qualifying.

OVER + 620 – FHA MORTGAGE LENDERS

FHA mortgage lenders are so popular because they will allow FHA Mortgage Applicants with credit scores over 620 FICO a maximum of 46.9% DTI front-end debt to income ratios, which is called the housing expense ratios, and the maximum debt to income ratio is 56.9% DTI on the back-end debt to income ratio. These debt-to-income ratios can only be extended when the borrower has provided compensating factors. Click here to learn more about FHA compensating factors.

FORECLOSURE, BANKRUPTCY, SHORT SALE QUALIFYING WITH FHA MORTGAGE LENDERS

In Addition, first-time FHA mortgage applicants as well as home buyers with prior bad credit, a prior bankruptcy, a prior foreclosure, a prior deed in lieu, and a prior short sale can qualify for FHA Mortgage within 3 years of a title transfer.

FORECLOSURE OR BANKRUPTCY FHA MORTGAGE LENDER’S APPROVALS

To qualify for an FHA mortgage there are statutory minimum waiting periods per FHA Loan Guidelines, after a bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale. For a traditional FHA mortgage loan, there is a minimum 2-year waiting period after the discharge date of bankruptcy. And, a mandatory 3-year waiting period after a foreclosure, deed in lieu of foreclosure, and short sale to qualify. The waiting period clock starts from the date of the foreclosure that is reflected on the title transfer in public records and not the date where the keys were surrendered to the FHA mortgage lender or the date of the court house sale. The (3) three-year waiting period after a short sale starts on the date of the short sale which is reflected on the HUD-1 Settlement Statement date. Read more about qualifying for an FHA mortgage after Foreclosure, Short sale or bankruptcy.

FHA- FHA MORTGAGE AFTER BANKRUPTCY or FORECLOSURE APPROVALS!

- Short Sale / Deed in Lieu – You may apply for an FHA-insured loan THREE (3) years after the sale date of your foreclosure. FHA treats a short sale the same as a Foreclosure for now. You may have to search the county records office to locate the deed to count a full 3 years.

- Credit must be re-established no late payments in past 12-24 months, depending on hardship

- Application Date must be after the above waiting period to be eligible for FHA financing after hardship. You may have to search county records office to locate the deed transfer out of your name fin order to count a full 3 years.

- Chapter 13 Bankruptcy- You may apply for an FHA mortgage after your bankruptcy has been discharged for 12 Months or (1) year with a Chapter 13 Bankruptcy. You must have 0 x 30 day late payments, and permission from the chapter 13 trustee.

- Chapter 7 Bankruptcy- You may apply for an FHA mortgage after your bankruptcy has been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for an FHA-insured loan after your bankruptcy has been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for an FHA-insured loan THREE (3) years after the Florida Foreclosure sale/deed transfer date. You may have to search the county records office to locate the deed to count a full 3 years.

BAD CREDIT WITH PAST COLLECTION ACCOUNTS QUALIFYING FHA MORTGAGE LENDERS GUIDELINES

FHA Mortgage Applicants can qualify for an FHA Loan with prior bad credit. FHA Collections Guidelines do not require FHA mortgage applicants to pay off unpaid outstanding collection accounts to qualify for an FHA mortgage. With unpaid outstanding medical collection accounts, debt to income ratios are excluded and the FHA mortgage underwriter can ignore medical collection accounts with unpaid outstanding medical collection account balances no matter how much the unpaid outstanding medical collection account balance is. However, with non-medical unpaid outstanding collection accounts (the sum of all non-medical collection accounts with balances) on the credit report with balances over $2,000 requires that 5% of the remaining unpaid collection account balances must be added to the borrower’s debt to income ratio. FHA Mortgage Applicants can qualify for an FHA Loan with unpaid collection accounts, charge-offs, or even judgments. FHA mortgage lenders provide mortgage lenders with no FHA mortgage lender overlays and just goes off the minimum FHA Loan Guidelines and the automated approval. If FHA says no collections need to be paid off, the no collection accounts need to be paid off. Click here to read more about FHA mortgage qualifying with collections and judgments on your credit report!

TAX LIENS AND QUALIFYING FOR FHA MORTGAGE LENDERS

have a tax lien that does not automatically disqualify you for an FHA mortgage. Click here to Read more about qualifying for an FHA Mortgage with a tax lien.

MEDICAL COLLECTIONS AND QUALIFYING WITH FHA MORTGAGE LENDERS

FHA mortgage lenders do not count unpaid medical collection accounts against your debt to income ratios.. Medical collections are exempt regardless of balance of unpaid medical collection accounts. With non-medical collection accounts, FHA Mortgage Applicants do not have to pay off any unpaid collection balance, however, if the total of unpaid collection balance is greater than $1,000, FHA will count 5% of the unpaid collection balance as a monthly debt obligation and will count it towards calculating FHA Mortgage Applicants debt to income ratios even though FHA Mortgage Applicants do not pay anything. This can become a problem if FHA Mortgage Applicants’ unpaid collection balance is of a larger amount. For instance, if FHA Mortgage Applicants have a $15,000 unpaid total collection balance, 5% of the $15,000, or $750, will be counted as a monthly debt obligation to your debt to income ratios. . For some FHA mortgage applicants, this can be a loan breaker. FHA does allow for FHA Mortgage Applicants to enter a written payment agreement with the creditor and whatever FHA Mortgage Applicants agree to mutually, will be used by the mortgage loan underwriter as FHA Mortgage Applicants’ monthly debt. For instance, on the $15,000 unpaid credit collection balance, if FHA Mortgage Applicants and the creditor agreed on a monthly payment of $150.00 per month, then the $150.00 per month must be used as a monthly debt payment on that collection account. There is no payment seasoning requirement with collection repayment plans.

FHA MORTGAGE LENDER’S GUIDELINES ON HIGH DEBT TO INCOME RATIOS

Conventional mortgage loan Applicants who have high debt to income ratios can turn to FHA Mortgage to qualify if they do not meet conventional debt to income guidelines. Maximum conventional debt to income ratios for conventional FNMA bank loans is capped at 45% DTI. FHA is much more lenient with debt-to-income ratios. FHA mortgage lenders cap their back-end debt to income ratios at 56.9%. FHA Mortgage Lenders have a front-end housing debt to income ratio cap of 46.9% DTI. FHA Mortgage is an incredible mortgage loan option for first-time home buyers, home buyers with bad credit and no Credit, self-employed buyers, and FHA mortgage applicants who have high debt to income ratios. Click here to read more about FHA mortgage lenders’ debt-to-income ratios.

Under the new FHA mortgage lenders guidelines that are outlined in the FHA Guide 4001. FHA Mortgage Lenders underwriting and loan approval criteria. FHA bad credit mortgage and No Credit mortgage applicants can qualify to purchase or refinance an FHA mortgage with a credit score as low as 500 FICO with a maximum of 31% DTI front end debt to income ratios, which is called the housing ratios, and the maximum debt to income ratio is 43% DTI on the back end debt to income ratio.

FHA MORTGAGE WITH NON-OCCUPANT CO-BORROWERS

One advantage you will not find with a conventional loan is that with an FHA Mortgage the main borrower has little or no income documentation, FHA permits the borrower to add a non-occupant co-borrower for income qualification purposes. The non-occupant co-borrower needs to be related.

SELLER CONCESSIONS AND GIFT FUNDS FOR DOWN PAYMENT

The FHA mortgage program allows the home buyer to get 100% gift funds to be used for the down payment and closing costs. The Gift funds must be properly documented and need to come from a relative of the home buyer. The gift letter needs to be signed by the donor stating that the funds is only a gift does not have to be paid back to the donor. Click here to learn more about FHA gift funds and documenting the gift for an FHA mortgage.

SELLER PAID CLOSING COST-

With an FHA loan, the seller can pay up to 6% of the buyers closing cost and prepaid. Click here to read more about seller-paid closing costs.

Search Florida Maximum Florida FHA Lending Limits By County

| County Name | State | One-Family | Median Sale Price | Last Revised | Limit Year | |

| GAINESVILLE, FL | ALACHUA | FL | $420,680 | $240,000 | 01/01/2022 | CY2022 |

| JACKSONVILLE, FL | BAKER | FL | $432,400 | $376,000 | 01/01/2022 | CY2022 |

| PANAMA CITY, FL | BAY | FL | $420,680 | $240,000 | 01/01/2022 | CY2022 |

| NON-METRO | BRADFORD | FL | $420,680 | $152,000 | 01/01/2022 | CY2022 |

| PALM BAY-MELBOURNE-TITUSVILLE, FL | BREVARD | FL | $420,680 | $252,000 | 01/01/2022 | CY2022 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | BROWARD | FL | $460,000 | $400,000 | 01/01/2022 | CY2022 |

| NON-METRO | CALHOUN | FL | $420,680 | $65,000 | 01/01/2022 | CY2022 |

| PUNTA GORDA, FL | CHARLOTTE | FL | $420,680 | $236,000 | 01/01/2022 | CY2022 |

| HOMOSASSA SPRINGS, FL | CITRUS | FL | $420,680 | $163,000 | 01/01/2022 | CY2022 |

| JACKSONVILLE, FL | CLAY | FL | $432,400 | $376,000 | 01/01/2022 | CY2022 |

| NAPLES-MARCO ISLAND, FL | COLLIER | FL | $552,000 | $480,000 | 01/01/2022 | CY2022 |

| LAKE CITY, FL | COLUMBIA | FL | $420,680 | $142,000 | 01/01/2022 | CY2022 |

| ARCADIA, FL | DESOTO | FL | $420,680 | $150,000 | 01/01/2022 | CY2022 |

| NON-METRO | DIXIE | FL | $420,680 | $78,000 | 01/01/2022 | CY2022 |

| JACKSONVILLE, FL | DUVAL | FL | $432,400 | $376,000 | 01/01/2022 | CY2022 |

| PENSACOLA-FERRY PASS-BRENT, FL | ESCAMBIA | FL | $420,680 | $266,000 | 01/01/2022 | CY2022 |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL | FLAGLER | FL | $420,680 | $260,000 | 01/01/2022 | CY2022 |

| NON-METRO | FRANKLIN | FL | $420,680 | $150,000 | 01/01/2022 | CY2022 |

| TALLAHASSEE, FL | GADSDEN | FL | $420,680 | $214,000 | 01/01/2022 | CY2022 |

| GAINESVILLE, FL | GILCHRIST | FL | $420,680 | $240,000 | 01/01/2022 | CY2022 |

| NON-METRO | GLADES | FL | $420,680 | $130,000 | 01/01/2022 | CY2022 |

| NON-METRO | GULF | FL | $420,680 | $190,000 | 01/01/2022 | CY2022 |

| NON-METRO | HAMILTON | FL | $420,680 | $74,000 | 01/01/2022 | CY2022 |

| WAUCHULA, FL | HARDEE | FL | $420,680 | $80,000 | 01/01/2022 | CY2022 |

| CLEWISTON, FL | HENDRY | FL | $420,680 | $140,000 | 01/01/2022 | CY2022 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL | HERNANDO | FL | $420,680 | $303,000 | 01/01/2022 | CY2022 |

| SEBRING-AVON PARK, FL | HIGHLANDS | FL | $420,680 | $155,000 | 01/01/2022 | CY2022 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL | HILLSBOROUGH | FL | $420,680 | $303,000 | 01/01/2022 | CY2022 |

| NON-METRO | HOLMES | FL | $420,680 | $98,000 | 01/01/2022 | CY2022 |

| SEBASTIAN-VERO BEACH, FL | INDIAN RIVER | FL | $420,680 | $275,000 | 01/01/2022 | CY2022 |

| NON-METRO | JACKSON | FL | $420,680 | $109,000 | 01/01/2022 | CY2022 |

| TALLAHASSEE, FL | JEFFERSON | FL | $420,680 | $214,000 | 01/01/2022 | CY2022 |

| NON-METRO | LAFAYETTE | FL | $420,680 | $94,000 | 01/01/2022 | CY2022 |

| ORLANDO-KISSIMMEE-SANFORD, FL | LAKE | FL | $420,680 | $340,000 | 01/01/2022 | CY2022 |

| CAPE CORAL-FORT MYERS, FL | LEE | FL | $420,680 | $279,000 | 01/01/2022 | CY2022 |

| TALLAHASSEE, FL | LEON | FL | $420,680 | $214,000 | 01/01/2022 | CY2022 |

| GAINESVILLE, FL | LEVY | FL | $420,680 | $240,000 | 01/01/2022 | CY2022 |

| NON-METRO | LIBERTY | FL | $420,680 | $74,000 | 01/01/2022 | CY2022 |

| NON-METRO | MADISON | FL | $420,680 | $70,000 | 01/01/2022 | CY2022 |

| NORTH PORT-SARASOTA-BRADENTON, FL | MANATEE | FL | $420,680 | $355,000 | 01/01/2022 | CY2022 |

| OCALA, FL | MARION | FL | $420,680 | $185,000 | 01/01/2022 | CY2022 |

| PORT ST. LUCIE, FL | MARTIN | FL | $431,250 | $375,000 | 01/01/2022 | CY2022 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | MIAMI-DADE | FL | $460,000 | $400,000 | 01/01/2022 | CY2022 |

| KEY WEST, FL | MONROE | FL | $710,700 | $618,000 | 01/01/2022 | CY2022 |

| JACKSONVILLE, FL | NASSAU | FL | $432,400 | $376,000 | 01/01/2022 | CY2022 |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL | OKALOOSA | FL | $539,350 | $469,000 | 01/01/2022 | CY2022 |

| OKEECHOBEE, FL | OKEECHOBEE | FL | $420,680 | $100,000 | 01/01/2022 | CY2022 |

| ORLANDO-KISSIMMEE-SANFORD, FL | ORANGE | FL | $420,680 | $340,000 | 01/01/2022 | CY2022 |

| ORLANDO-KISSIMMEE-SANFORD, FL | OSCEOLA | FL | $420,680 | $340,000 | 01/01/2022 | CY2022 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | PALM BEACH | FL | $460,000 | $400,000 | 01/01/2022 | CY2022 |

CATEGORY: FHA MORTGAGE GUIDELINES

FHA Bad Credit Mortgage Lenders Qualifications

FHA MORTGAGE LENDERS QUALIFICATIONS Why Are FHA Mortgage Lenders So Popular With For Homebuyers? Lower Down Payment: FHA loans have a low 3.5%. Easier to Qualify: FHA mortgage insurance FHA mortgage lenders may be more willing to give you better loan terms and easier credit qualifying requirements. Bad Credit Options: You don’t have to have…

Will FHA Bad Credit Mortgage Lenders allow rental Income?

The FHA mortgage lender may consider Rental Income from existing and prospective tenants if documented in accordance with the following requirements. Rental Income from the subject Property may be considered Effective Income when the Property is a two- to four-unit dwelling or an acceptable one- to four-unit Investment Property. Rent received for properties owned by…

How Do FHA Bad Credit Mortgage Lenders Consider Debts Paid By Another Person?

A liability that may result in the obligation to repay only when a specific event occurs. For example, a liability exists when an FHA mortgage applicant can be held responsible for the repayment of a debt if another legally obligated party defaults on the payment. Contingent liabilities may include cosigner liabilities and liabilities resulting from…

Do FHA Bad Credit Mortgage Lenders Approve Borrowers With Bad Credit?

The main advantage with FHA mortgage lenders is that the credit qualifying criteria for a borrower are not as strict as conventional financing. FHA mortgage lenders may consider a bad credit mortgage applicant to have an acceptable payment history if the bad credit mortgage applicant has made all housing and installment debt payments on time…

Do FHA Bad Credit Mortgage Lenders allow gifts of equity?

Do FHA Mortgage Lenders allow gifts of equity? Only Family Members may provide equity credit as a gift on property being sold to other Family Members. FHA mortgage must obtain a gift letter signed and dated by the donor and FHA mortgage applicant that includes the following: • the donor’s name, address, telephone number; •…

How to Get An FHA Mortgage Lenders Approval With Bad Credit?

The bad credit FHA mortgage lenders must use a traditional credit report, if available. A Residential Mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Bad credit FHA mortgage lenders must use the same credit report and credit scores sent to TOTAL Mortgage Scorecard. If a traditional credit report is not…

Why Are FHA Bad Credit Mortgage Lenders So Popular With For Homebuyers?

FHA mortgage lenders offer many advantages and protections that only come with an FHA mortgage: Lower Down Payment: FHA loans have a low 3.5% down payment and that money can come from a family member, employer or charitable organization as a gift. Conventional mortgage lenders do not allow this. Easier to Qualify: Due to the…

Do FHA Bad Credit Mortgage Lenders allow Flipping?

Property Flipping is indicative of a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value. The term Property Flipping refers to the purchase and subsequent resale of a property in a short period of time. The eligibility of a property for an FHA mortgage lender is determined by…

Do Bad Credit FHA Mortgage Lenders Allow Collections or Judgements?

COLLECTIONS-JUDGEMENTS COLLECTIONS- FHA Mortgage applicants are not required to pay off all collection accounts. However, outstanding collections will reflect on your creditworthiness overall and may be held against you. In this case, one or more of the collections may need to be paid off in order to improve your credit score and show your willingness to pay debts….

Do FHA Bad Credit Mortgage Lenders Lend on Condos?

Yes, FHA mortgage lenders will finance FHA Approved Condominium under the 203b program, FHA mortgage lenders provide insurance on FHA mortgage loans secured by one-family condominium Units located in FHA-Approved Condominium Projects and in Units located in Condominium Projects not approved by FHA. FHA Mortgage loans are made by FHA-approved mortgage lenders, such as…

Will FHA Mortgage Lenders Accept bad credit? What are the requirements for a manually underwritten mortgage?

Will FHA Mortgage Lenders Accept bad credit? What are the requirements for a manually underwritten mortgage? The bad credit FHA mortgage lenders must use a traditional credit report, if available. A Residential Mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Bad credit FHA mortgage lenders must use the same…

Can I use FHA Mortgage Lenders to buy a Second Home?

Secondary home refers to a dwelling that an FHA mortgage applicant occupies, in addition to their principal home, but less than a majority of the calendar year. A Secondary home does not include a vacation home. Secondary homes are only permitted with written approval from the FHA mortgage lenders approved jurisdictional Homeownership Center provided that: …

Do FHA Mortgage Lenders Require Collections To Be Paid Off To Qualify For An FHA Mortgage?

A Collection Account refers to a FHA mortgage applicants loan or debt that has been submitted to a collection agency by a creditor. If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the FHA mortgage lender must: • verify that the debt is paid in full…

Do FHA Mortgage Lenders require reserves for manually underwritten loans?

Yes, the Mortgagee must verify and document Reserves equivalent to (1) one month’s Principal, Interest, Taxes, and Insurance (PITI) after closing for one- to two-unit Properties. The Mortgagee must verify and document Reserves equivalent to (3) three months’ PITI after closing for three- to four-unit properties. What are FHA mortgage reserves? FHA Mortgage reserves are…

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends or Employer?

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends? FHA mortgage lenders refer to gifts or contributions of cash or equity with no expectation of repayment. Gifts may be provided by: • a close friend with a clearly defined and documented interest in the Borrower; • the Borrower’s Family Member; •…

Do FHA Mortgage Lenders allow employers gift the borrower’s down payment?

Do FHA Mortgage Lenders allow employers gift the FHA mortgage applicants down payment? Employer Assistance refers to benefits provided by an employer to relocate the FHA mortgage applicants or assist in the FHA mortgage applicants housing purchase, including closing costs, Mortgage Insurance Premiums (MIP), or any portion of the FHA mortgage applicants Minimum Required…

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment?

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment? Can A Realtors real estate Commission from Sale of Subject Property refers to the Borrower’s down payment portion of a real estate commission earned from the sale of the property being purchased. FHA mortgage lenders may consider Real…

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost?

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost? FHA Mortgage Lenders refer to Gifts as contributions of cash or equity with no expectation of repayment. FHA Mortgage Lenders Allow Gift Funds from the following approved sources • The FHA mortgage applicants Family Member; • The FHA mortgage applicants employer or labor…

Will FHA Mortgage Lenders Allow More Than 1 FHA Mortgage?

FHA mortgage lenders will not insure more than one Property as a Principal Residence for any FHA mortgage applicants, except as noted below. FHA mortgage lenders will not insure a Mortgage if it is determined that the transaction was designed to use FHA mortgage insurance as a vehicle for obtaining Investment Properties, even if the…

FHA Mortgage Lenders Cash Out and Rate Term Refinance

FHA Mortgage Lenders Rate Term Refinance Properties owned > 12 months: The subject property must be owner occupied for at least 12 months at the time of case number assignment. Properties owned < 12 months: The subject property must be owner occupied for the entire period of ownership at the time of case number assignment. …

FHA Mortgage Lenders Compensating Factors

FHA COMPENSATING FACTORS What are FHA compensating factors? (FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application) but it’s more complicated than that. Different FHA Lenders manage the consideration of compensating factors in different ways. FHA’s written guidelines outline specific examples of what FHA compensating factors…

FHA Mortgage Lenders Manual Underwriting Approvals

FHA Manual Underwrite Lenders Specifications CREDIT SCORE RANGE MAXIMUM QUALIFYING RATIOS APPLICABLE GUIDELINE 500 – 579 ·31/43 ·Energy Efficient Homes may stretch ratios to 33/45 ·Max LTV 90% unless cash out (80%) ·No gifts ·No down payment assistance ·No streamlines ·One month in reserves for 1-2-unit Properties, three months in reserves for 3-4-unit properties (cannot be a…

FHA Mortgage Lenders Allow Non Occupant Co Borrowers

FHA Mortgage Lenders Non-Occupant co borrower 1-Unit properties only. Max mortgage is limited to 75% LTV unless non-occupying co- borrower’s meet FHA definition of ‘family member’. Seller cannot be non-occupant co-borrower. Non-occupant co-borrowers may be added to improve ratios. Non-occupant co-borrowers cannot be used to overcome or offset borrower’s derogatory credit. The non-occupying borrower arrangement…

FHA Mortgage Lenders Source Of Down Payment And Reserves

FHA Mortgage Lenders require a minimum cash investment from FHA mortgage applicants own funds and/or gift (no cash on hand allowed when FHA mortgage applicants uses traditional banking sources and has traditional credit history). Any deposit 1 % and greater of the sales price must be sourced and seasoned. An aggregate of deposits 1 °/o…

FHA Mortgage Lenders Can Use Non Taxable Income To Qualify

FHA Mortgage Lenders Allow Nontaxable income such as Social Security, Pension, Workers Comp and Disability Retirement income can be grossed up 115% of the income can be used to qualify for an FHA mortgage loan. Unacceptable Sources of Income Include: The following income sources are not acceptable for purposes of qualifying the borrower: Any unverified…

What Are FHA Mortgage Lenders Debt To Income Ratio Requirements?

Debt Ratio – Loans with AUS Approve/Eligible – follow AUS decision. Credit scores of 640 and under and DTI greater than 43% regardless of AUS decision require explanation for derogatory credit and a VOR or rent free letter (if applicable). Manually underwritten loans with FICO score> 580 may exceed 31°/o/43°/o ratios with acceptable compensating factors…

FHA Mortgage Lenders Cash-Out Refinance Payment History

FHA Mortgage Lenders Mortgage/Rental History Payment History All Cash Out Refinance Transactions and Manually Underwritten Rate Term Refinance Transactions: No 30 Day late payments within the last 12 months of case number assignment. FHA Mortgage Lenders Rate and Term Refinance Transactions: AUS Accept – follow AUS. ALSO CHECK FHA Mortgage Lenders Compensating Factors FHA COMPENSATING…

FHA Mortgage Lenders Minimum Trade Line Requirement

FHA Minimum Tradelines or Minimum Credit Reporting History FHA mortgage applicants must have sufficient credit history to generate a valid FICO score, or FHA mortgage applicants must meet the non-traditional FHA mortgage lenders guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Authorized tradelines…

How Do FHA Mortgage Lenders calculate student loan payments?

How Do FHA Mortgage Lenders treat Student Loans? Student Loan Payments – Student loan(s) would be calculated as follows, regardless of the payment status. FHA mortgage lenders must use either the greater of: 1% of the outstanding balance on the loan; or the monthly payment reported on the FHA mortgage applicants credit report; or the…

FHA Mortgage Lenders Approval With Disputed Accounts

FHA Mortgage Lenders Approval With Disputed Accounts derogatory accounts >= $1,000 cumulative must be downgraded to “Refer” manual underwrite. Medical and accounts resulting from identity and credit card theft or unauthorized use are excluded. A letter from the creditor, police report, etc. is required. Disputed non-derogatory accounts are excluded from the $1000 cumulative total which…

FHA Mortgage Lenders Approval With Loan Modifications

FHA Mortgage Lenders Approval After A Loan Modifications FHA Mortgage Lenders Automated Underwriting System required to follow guidance for acceptable mortgage history. Manual Underwrite -follow manual mortgage requirements (Ox30 for most recent 12 months and 2×30 for the most recent 24 months on the modified mortgage.) Payment history is evaluated based upon the FHA mortgage…

FHA Mortgage Lenders Qualifying Requirements After A Short Sale

FHA Mortgage Qualifying After A Short Sale Any Short Sale within three (3) years of the case assignment requires a manual underwrite. An FHA mortgage applicant who is in default at the time of short sale/restructure or pre-foreclosure or late on any mortgage or installment obligations within 12 months of the short sale is not…

FHA Mortgage Lenders After Foreclosure or Deed In Lieu of Foreclosure

What are the guidelines for FHA mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure? A FHA mortgage applicants is generally NOT eligible for a new FHA-insured mortgage if the Borrower had a foreclosure or a deed-in-lieu of foreclosure in the last 3 three-year period prior to the date of case number assignment. This…

FHA Mortgage Lenders DoNot Consider Timeshares A Housing Obligation

Is a foreclosure on a timeshare considered a mortgage foreclosure or installment loan? A loan secured by an interest in a timeshare must be considered an Installment Loan and NOT a housing obligation and not considered a Foreclosure event! Also Check out! FHA Mortgage Lenders Credit Score For FHA Mortgage Qualifying FHA Mortgage Lenders After…

FHA Mortgage Lenders With Judgements And Liens

How Do FHA Mortgage Lenders treat judgements or liens? All outstanding judgments and liens must be paid prior to or at closing except when the FHA mortgage applicant has an agreement with the creditor to make regular and timely payments. Copy of the agreement and a minimum of three (3) monthly scheduled payments prior to…

FHA Mortgage Lenders Disputed Credit Accounts

How are disputed credit accounts considered with FHA mortgage lenders? Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report indicates that the Borrower is disputing derogatory credit accounts, the Borrower must provide a letter of…

FHA Mortgage Lenders Approval With Collection Accounts

FHA Mortgage Lenders Approval W Collection Accounts • FHA mortgage lenders add 5% of the outstanding balance of each collection will be used as the monthly payment and will be included in the DTI . • FHA mortgage lenders treat Repossessions as charge offs unless specifically notated that the account was sent to collections. Balances…

What Are FHA Mortgage Lenders Minimum Credit Score?

The FHA mortgage applicant is not eligible for FHA-insured financing if the Minimum Credit Score is less than 500. If the Minimum FHA Mortgage Credit Score is between 500 and 579, the FHA mortgage applicant is limited to a maximum loan-to-value (LTV) of 90 percent. If the Minimum FHA Mortgage Credit Score is at or…

FHA Mortgage Lenders For DACA Status Recipients

FHA to Permit DACA Status Recipients to Apply for FHA Insured Mortgages Effective January 19, 2021, the Federal Housing Administration (FHA) is permitting DACA FHA mortgage applicants classified under the “Deferred Action for Childhood Arrivals” program DACA FHA mortgage applicants with the U.S. Citizenship & Immigration Service (USCIS) and are legally permitted to work in…

FHA Mortgage Lenders While In Consumer Credit Counseling

How long do FHA mortgage require to qualify for an FHA mortgage after consumer Credit concealing? Qualify for an FHA mortgage after consumer Credit counseling? 1 year of the pay-out has elapsed under the plan, borrower’s payment performance has been satisfactory with all required payments made timely and borrower has received written permission from the…

FHA Mortgage Lenders Approval After Bankruptcy

For FHA Mortgage Lenders Approval After Bankruptcy How does a bankruptcy affect a FHA mortgage applicants eligibility for an FHA mortgage? A Chapter 7 bankruptcy (liquidation) does not disqualify a FHA mortgage applicants from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least 2 years have past since the date…

FHA Mortgage Lenders Lead Based Paint Disclosure

FHA Mortgage Lenders require Lead based Paid Disclosure Required for Defective Paint Surfaces -An automatic correction is required to all defective paint surfaces in or on structures and/or property improvements built before January 1, 1978. Contractors who perform the repair must be certified and must follow specific work practices to prevent lead contamination. A copy …

FHA Mortgage Lenders To Purchase Foreclosures

FHA mortgage lenders require FHA appraisals to be performed only by FHA licensed appraiser listed on the FHA roster. Obtain an “as-is” appraisal and the appraisal must be HUD REO Appraisal and Property Requirements marked as “Insurable”. HU D’s Foreclosure REO appraisal may be available at no charge. If the original HUD REO appraisal is…

FHA Mortgage Lenders For Homes For Sale Within 90 Days

Does FHA have requirements for homes sold within 90 days? Property Flipping is a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value Property Flipping refers to the purchase and resale of a property in a short period of time. The eligibility of a property for a Mortgage…

FHA Mortgage Lenders For Manufactured Homes

FHA Mortgage Lenders For Manufactured Homes FHA Mortgage Lenders accepts manufactured homes permanently affixed to the foundation, built on or after June 15, 1976, and meet all FHA Mortgage Lenders For Manufactured Homes requirements. Single-wide manufactured homes are not eligible. Manufactured homes with acceptable alterations or additions must have marketability, “like” comparable, gross living area…

FHA Mortgage Lenders For Condos

FHA Condo Mortgage Lenders – Condo FHA Mortgage Lenders FHA Mortgage Lenders approve condos on case by case bases. FHA condo mortgage lenders require the condominium complex and meet all FHA mortgage lenders minimum requirements including 51 occupancy, 15% delinquencies). All condos and attached PUD’s require 100% ‘walls-in’ H06 coverage. Stick-built site condos do not…

FHA Mortgage Lenders Ineligible Property Types

Ineligible Collateral -FHA Mortgage Lenders Ineligible Property Types to include some built before June 15, 1976 single wide Mobile homes, co-ops, Single-wide manufactured homes, houseboats, commercial or industrial zoned properties, mixed-use with residential building use less than 51%, properties encumbered with Property Assessed Clean Energy (PACE) or Home Energy Renovation Opportunity (HERO) obligations, State-approved medical…

FHA Mortgage Lenders Eligible Property Types

FHA mortgage loans are only for Owner Occupied Only Home Only To Include. 1-4 Units. Villas including FHA approved PUD’s, Condos, FHA approved condominiums projects, land contracts, FHA approved manufactured , FHA approved modular homes (minimum doublewide manufactured homes are Eligible Collateral wide) that follow manufactured housing requirements below.

FHA Mortgage Lenders Maximum Loan Amounts

FHA Mortgage Lenders Maximum FHA mortgage amounts. # of Units Lowest Maximum Floor for All FHA mortgage Amounts Highest Maximum Ceiling for All FHA mortgage Highest FHA Maximum Ceiling for all FHA. 1 Unit 356,362 548,250 822,375 2 Units 456,275 702,000 1,053,000 3 Units 551,500 848,500 1,272,750 4 Units 685,400 1,054,500 1,571,750 FHA Max Base…

FHA Mortgage Lenders Loan To Value Based On Credit Scores

FHA Mortgage Lenders to Purchase A home FHA MORTGAGE LENDERS PURCHASE MINIMUM FICO 500 = 90.00% 1-4 UNITS. PER FHA MAX COUNTY LIMITS FOR STANDARD PROGRAM. AUS Accept: Per AUS; Manual max Debt To Income Ratios:31%/43% Evaluated by **FHA Mortgage Lenders Automated Underwriting System** FHA MORTGAGE LENDERS MINIMUM FICO 580 = 96.50% 1-4 UNITS. PER…

ORLANDO FL FHA MORTGAGE LENDERS

Orlando FL FHA mortgage Lenders – Orlando Florida FHA Home Loans – FL FHA Home Loans – FHA Mortgage Lenders Orlando FL How do FHA Mortgage Lenders work? An FHA mortgage requires two types of FHA mortgage insurance, 1) Upfront Mortgage Insurance Premium (UFMIP) and 2) an Annual MIP added to your monthly payment. The Upfront MIP is equal to…

LARGO FL FHA MORTGAGE LENDERS

LargoFlorida FHA Mortgage Lenders Largo FL FHA Mortgage FHA Mortgage Lenders Largo FL Largo FL FHA Mortgage Lenders LARGO FL MORTGAGE APPLICANTS WHAT TO KNOW “WHAT IS THE MINIMUM CREDIT SCORE FOR AN FHA MORTGAGE”? If the Minimum FHA Mortgage Credit Score is at or above 580+ the FHA mortgage applicant is eligible for 96.5%…

PLANTATION FL FHA MORTGAGE LENDERS

Plantation FL FHA Mortgage Lenders What Is an FHA Mortgage? An FHA mortgage loan issued by an FHA-approved lender and insured by the Federal Housing Administration (FHA). Created for low-to-moderate-income borrowers, FHA mortgage loans require lower minimum down payments and credit scores than many conventional loans. HOME BUYERS ASK EVERY DAY, “WHAT IS THE MINIMUM…

CATEGORY: FHA MORTGAGE GUIDELINES

FHA Mortgage Lenders Qualifications

FHA MORTGAGE LENDERS QUALIFICATIONS Why Are FHA Mortgage Lenders So Popular With For Homebuyers? Lower Down Payment: FHA loans have a low 3.5%. Easier to Qualify: FHA mortgage insurance FHA mortgage lenders may be more willing to give you better loan terms and easier credit qualifying requirements. Bad Credit Options: You don’t have to have…

Will FHA Mortgage Lenders allow rental Income?

The FHA mortgage lender may consider Rental Income from existing and prospective tenants if documented in accordance with the following requirements. Rental Income from the subject Property may be considered Effective Income when the Property is a two- to four-unit dwelling or an acceptable one- to four-unit Investment Property. Rent received for properties owned by…

How Do FHA Mortgage Lenders Consider Debts Paid By Another Person?

A liability that may result in the obligation to repay only when a specific event occurs. For example, a liability exists when an FHA mortgage applicant can be held responsible for the repayment of a debt if another legally obligated party defaults on the payment. Contingent liabilities may include cosigner liabilities and liabilities resulting from…

Do FHA Mortgage Lenders Approve Borrowers With Bad Credit?

The main advantage with FHA mortgage lenders is that the credit qualifying criteria for a borrower are not as strict as conventional financing. FHA mortgage lenders may consider a bad credit mortgage applicant to have an acceptable payment history if the bad credit mortgage applicant has made all housing and installment debt payments on time…

Do FHA Mortgage Lenders allow gifts of equity?

Do FHA Mortgage Lenders allow gifts of equity? Only Family Members may provide equity credit as a gift on property being sold to other Family Members. FHA mortgage must obtain a gift letter signed and dated by the donor and FHA mortgage applicant that includes the following: • the donor’s name, address, telephone number; •…

How to Get An FHA Mortgage Lenders Approval With Bad Credit?

The bad credit FHA mortgage lenders must use a traditional credit report, if available. A Residential Mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Bad credit FHA mortgage lenders must use the same credit report and credit scores sent to TOTAL Mortgage Scorecard. If a traditional credit report is not…

Why Are FHA Mortgage Lenders So Popular With For Homebuyers?

FHA mortgages lenders offer many advantages and protections that only come with an FHA mortgage: Lower Down Payment: FHA loans have a low 3.5% down payment and that money can come from a family member, employer or charitable organization as a gift. Conventional mortgage lenders do not allow this. Easier to Qualify: Due to the…

Do FHA Mortgage Lenders allow Flipping?

Property Flipping is indicative of a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value. The term Property Flipping refers to the purchase and subsequent resale of a property in a short period of time. The eligibility of a property for an FHA mortgage lender is determined by…

Do FHA Mortgage Lenders Allow Collections or Judgements?

COLLECTIONS-JUDGEMENTS COLLECTIONS- FHA Mortgage applicants are not required to pay off all collection accounts. However, outstanding collections will reflect on your creditworthiness overall and may be held against you. In this case, one or more of the collections may need to be paid off in order to improve your credit score and show your willingness to pay debts….

Do FHA Mortgage Lenders Lend on Condos?

Yes, FHA mortgage lenders will finance FHA Approved Condominium under the 203b program, FHA mortgage lenders provide insurance on FHA mortgage loans secured by one-family condominium Units located in FHA-Approved Condominium Projects and in Units located in Condominium Projects not approved by FHA. FHA Mortgage loans are made by FHA-approved mortgage lenders, such as…

Will FHA Mortgage Lenders Accept bad credit? What are the requirements for a manually underwritten mortgage?

Will FHA Mortgage Lenders Accept bad credit? What are the requirements for a manually underwritten mortgage? The bad credit FHA mortgage lenders must use a traditional credit report, if available. A Residential Mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Bad credit FHA mortgage lenders must use the same…

Can I use FHA Mortgage Lenders to buy a Second Home?

Secondary home refers to a dwelling that an FHA mortgage applicant occupies, in addition to their principal home, but less than a majority of the calendar year. A Secondary home does not include a vacation home. Secondary homes are only permitted with written approval from the FHA mortgage lenders approved jurisdictional Homeownership Center provided that: …

Do FHA Mortgage Lenders Require Collections To Be Paid Off To Qualify For An FHA Mortgage?

A Collection Account refers to a FHA mortgage applicants loan or debt that has been submitted to a collection agency by a creditor. If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the FHA mortgage lender must: • verify that the debt is paid in full…

Do FHA Mortgage Lenders require reserves for manually underwritten loans?

Yes, the Mortgagee must verify and document Reserves equivalent to (1) one month’s Principal, Interest, Taxes, and Insurance (PITI) after closing for one- to two-unit Properties. The Mortgagee must verify and document Reserves equivalent to (3) three months’ PITI after closing for three- to four-unit properties. What are FHA mortgage reserves? FHA Mortgage reserves are…

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends or Employer?

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends? FHA mortgage lenders refer to gifts or contributions of cash or equity with no expectation of repayment. Gifts may be provided by: • a close friend with a clearly defined and documented interest in the Borrower; • the Borrower’s Family Member; •…

Do FHA Mortgage Lenders allow employers gift the borrower’s down payment?

Do FHA Mortgage Lenders allow employers gift the FHA mortgage applicants down payment? Employer Assistance refers to benefits provided by an employer to relocate the FHA mortgage applicants or assist in the FHA mortgage applicants housing purchase, including closing costs, Mortgage Insurance Premiums (MIP), or any portion of the FHA mortgage applicants Minimum Required…

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment?

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment? Can A Realtors real estate Commission from Sale of Subject Property refers to the Borrower’s down payment portion of a real estate commission earned from the sale of the property being purchased. FHA mortgage lenders may consider Real…

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost?

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost? FHA Mortgage Lenders refer to Gifts as contributions of cash or equity with no expectation of repayment. FHA Mortgage Lenders Allow Gift Funds from the following approved sources • The FHA mortgage applicants Family Member; • The FHA mortgage applicants employer or labor…

Will FHA Mortgage Lenders Allow More Than 1 FHA Mortgage?

FHA mortgage lenders will not insure more than one Property as a Principal Residence for any FHA mortgage applicants, except as noted below. FHA mortgage lenders will not insure a Mortgage if it is determined that the transaction was designed to use FHA mortgage insurance as a vehicle for obtaining Investment Properties, even if the…

FHA Mortgage Lenders Cash Out and Rate Term Refinance

FHA Mortgage Lenders Rate Term Refinance Properties owned > 12 months: The subject property must be owner occupied for at least 12 months at the time of case number assignment. Properties owned < 12 months: The subject property must be owner occupied for the entire period of ownership at the time of case number assignment. …

FHA Mortgage Lenders Compensating Factors

FHA COMPENSATING FACTORS What are FHA compensating factors? (FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application) but it’s more complicated than that. Different FHA Lenders manage the consideration of compensating factors in different ways. FHA’s written guidelines outline specific examples of what FHA compensating factors…

FHA Mortgage Lenders Manual Underwriting Approvals

FHA Manual Underwrite Lenders Specifications CREDIT SCORE RANGE MAXIMUM QUALIFYING RATIOS APPLICABLE GUIDELINE 500 – 579 ·31/43 ·Energy Efficient Homes may stretch ratios to 33/45 ·Max LTV 90% unless cash out (80%) ·No gifts ·No down payment assistance ·No streamlines ·One month in reserves for 1-2-unit Properties, three months in reserves for 3-4-unit properties (cannot be a…

FHA Mortgage Lenders Allow Non Occupant Co Borrowers

FHA Mortgage Lenders Non-Occupant co borrower 1-Unit properties only. Max mortgage is limited to 75% LTV unless non-occupying co- borrower’s meet FHA definition of ‘family member’. Seller cannot be non-occupant co-borrower. Non-occupant co-borrowers may be added to improve ratios. Non-occupant co-borrowers cannot be used to overcome or offset borrower’s derogatory credit. The non-occupying borrower arrangement…

FHA Mortgage Lenders Source Of Down Payment And Reserves

FHA Mortgage Lenders require a minimum cash investment from FHA mortgage applicants own funds and/or gift (no cash on hand allowed when FHA mortgage applicants uses traditional banking sources and has traditional credit history). Any deposit 1 % and greater of the sales price must be sourced and seasoned. An aggregate of deposits 1 °/o…

FHA Mortgage Lenders Can Use Non Taxable Income To Qualify

FHA Mortgage Lenders Allow Nontaxable income such as Social Security, Pension, Workers Comp and Disability Retirement income can be grossed up 115% of the income can be used to qualify for an FHA mortgage loan. Unacceptable Sources of Income Include: The following income sources are not acceptable for purposes of qualifying the borrower: Any unverified…

What Are FHA Mortgage Lenders Debt To Income Ratio Requirements?

Debt Ratio – Loans with AUS Approve/Eligible – follow AUS decision. Credit scores of 640 and under and DTI greater than 43% regardless of AUS decision require explanation for derogatory credit and a VOR or rent free letter (if applicable). Manually underwritten loans with FICO score> 580 may exceed 31°/o/43°/o ratios with acceptable compensating factors…

FHA Mortgage Lenders Cash-Out Refinance Payment History

FHA Mortgage Lenders Mortgage/Rental History Payment History All Cash Out Refinance Transactions and Manually Underwritten Rate Term Refinance Transactions: No 30 Day late payments within the last 12 months of case number assignment. FHA Mortgage Lenders Rate and Term Refinance Transactions: AUS Accept – follow AUS. ALSO CHECK FHA Mortgage Lenders Compensating Factors FHA COMPENSATING…

FHA Mortgage Lenders Minimum Trade Line Requirement

FHA Minimum Tradelines or Minimum Credit Reporting History FHA mortgage applicants must have sufficient credit history to generate a valid FICO score, or FHA mortgage applicants must meet the non-traditional FHA mortgage lenders guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Authorized tradelines…

How Do FHA Mortgage Lenders calculate student loan payments?

How Do FHA Mortgage Lenders treat Student Loans? Student Loan Payments – Student loan(s) would be calculated as follows, regardless of the payment status. FHA mortgage lenders must use either the greater of: 1% of the outstanding balance on the loan; or the monthly payment reported on the FHA mortgage applicants credit report; or the…

FHA Mortgage Lenders Approval With Disputed Accounts

FHA Mortgage Lenders Approval With Disputed Accounts derogatory accounts >= $1,000 cumulative must be downgraded to “Refer” manual underwrite. Medical and accounts resulting from identity and credit card theft or unauthorized use are excluded. A letter from the creditor, police report, etc. is required. Disputed non-derogatory accounts are excluded from the $1000 cumulative total which…

FHA Mortgage Lenders Approval With Loan Modifications

FHA Mortgage Lenders Approval After A Loan Modifications FHA Mortgage Lenders Automated Underwriting System required to follow guidance for acceptable mortgage history. Manual Underwrite -follow manual mortgage requirements (Ox30 for most recent 12 months and 2×30 for the most recent 24 months on the modified mortgage.) Payment history is evaluated based upon the FHA mortgage…

FHA Mortgage Lenders Qualifying Requirements After A Short Sale

FHA Mortgage Qualifying After A Short Sale Any Short Sale within three (3) years of the case assignment requires a manual underwrite. An FHA mortgage applicant who is in default at the time of short sale/restructure or pre-foreclosure or late on any mortgage or installment obligations within 12 months of the short sale is not…

FHA Mortgage Lenders After Foreclosure or Deed In Lieu of Foreclosure

What are the guidelines for FHA mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure? A FHA mortgage applicants is generally NOT eligible for a new FHA-insured mortgage if the Borrower had a foreclosure or a deed-in-lieu of foreclosure in the last 3 three-year period prior to the date of case number assignment. This…

FHA Mortgage Lenders DoNot Consider Timeshares A Housing Obligation

Is a foreclosure on a timeshare considered a mortgage foreclosure or installment loan? A loan secured by an interest in a timeshare must be considered an Installment Loan and NOT a housing obligation and not considered a Foreclosure event! Also Check out! FHA Mortgage Lenders Credit Score For FHA Mortgage Qualifying FHA Mortgage Lenders After…

FHA Mortgage Lenders With Judgements And Liens

How Do FHA Mortgage Lenders treat judgements or liens? All outstanding judgments and liens must be paid prior to or at closing except when the FHA mortgage applicant has an agreement with the creditor to make regular and timely payments. Copy of the agreement and a minimum of three (3) monthly scheduled payments prior to…

FHA Mortgage Lenders Disputed Credit Accounts

How are disputed credit accounts considered with FHA mortgage lenders? Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report indicates that the Borrower is disputing derogatory credit accounts, the Borrower must provide a letter of…

FHA Mortgage Lenders Approval With Collection Accounts

FHA Mortgage Lenders Approval W Collection Accounts • FHA mortgage lenders add 5% of the outstanding balance of each collection will be used as the monthly payment and will be included in the DTI . • FHA mortgage lenders treat Repossessions as charge offs unless specifically notated that the account was sent to collections. Balances…

What Are FHA Mortgage Lenders Minimum Credit Score?

The FHA mortgage applicant is not eligible for FHA-insured financing if the Minimum Credit Score is less than 500. If the Minimum FHA Mortgage Credit Score is between 500 and 579, the FHA mortgage applicant is limited to a maximum loan-to-value (LTV) of 90 percent. If the Minimum FHA Mortgage Credit Score is at or…

FHA Mortgage Lenders For DACA Status Recipients

FHA to Permit DACA Status Recipients to Apply for FHA Insured Mortgages Effective January 19, 2021, the Federal Housing Administration (FHA) is permitting DACA FHA mortgage applicants classified under the “Deferred Action for Childhood Arrivals” program DACA FHA mortgage applicants with the U.S. Citizenship & Immigration Service (USCIS) and are legally permitted to work in…

FHA Mortgage Lenders While In Consumer Credit Counseling

How long do FHA mortgage require to qualify for an FHA mortgage after consumer Credit concealing? Qualify for an FHA mortgage after consumer Credit counseling? 1 year of the pay-out has elapsed under the plan, borrower’s payment performance has been satisfactory with all required payments made timely and borrower has received written permission from the…

FHA Mortgage Lenders Approval After Bankruptcy

For FHA Mortgage Lenders Approval After Bankruptcy How does a bankruptcy affect a FHA mortgage applicants eligibility for an FHA mortgage? A Chapter 7 bankruptcy (liquidation) does not disqualify a FHA mortgage applicants from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least 2 years have past since the date…

FHA Mortgage Lenders Lead Based Paint Disclosure

FHA Mortgage Lenders require Lead based Paid Disclosure Required for Defective Paint Surfaces -An automatic correction is required to all defective paint surfaces in or on structures and/or property improvements built before January 1, 1978. Contractors who perform the repair must be certified and must follow specific work practices to prevent lead contamination. A copy …

FHA Mortgage Lenders To Purchase Foreclosures

FHA mortgage lenders require FHA appraisals to be performed only by FHA licensed appraiser listed on the FHA roster. Obtain an “as-is” appraisal and the appraisal must be HUD REO Appraisal and Property Requirements marked as “Insurable”. HU D’s Foreclosure REO appraisal may be available at no charge. If the original HUD REO appraisal is…

FHA Mortgage Lenders For Homes For Sale Within 90 Days

Does FHA have requirements for homes sold within 90 days? Property Flipping is a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value Property Flipping refers to the purchase and resale of a property in a short period of time. The eligibility of a property for a Mortgage…

FHA Mortgage Lenders For Manufactured Homes

FHA Mortgage Lenders For Manufactured Homes FHA Mortgage Lenders accepts manufactured homes permanently affixed to the foundation, built on or after June 15, 1976, and meet all FHA Mortgage Lenders For Manufactured Homes requirements. Single-wide manufactured homes are not eligible. Manufactured homes with acceptable alterations or additions must have marketability, “like” comparable, gross living area…

FHA Mortgage Lenders For Condos

FHA Condo Mortgage Lenders – Condo FHA Mortgage Lenders FHA Mortgage Lenders approve condos on case by case bases. FHA condo mortgage lenders require the condominium complex and meet all FHA mortgage lenders minimum requirements including 51 occupancy, 15% delinquencies). All condos and attached PUD’s require 100% ‘walls-in’ H06 coverage. Stick-built site condos do not…

FHA Mortgage Lenders Ineligible Property Types

Ineligible Collateral -FHA Mortgage Lenders Ineligible Property Types to include some built before June 15, 1976 single wide Mobile homes, co-ops, Single-wide manufactured homes, houseboats, commercial or industrial zoned properties, mixed-use with residential building use less than 51%, properties encumbered with Property Assessed Clean Energy (PACE) or Home Energy Renovation Opportunity (HERO) obligations, State-approved medical…

FHA Mortgage Lenders Eligible Property Types

FHA mortgage loans are only for Owner Occupied Only Home Only To Include. 1-4 Units. Villas including FHA approved PUD’s, Condos, FHA approved condominiums projects, land contracts, FHA approved manufactured , FHA approved modular homes (minimum doublewide manufactured homes are Eligible Collateral wide) that follow manufactured housing requirements below.

FHA Mortgage Lenders Maximum Loan Amounts

FHA Mortgage Lenders Maximum FHA mortgage amounts. # of Units Lowest Maximum Floor for All FHA mortgage Amounts Highest Maximum Ceiling for All FHA mortgage Highest FHA Maximum Ceiling for all FHA. 1 Unit 356,362 548,250 822,375 2 Units 456,275 702,000 1,053,000 3 Units 551,500 848,500 1,272,750 4 Units 685,400 1,054,500 1,571,750 FHA Max Base…

FHA Mortgage Lenders Loan To Value Based On Credit Scores

FHA Mortgage Lenders to Purchase A home FHA MORTGAGE LENDERS PURCHASE MINIMUM FICO 500 = 90.00% 1-4 UNITS. PER FHA MAX COUNTY LIMITS FOR STANDARD PROGRAM. AUS Accept: Per AUS; Manual max Debt To Income Ratios:31%/43% Evaluated by **FHA Mortgage Lenders Automated Underwriting System** FHA MORTGAGE LENDERS MINIMUM FICO 580 = 96.50% 1-4 UNITS. PER…

ORLANDO FL FHA MORTGAGE LENDERS

Orlando FL FHA mortgage Lenders – Orlando Florida FHA Home Loans – FL FHA Home Loans – FHA Mortgage Lenders Orlando FL How do FHA Mortgage Lenders work? An FHA mortgage requires two types of FHA mortgage insurance, 1) Upfront Mortgage Insurance Premium (UFMIP) and 2) an Annual MIP added to your monthly payment. The Upfront MIP is equal to…

LARGO FL FHA MORTGAGE LENDERS

LargoFlorida FHA Mortgage Lenders Largo FL FHA Mortgage FHA Mortgage Lenders Largo FL Largo FL FHA Mortgage Lenders LARGO FL MORTGAGE APPLICANTS WHAT TO KNOW “WHAT IS THE MINIMUM CREDIT SCORE FOR AN FHA MORTGAGE”? If the Minimum FHA Mortgage Credit Score is at or above 580+ the FHA mortgage applicant is eligible for 96.5%…

PLANTATION FL FHA MORTGAGE LENDERS

Plantation FL FHA Mortgage Lenders What Is an FHA Mortgage? An FHA mortgage loan issued by an FHA-approved lender and insured by the Federal Housing Administration (FHA). Created for low-to-moderate-income borrowers, FHA mortgage loans require lower minimum down payments and credit scores than many conventional loans. HOME BUYERS ASK EVERY DAY, “WHAT IS THE MINIMUM…