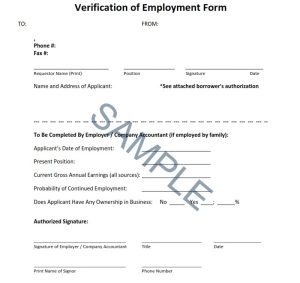

No Tax Return Florida Mortgage Lenders use VOE to qualify! We offer a VOE-only Florida mortgage that will only require the employer to fill out a verification of employment (VOE) form, no other income documents are needed to verify your income. No W2, No tax returns, NO pay stubs, NO 1099 form, all we need is for your employer to complete the verification form, that is the income that we will use to qualify you for a mortgage loan. The VOE-only mortgage works great for cash businesses that don’t receive traditional income pay stubs and W2s.

Work (VOE) Verification of Employment Mortgage

The Verification of Employment (VOE) Only is a mortgage loan option that uses your Employment verification of income to qualify for a Florida mortgage without tax returns, pay stubs, and or W2s.

VOE Only Florida Mortgage Lenders

• 80% LTV Purchase / Rate /Term

• MInimum 660+ Credit Scores

• No tradeline requirement w/ 3 credit scores

• No tax return, W2, or paystubs

• Unlimited Cash in Hand

• Cash-out used for reserves

• SFR, Condotels, Condos, 2-4

• Loan amounts up to $3m

• 2 months bank statements required

Why Would Someone Want A VOE Only a Mortgage?

A “VOE only” mortgage, which stands for “Verification of Employment only” mortgage, is needed when a borrower wants to qualify for a loan based solely on their employment status, without providing additional income documentation like paystubs or tax returns, typically because their income source is non-traditional or difficult to verify through standard means, like self-employment or commission-based work; this allows them to still access a mortgage even if they can’t readily provide traditional income verification.

VOE Key Points

Suitable for non-traditional income: This type of mortgage can be helpful for individuals with income sources that are difficult to verify with traditional methods, such as self-employed individuals, freelancers, or those with significant commission-based income.

Less stringent income verification: Unlike a standard Florida mortgage, a VOE-only mortgage loan relies primarily on contacting the borrower’s employer to confirm their employment and income via VOE, without requiring extensive documentation requirements like w2, paystubs, tax returns or paystubs.

Higher risk for lenders: Since Florida mortgage lenders have less concrete proof of income with a VOE-only mortgage, they may consider the borrower to be a higher risk and could charge higher interest rates or require a larger down payment.

VOE Disclosures Requirements

- Borrowers’ ID (Passport or Driver License).

- Purchase Contract (if applicable)

- Credit Report – LOS merged

- Complete Loan Application – Including Income & Employment.

- Submission Form Completed.

- Required to Underwrite

VOE Must SHow YTD income and 2 years income.

Florida Verification of Employment Mortgage Lenders (Form 1005): PDF

Those requesting employment or salary verification may access THE WORK NUMBER® online at https://www.theworknumber.com/verifiers/ using DOL’s code: 10915.