Florida FHA Mortgage Lenders – 100% Florida FHA mortgage lenders – FHA Mortgage Refinance

You came to the right place if you are searching for FHA Mortgage Lenders In Florida who provide FHA mortgage refinance, bad credit FHA mortgage Lenders, No Credit Florida FHA mortgage lenders, and Florida FHA rent to own mortgage program, manual underwriting Florida FHA mortgage lenders.

Contents

- FHA Mortgage Lenders Summary

- What is an FHA Mortgage loan?

- What Are The FHA Advantages?

- What Are The FHA Mortgage Requirements?

- What Are The FHA Mortgage Benefits?

- What Are The FHA Income Limitations?

- FHA Frequently Asked FHA Questions & Answers!

1. FHA Mortgage Lenders Summary

| CASH | Min 580 credit score qualifies for 3.5% down with 100% financing options available. Or, 10% downpayment is required if your credit score is between 500 – 579. The seller can pay up to 6% of the closing cost this must be requested in your purchase contract. |

| CREDIT | Minimum 500+ credit score – based on payment history, not credit score driven. |

| CAPACITY/(DTI) | Max DTI 46.9-56.9% with AUS approval |

| COLLATERAL | Single-family homes multi-family 2-4 units, townhomes, villas, FHA-approved condos, manufactured, modular homes. |

| SUMMARY | FHA mortgage loans are basically the easiest loan to qualify for. Purchase or Refinancing using FHA loans must fully document income and assets. |

2. What is an FHA Mortgage Loan? FHA stands for the Federal Housing Administration. The FHA does not make loans directly instead the FHA insures private Florida mortgage lenders against loss. The FHA is governed by the U.S. Department of Housing and Urban Development (HUD) and FHA mortgages are backed and guaranteed by the U.S. government. This means that if a borrower stops making their mortgage payments, the government helps Florida FHA mortgage lenders to recover losses. The FHA mortgage insurance encourages lenders to make loans to first-time home buyers, borrowers with bad credit, or no credit score, and manually underwrite FHA loans. Overall the FHA mortgage insurance makes FHA mortgage loans the easiest of all loan programs to qualify for. Keep in mind that the FHA loan is only for primary residence and is not intended to be used for second homes or investment properties.

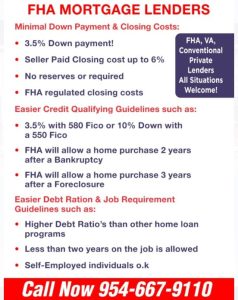

3. What Are The FHA Advantages?

FHA Mortgages Are More Affordable:

- 3.5% Down with 100% Financing options available.

- Seller Paid Closing costs up to 6%.

- Gifts from family or Grants OK!

- No reserves are required.

- FHA Regulated closing costs.

FHA Allows Higher Debt And Is More Flexible:

- Higher debt ratios up to 56.9%

- Less than two years on the same job is OK!

- Self-employed OK!

Reasons FHA Mortgages Are Easier:

- FHA minimum 580 score = 3.5% down or 96.5% financing.

- FHA minimum 500+ credit score = 10% Down

- FHA purchase 12 months after a Chapter 13 Bankruptcy

- FHA purchases 24 months after a Chapter 7 Bankruptcy.

- FHA purchase 3 years after a Foreclosure.

- No Credit Score Approvals using alternate trade lines.

- FHA Cashout Refinance Up To 80% loan to value!

4. What Are FHA Mortgage Requirements?

FHA mortgage approval requires a review of the borrower’s Cash, Credit, Capacity, and Collateral.

- Cash- FHA requires a minimum of 3.5% down with a 580 credit score and 10% down with a 500+ credit score. The FHA downpayment requirement can come from a gift, grand, or 100% FHA downpayment assistance program. According to Aottom the median home price in Florida for single-family homes is $396,000 x3.5% down = %13,860

- Capacity – or (DTI) Debt To Income Ratio- FHA guidelines say 31/43. This means your income for housing and 43 for housing plus all other payments on your credit report. But with the right FHA compensating factors, we have seen debt to income up to 46.9/56.9

- Collateral – The home must appraise for the purchase price and be livable habitable and insurable.

- Credit- A 3.5% down is needed for those with scores at or above 580; for scores 579 to 500, it’s at least 10% down. It’s even possible to qualify with no credit score.

-

Credit Score = Down Payment Over 580+ = Minimum 3.5% Down Between 500-579 = Minimum 10% Down

4. What Are the FHA Mortgage Benefits?

- Qualifying for an FHA Mortgage loan with bad credit or even no credit score is possible. Note that the current minimum FHA mortgage credit score requirement is 580+ for the maximum financing of 96.5%. Some borrowers with a good payment history can still qualify with credit scores as low as 500 and a 10% down payment. Without any compensation factors, the maximum debt-to-income ratio is caped at 31/43 on a manual underwrite.

- FHA will allow the gift of equity to provide equity credit as a gift on the property being sold to other Family Members to cover downpayment and closing cost.

- The FHA Mortgage offers flexible FHA mortgage refinancing and is sometimes the only option for existing Florida homeowners.

- Some Florida FHA mortgage lenders offer Special FHA Florida down payment assistance programs that can help eligible Florida 100% FHA Mortgage financing.

- FHA mortgage loans are backed by the US Government and have NO prepayment penalty meaning you can Pay off the mortgage anytime.

- Home buyers can use FHA-approved gift funds to help with the down payment and closing costs expenses.

- FHA Closing costs can also be paid by the seller of the home, up to 6% of the home’s sale price.

- FHA loans offer secure 30-year fixed interest rates set by Florida FHA mortgage lenders, banks, and mortgage companies. FHA mortgage interest rates are often lower than conventional loans that require a larger down payment.

- No minimum or maximum income restrictions.

- The FHA mortgage can be used for any new & existing single-family residence, townhome, or FHA-approved condo list. The property being purchased can be a regular sale, short sale, foreclosure home, etc, that meets FHA maximum property standards.

- FHA allows co-borrowers and Co-signers and non-occupying home buyers to help qualify for an FHA mortgage.

- Most FHA programs do not have a first-time buyer class and FHA Mortgage applicants can apply and get pre-approved all day.

- The Newly increased Florida FHA loan limit for 2025 to $524,225. Monroe County Florida holds the highest FHA loan limit of $967,150.

- The FHA Good Neighbor Next Door is great for public service workers like FHA Teachers, Firefighters, and Police Law Enforcement.

5. What Are The FHA Income Limitations?

Florida homebuyers often call and ask about FHA income restrictions. However, FHA mortgage loans are available to all families from all income classes. There are no income restrictions other than the loan must be for a primary home and not meant to be used to acquire investment properties.

As required on primary homes FHA mortgage lenders will consider your (DTI) debt-to-income ratio. The (DTI) is calculated by dividing your monthly debt obligations by your before-tax income. Most Florida mortgage lenders prefer that borrowers have a DTI of less than 50 percent. FHA mortgage lenders lenders will also look at your housing ratio. This measures what percentage of your gross income will go to housing-related expenses that include principal, interest, taxes, insurance, and HOA.

To wrap it up FHA mortgage loans don’t require that you make a specific amount of money. However, if you have a lot of monthly debt including paying down your debts will increase your purchasing power.

6. Frequently Asked FHA Questions & Answers!

Q: Are there any options For Me To rent to own a house and build equity while I’m rebuilding my credit? M.Cory- Orlando, Florida A: Our Rent Own FHA Mortgage Lenders program turns renters into future Florida homeowners by offering a lease-to-own solution with earned equity. This program allows homebuyers to rent to own not as ordinary “renters” but as future homeowners while building equity and positioning their credit and financials for an FHA mortgage lender. A FHA Eligible Government Entity to purchase a home that can ultimately be purchased by you providing housing stability and equity creation.

Q: How does an FHA mortgage and how does it work? B. Roberts- Miami Florida

A: The Federal Housing Administration (FHA) is an agency of the federal government. The FHA insures private Florida FHA mortgage lenders for new and existing housing and for approved programs for Florida home repairs. The FHA was created by Congress in 1934, and in 1965 became part of the Department of Housing and Urban Development’s Office of Housing, also known as HUD. The FHA’s mission in the present day includes offering to help Florida mortgage applicants achieve the dream of homeownership with minimum savings and bad credit. FHA also insures Florida bad credit mortgage lenders.

Q: I need assistance I have been paying for her car out of my business account for 4+ years. However, I did not pay in September, October, and November (hurricane-related). I have an email trail from Wells Fargo, where they agree to put those payments at the end of the loan. What options do I have to qualify for an FHA mortgage? G- Talbert – Tampa Florida

A: You may qualify for an FHA mortgage exception if you can prove the extenuating circumstances as outlined in the FHA guide see page 2 https://www.hud.gov/sites/documents/13-26ml.pdf . We can submit your loan to underwriting approval before you go searching for a home.

Q: Who is eligible for an FHA loan? A. Cable – Jacksonville Florida

A: FHA loans are available to U.S. citizens, permanent residents, and non-permanent residents who meet certain credit scores, income, and employment requirements.

Q: What is the minimum credit score required for an FHA loan? – R. Steel – Orlando, FL

A: The FHA requires a minimum credit score of 580 for a 3.5% down payment. For scores between 500 and 579, a 10% down payment is required.

Q: What are the income requirements for an FHA loan? – M. Torres – Tampa, FL

A: There are no specific income limits for FHA loans, but you must demonstrate that you can afford the mortgage based on your income, credit, and debts.

Q: Can I get an FHA loan if I have bad credit?

A: Yes, FHA loans are designed to help individuals with bad credit. However, the better your credit score, the better your terms will be.

Q: How much can I borrow with an FHA loan?

A: Loan limits vary by Florida county and are based on the median home price in the area. The maximum Florida FHA loan limit ranges from about $320,000 to $1,000,000.

Q: What are the requirements for FHA Condo Spot Approval?

A: Here are the Basic FHA Loan Spot Approval Requirements. The project must have at least five units. 10 or more units, up to 10% may be FHA-Insured.Less than 10 units, up to two FHA-Insured units.At least 50% owner-occupancy.HOA Budget 10% reserve requirement (or amount supported by reserve study).Maximum of 35% commercial space.Maximum 10% individual ownership. Manufactured homes, gut rehab, or new construction are not eligible. No more than 15% of units are 60 days delinquent.

Q: Is there an FHA loan limit?

A: Yes, the FHA sets limits for how much you can borrow depending on where the Florida property is located.

Q: How long do I have to move in a home with an FHA loan?

A: FHA loans require the borrower to occupy the home as their primary residence within 60 days of closing and for at least one year.

Q: Can I rent out my FHA home?

A: Yes, but only after living in the home as your primary residence for at least one year.

Q: Can I refinance with an FHA loan?

A: Yes, the FHA offers options like the FHA streamline refinance, which is a simplified way to lower your mortgage rate.

Q: What types of properties can I buy with an FHA loan?

A: FHA loans can be used to purchase single-family homes, multi-family homes (up to 4 units), and some condos, manufactured homes, and HUD-approved properties.

Q: Do I need to be a first-time homebuyer for an FHA loan?

A: No, you do not need to be a first-time homebuyer, but you cannot have an FHA loan currently in place if you are purchasing another home with FHA financing.

Q: What is the FHA loan down payment?

A: The FHA requires a down payment of 3.5% if your credit score is 580 or higher.

Q: Can I use gift funds for an FHA loan down payment?

A: Yes, you can use gift funds from family members or approved donors for the down payment.

Q: How does the FHA loan approval process work?

A: The FHA loan approval process involves submitting an application to an FHA-approved mortgage lender, undergoing a credit and financial review, title search, and an FHA appraisal of the home.

Q: Can I use an FHA loan to buy a second Florida home or investment property? A: A: No, FHA loans are only for primary residences. However, you can buy a multi-family home and live in one unit.

Q: What is an FHA streamlined refinance?

A: An FHA streamlined refinance allows you to refinance your current FHA loan with minimal documentation and no appraisal required, provided you meet certain eligibility criteria.

Q: What is the FHA 203(b) loan program?

A: The FHA 203(b) is the standard FHA loan used for the purchase of homes and covers single-family and multi-family properties.

Q: Can I use an FHA loan to buy a fixer-upper

A: Yes, you can use an FHA loan for homes that need repairs, especially with the FHA 203(k) loan.

Q: What is an FHA 203(k) loan?A: The FHA 203(k) loan is designed for homes that need significant repairs or renovations and allows you to finance both the home and the repairs.

Q: How long does it take to get an FHA loan approval?

A: The FHA loan approval process typically takes 30-45 days but can vary depending on the lender and documentation.

Q: How do I apply for an FHA loan?

A: You apply through an FHA-approved lender, providing your financial information and undergoing a credit check.

Q: What are the FHA loan interest rates?

A: FHA loan interest rates are typically competitive with conventional loan rates but can vary based on your credit score, market conditions, and loan terms.

Q: Are FHA loans only for primary residences?

A: Yes, FHA loans are only for homes that you intend to live in as your primary residence.

Q: Can I get an FHA loan if I’ve had a foreclosure?

A: Yes, you can apply for an FHA loan after a foreclosure if it has been at least 3 years since the foreclosure was completed.

Q: Can I get an FHA loan if I’ve had a bankruptcy?

A: Yes, after 2 years for a Chapter 7 bankruptcy, or 1 year for a Chapter 13 bankruptcy, with evidence of re-established credit.

Q: Can I have multiple FHA loans at the same time?

A: Yes, but only under certain conditions, such as if you need to move due to work or other reasons.

Q: What is the FHA mortgage insurance premium (MIP)?

A: MIP is insurance that protects the lender in case you default on the loan. It’s required for all FHA loans.

Q: How much is the upfront MIP for an FHA loan?

A: The upfront MIP is typically 1.75% of the loan amount, which can be rolled into the mortgage.

Q: Is MIP required for all FHA loans?

A: Yes, MIP is required for all FHA loans.

Q: How long do I have to pay MIP on an FHA loan?

A: If your loan is for more than 90% of the home’s value, you’ll pay MIP for the life of the loan. If less than 90%, MIP can be removed after 11 years.

Q: What happens when I pay off my FHA loan?

A: Once paid off, you’ll no longer be required to pay MIP, and the lender will release the lien on your property.

Q: Can I cancel my FHA MIP?

A: You cannot cancel upfront MIP but may be able to cancel monthly MIP under certain conditions (e.g., refinancing to a conventional loan).

Q: Are FHA loans available for manufactured homes?

A: Yes, the FHA insures loans for manufactured homes, provided they meet certain standards.

Q: Can I use an FHA loan to buy a condo?

A: Yes, as long as the condo project is approved by the FHA.

Q: Can I use an FHA loan to buy a multi-family property?

Yes, you can use an FHA loan to buy a property with up to 4 units, as long as you live in one unit.

Q: Can I use an FHA loan for new construction?

A: Yes, FHA loans can be used to finance new construction homes.

Q: Can I get an FHA loan if I’m self-employed?

A: Yes, self-employed borrowers can qualify for FHA loans by providing tax returns, profit & loss statements, and other documentation.

Q: What is an FHA-approved lender?

A: An FHA-approved lender is a financial institution authorized by the FHA to issue FHA-insured loans.

Q: How do I find an FHA-approved lender?

A: We find the best one for your situation.

Q: How do FHA loans differ from conventional loans?

A: FHA loans typically have lower credit scores and down payment requirements compared to conventional loans but come with mortgage insurance.

Q: What is the FHA loan limit by county?

A: Loan limits vary by county and can be found on the FHA website or by asking your lender.

Q: How do I check if my county has an FHA loan limit?

A: You can check the FHA loan limits for your county on the FHA website.

Q: Can I use an FHA loan if I’ve previously had one?

A: Yes, you can apply for an FHA loan again, but it will depend on your current financial situation.

Q: What is the FHA 5% down program?

A: The FHA 5% down program is a variant where a borrower puts down 5% of the home’s value instead of the standard 3.5%.

Q: Can I use an FHA loan if I’m not a U.S. citizen?

A: Yes, if you’re a permanent Florida resident or a non-permanent Florida resident with lawful status, you can qualify for an FHA mortgage.

Q: What documents do I need for an FHA loan?

A: You’ll typically need proof of income, credit history, employment records, and tax returns.

Q: What are the standard FHA mortgage requirements for debt-to-income ratio (DTI)?

A: The standard DTI ratio is 31% for the front-end ratio (housing costs) and 43% for the back-end ratio (all monthly debts).

| Florida Counties | Jumbo Florida loan limits | Florida FHA Loan limits |

|---|---|---|

| Alachua | $806,500 | $524,225 |

| Baker | $806,500 | $580,750 |

| Bay | $806,500 | $524,225 |

| Bradford | $806,500 | $524,225 |

| Brevard | $806,500 | $524,225 |

| Broward | $806,500 | $654,350 |

| Calhoun | $806,500 | $524,225 |

| Charlotte | $806,500 | $524,225 |

| Citrus | $806,500 | $524,225 |

| Clay | $806,500 | $580,750 |

| Collier | $806,500 | $764,750 |

| Columbia | $806,500 | $524,225 |

| Desoto | $806,500 | $524,225 |

| Dixie | $806,500 | $524,225 |

| Duval | $806,500 | $580,750 |

| Escambia | $806,500 | $524,225 |

| Flagler | $806,500 | $524,225 |

| Franklin | $806,500 | $524,225 |

| Gadsden | $806,500 | $524,225 |

| Gilchrist | $806,500 | $524,225 |

| Glades | $806,500 | $524,225 |

| Gulf | $806,500 | $524,225 |

| Hamilton | $806,500 | $524,225 |

| Hardee | $806,500 | $524,225 |

| Hendry | $806,500 | $524,225 |

| Hernando | $806,500 | $524,225 |

| Highlands | $806,500 | $524,225 |

| Hillsborough | $806,500 | $524,225 |

| Holmes | $806,500 | $524,225 |

| Indian River | $806,500 | $524,225 |

| Jackson | $806,500 | $524,225 |

| Jefferson | $806,500 | $524,225 |

| Lafayette | $806,500 | $524,225 |

| Lake | $806,500 | $524,225 |

| Lee | $806,500 | $524,225 |

| Leon | $806,500 | $524,225 |

| Levy | $806,500 | $524,225 |

| Liberty | $806,500 | $524,225 |

| Madison | $806,500 | $524,225 |

| Manatee | $806,500 | $547,400 |

| Marion | $806,500 | $524,225 |

| Martin | $806,500 | $596,850 |

| Miami-Dade | $806,500 | $654,350 |

| Monroe | $967,150 | $967,150 |

| Nassau | $806,500 | $580,750 |

| Okaloosa | $806,500 | $603,750 |

| Okeechobee | $806,500 | $524,225 |

| Orange | $806,500 | $524,225 |

| Osceola | $806,500 | $524,225 |

| Palm Beach | $806,500 | $654,350 |

| Pasco | $806,500 | $524,225 |

| Pinellas | $806,500 | $524,225 |

| Polk | $806,500 | $524,225 |

| Putnam | $806,500 | $524,225 |

| Santa Rosa | $806,500 | $524,225 |

| Sarasota | $806,500 | $547,400 |

| Seminole | $806,500 | $524,225 |

| St. Johns | $806,500 | $580,750 |

| St. Lucie | $806,500 | $596,850 |

| Sumter | $806,500 | $524,225 |

| Suwannee | $806,500 | $524,225 |

| Taylor | $806,500 | $524,225 |

| Union | $806,500 | $524,225 |

| Volusia | $806,500 | $524,225 |

| Wakulla | $806,500 | $524,225 |

| Walton | $806,500 | $603,750 |

| Washington | $806,500 | $524,225 |

7. What Areas Do You Cover?

We cover every county and city in Florida including Alachua – Baker – Bay – Bradford – Brevard – Broward – Calhoun – Charlotte – Citrus – Clay -Collier – Columbia – DeSoto – Dixie – Duval – Escambia – Flagler – Franklin – Gadsden – Gilchrist – Glades – Gulf – Hamilton – Hardee – Hendry – Hernando – Highlands – Hillsborough – Holmes – Indian River – Jackson – Jefferson – Lafayette – Lake – Lee – Leon – Levy – Liberty – Madison – Manatee – Marion – Martin – Miami-Dade – Monroe – Nassau – Okaloosa – Okeechobee – Orange – Osceola – Palm Beach – Pasco – Pinellas – Polk – Putnam – Santa Rosa – Sarasota – Seminole – St. Johns – St. Lucie – Sumter – Suwannee – Taylor – Union – Volusia – Wakulla – Walton – Washington –

| All Florida | Manasota Key | Timber Pines | Stuart |

| Jacksonville | Crooked Lake Park | Flagler Beach | Southchase |

| Miami | Navarre Beach | Belleview | Auburndale |

| Tampa | Taft | Hutchinson Island South | Zephyrhills |

| Orlando | Punta Rassa | Samsula-Spruce Creek | Opa-locka |

| St. Petersburg | Baldwin | Lochmoor Waterway Estates | Warrington |

| Hialeah | Roseland | St. Augustine South | Lady Lake |

| Port St. Lucie | Franklin Park | South Sarasota | Niceville |

| Tallahassee | Yalaha | June Park | Longwood |

| Cape Coral | Bokeelia | Brookridge | Azalea Park |

| Fort Lauderdale | Mayo | Connerton | Three Lakes |

| Pembroke Pines | Lake Hamilton | Plantation |

Bellair-Meadowbrook Terrace

|

| Hollywood | Rainbow Park | Ridge Wood Heights | Groveland |

| Miramar | Cypress Quarters | Big Pine Key | St. Augustine |

| Gainesville | Ocklawaha | Pea Ridge | West Park |

| Coral Springs | Hawthorne | Bay Hill | Lockhart |

| Lehigh Acres | Lake Butler | Butler Beach | Sunset |

| Clearwater | Pierson | Mount Plymouth | Oldsmar |

| Brandon | Keystone Heights | Wauchula | Hobe Sound |

| Palm Bay | Old Miakka | Nassau Village-Ratliff | Callaway |

| Spring Hill | East Bronson | Fussels Corner | Homosassa Springs |

| Pompano Beach | Belleair Beach | Suncoast Estates | Thonotosassa |

| West Palm Beach | Buckhead Ridge | Dundee | Destin |

| Miami Gardens | Babson Park | Samoset | Villas |

| Lakeland | Glencoe | Lower Grand Lagoon | East Milton |

| Davie | Midway | Rainbow Springs and Stock Island | West Lealman |

| Boca Raton | Callahan | Clarcona | Olympia Heights |

| Riverview | DeLand Southwest | Charlotte Harbor | Gonzalez |

| Sunrise | Mexico Beach | Pine Manor | Lakewood Park |

| Plantation city | Molino | Ridge Manor | Viera West |

| Deltona | Harlem Heights | Daytona Beach Shores | Mount Dora |

| Alafaya | Greenville | Gifford | Fruitville |

| Town ‘n’ Country | Solana | Fort Pierce South | Miami Springs |

| Miami Beach | Hastings | Parker | Atlantic Beach |

| Palm Coast | Paisley | Whitfield CDP | Palmer Ranch |

| Largo | Verandah | Mary Esther | Palmetto |

| Fort Myers | St. Leo | Taylor Creek |

Jensen Beach and Forest City

|

| Melbourne | Five Points | Madeira Beach | Iona |

| The Villages | Heritage Bay | Holmes Beach | Gladeview |

| Pine Hills | North Redington Beach | Laguna Beach | Yulee |

| Deerfield Beach | Astor | Indian Rocks Beach and Buckingham | Conway |

| Boynton Beach | Redington Beach | Indian River Shores | South Daytona |

| Kendall | Indian Shores | Grant-Valkaria | North Palm Beach |

| Kissimmee | Juno Ridge | Moon Lake | Sarasota Springs |

| Lauderhill | Fanning Springs | Orangetree | Jupiter Farms |

| Weston | Pomona Park | Belleair | Elfers |

| Homestead | San Antonio | Jasper | Key Biscayne |

| Delray Beach | Gretna | Lake Sarasota | Cypress Lake |

| North Port | Kenwood Estates | Mulberry | Trinity |

| Daytona Beach | Desoto Acres and Weeki Wachee Gardens | Crawfordville | Panama City Beach |

| Poinciana | Palm Beach Shores | Ave Maria | Fernandina Beach |

| Tamarac | Chokoloskee | Sawgrass | Wilton Manors |

| Jupiter | Webster | Nokomis | Middleburg |

| Wellington | Pine Lakes | Woodville | Goldenrod |

| Port Charlotte | North DeLand | San Castle | Gulfport |

| Port Orange | Black Diamond | Lake Panasoffkee | Viera East |

| The Hammocks | Archer | Tierra Verde | Naranja |

| North Miami | Bronson | Wahneta | Holly Hill |

| Doral | Gun Club Estates | Balm | Orange City |

| Palm Harbor | Anna Maria | High Point | Minneola |

| Coconut Creek | Crescent Beach | Highland Beach | Lake City |

| Wesley Chapel | Black Hammock | Goulding | Laurel |

| Sanford | Harold | North River Shores | Shady Hills |

| Ocala | Bristol | Ridgecrest | Port Salerno |

| Fountainebleau | Lawtey | Harbour Heights | Cheval |

| Margate | Medley | Umatilla | Fuller Heights |

| Sarasota | Silver Springs Shores East | Alturas | South Miami and Lantana |

| Bonita Springs | Masaryktown | West Bradenton | Westview |

| Bradenton | Center Hill | Watergate | Florida City |

| Palm Beach Gardens | Garden Grove | Bagdad | Cocoa Beach |

| Tamiami | St. George Island | Zephyrhills North | Mango |

| Kendale Lakes | White Springs | Lake Clarke Shores | Lakeland Highlands |

| Westchester | Chumuckla | Juno Beach | Pine Castle |

| Pinellas Park | Welaka | Chipley | Highland City |

| St. Cloud | Andrews | Rainbow Lakes Estates | Medulla |

| Pensacola | Waldo | Loxahatchee Groves | Pasadena Hills |

| Apopka | Coleman | Lely | Hudson |

| Country Club | Seville | Tiger Point | Lighthouse Point |

| Coral Gables | Bradenton Beach | Montura | Goulds |

| University CDP | Raleigh | St. James City | Pebble Creek |

| Ocoee | Gulf Stream | Holden Heights | Westwood Lakes |

| Titusville | North Key Largo | Port St. Joe | Celebration |

| Horizon West | Westlake | Cedar Grove | Doctor Phillips |

| Four Corners | Crystal Springs | Windermere | Satellite Beach |

| Fort Pierce | Scottsmoor | Kensington Park | On Top of the World |

| Oakland Park | Branford | Venice Gardens | Asbury Lake |

| Winter Garden | Jupiter Island | Feather Sound | Union Park |

| North Lauderdale | Fort Braden | Ocala Estates | Memphis |

| Altamonte Springs | Matlacha | Vineyards | New Port Richey East |

| Cutler Bay | Cedar Key | Winter Beach | Gateway |

| Ormond Beach | Shalimar | Silver Springs | Avon Park |

| Winter Haven | Melbourne Village | Flagler Estates | West Vero Corridor |

| North Miami Beach | Cottondale | South Beach | Sebring |

| North Fort Myers | Grand Ridge | Woodlawn Beach | Sugarmill Woods |

| Greenacres | Wiscon | Blountstown | Cape Canaveral |

| Oviedo | Allentown | Ponce Inlet | Palatka |

| Valrico | Jennings | West DeLand | Progress Village |

| The Acreage | St. Lucie Village | Melbourne Beach | Miami Shores |

| Hallandale Beach | Duck Key | North Brooksville | Fairview Shores |

| Royal Palm Beach | Palmona Park | Frostproof | Bee Ridge |

| Plant City | Panacea | Hilliard | Milton |

| Meadow Woods | Briny Breezes | Bushnell | Rotonda |

| Land O’ Lakes | Lake Kathryn | Geneva | Bithlo |

| Lake Worth Beach | Waverly | Crystal River | Cypress Gardens |

| Kendall West | Homestead Base | Midway city and Hill ‘n Dale | Westgate |

| Egypt Lake-Leto | Marco Shores-Hammock Bay | Chattahoochee | Wimauma |

| Navarre | Rio | Malabar | Alachua |

| Aventura | Bradley Junction and Fort White | Harbor Bluffs | St. Augustine Shores |

| Richmond West | Greensboro | Dover | Key Largo |

| Winter Springs | Wabasso | Biscayne Park | West Perrine |

| Clermont | Ponce de Leon | Grenelefe | Bardmoor |

| University | Indian Lake Estates | Point Baker | Richmond Heights |

| Dunedin | Cinco Bayou | Oakland | St. Pete Beach |

| Lauderdale Lakes | Glen St. Mary | Alva | Pine Ridge CDP |

| Panama City | Roeville | De Leon Springs | Beverly Hills |

| Cooper City | Paxton | Bal Harbour | Fruitland Park |

| South Miami Heights | Ona | Edgewood | Citrus Springs |

| Princeton | Penney Farms | Seminole Manor | Springfield |

| Carrollwood | Acacia Villas | Tangerine | Micco |

| Buenaventura Lakes | Vernon | Bowling Green | Hernando |

| Riviera Beach | Hosford | Pretty Bayou | Southeast Arcadia |

| Merritt Island | Hillsboro Pines | Port Richey | Miramar Beach |

| Golden Glades | Whitfield | Tangelo Park | Palm Beach |

| DeLand | Page Park | Indialantic | Orange Park |

| Estero | Stacey Street | Zellwood | Marathon |

| Fruit Cove | Greenwood | Bunnell | Fern Park |

| Parkland | Lake Mystic | Meadow Oaks | Lake Park |

| East Lake | Pinecraft | Island Walk | Gulf Gate |

| West Little River | Avalon | Hypoluxo | Indian Harbour Beach |

| Lake Magdalene | Schall Circle | Quail Ridge | Brooksville |

| Dania Beach | Golden Beach | Madison | North Merritt Island |

| Ferry Pass | Laurel Hill | Lake Helen | Green Cove Springs |

| Lakeside | Yankeetown | Olga | Seffner |

| Miami Lakes | Bell and Lee | Greenbriar | Arcadia |

| Winter Park | Alford | Eagle Lake | Broadview Park |

| Fleming Island | Beverly Beach | Bay Pines | West Miami |

| Golden Gate | Steinhatchee | Sharpes | North Bay Village |

| East Lake-Orient Park | Paradise Heights | Inverness Highlands North | Southwest Ranches |

| Vero Beach South | Fort Green Springs | Williston | Clewiston |

| Casselberry | Key Colony Beach | Harlem | McGregor |

| Oakleaf Plantation | Hampton | Bonifay | Odessa |

| Immokalee | Jay | Cleveland | Citrus Hills |

| Rockledge | Sea Ranch Lakes | Carrabelle | Wedgefield |

| Citrus Park | Ferndale | Vamo | North Weeki Wachee |

| New Smyrna Beach | Reddick | Cabana Colony | Williamsburg |

| Temple Terrace | Spring Lake | Big Coppitt Key | Lake Lorraine |

| Leisure City | Garcon Point | Wallace | Orlovista |

| Bayonet Point | Micanopy | Verona Walk | Inverness |

| Lakewood Ranch | Lemon Grove | Cross City | Sanibel |

| Sun City Center | Sopchoppy | Apalachicola | Wildwood |

| Ruskin | Altha | Dade City North | Longboat Key |

| Sebastian | Orchid | Eastpoint | Dade City |

| Coral Terrace | Lisbon | Florida Gulf Coast University | Quincy |

| Tarpon Springs | Canal Point | Hernando Beach | South Apopka |

| Keystone | Jupiter Inlet Colony | Pine Air | Lecanto |

| Haines City | East Williston | Hurlburt Field | Neptune Beach |

| Palm Springs | Chaires | Berkshire Lakes | Sky Lake |

| Bloomingdale | Winding Cypress | Vilano Beach | Fort Pierce North |

| Palm City | Cloud Lake | Eglin AFB | Inwood |

| Silver Springs Shores | Wausau | Freeport | West Samoset |

| South Bradenton | Lake Hart | Haverhill | Willow Oak |

| Ives Estates | Windsor and Pioneer | Lake Mack-Forest Hills | Mims |

| Crestview | Brownsdale | Williston Highlands | Belle Isle and River Park |

| Wright | Gardner | Polk City | Indiantown |

| Northdale | Fisher Island | Eatonville | South Patrick Shores |

| Palm River-Clair Mel | Wacissa | Watertown | Inverness Highlands South |

| Key West | La Crosse | Dunnellon | Fort Myers Beach |

| Palmetto Bay | St. Marks | Virginia Gardens | Beacon Square |

| Wekiwa Springs | McIntosh and Matlacha Isles-Matlacha Shores | Chiefland | St. Augustine Beach |

| Port St. John | Westville | Belleair Bluffs | Ormond-by-the-Sea |

| Edgewater | Manalapan | Lake Placid | Vero Lake Estates |

| Oak Ridge | Limestone | Moore Haven | Live Oak |

| Venice | Brooker | North Sarasota | Treasure Island |

| Jacksonville Beach | Floridatown | Astatula | Heathrow |

| Fish Hawk | Hillcrest Heights | Campbell | Perry |

| Hialeah Gardens | Miccosukee | Monticello | Loughman |

| Apollo Beach | Esto | Pelican Marsh | Fort Myers Shores |

| West Melbourne | Capitola | Pine Island Center | Macclenny |

| Westchase | Spring Ridge | Mangonia Park | Gulf Breeze |

| Leesburg | Worthington Springs and Munson | Silver Lake | Pembroke Park |

| The Crossings | Trilby | Holley | Lauderdale-by-the-Sea |

| Lutz | Noma | Havana | DeFuniak Springs |

| Jasmine Estates | Ocean Breeze | Graceville | South Bay |

| West Pensacola | Golf | Cudjoe Key | Southgate |

| Fort Walton Beach | Waukeenah | Zolfo Springs | Marianna |

| Pace | Pineland | Sewall’s Point | Lely Resort |

| Sunny Isles Beach | Jacob City | Burnt Store Marina | Indian River Estates |

| Brent | Caryville | Sneads | Kathleen |

| Naples | Pittman | Redington Shores | Naples Manor |

| Lealman | Yeehaw Junction | Bear Creek |

Islamorada, Village of Islands

|

| Ensley | Homeland | Manatee Road | Pahokee |

| Bellview | Everglades | Malone | Pelican Bay |

| Florida Ridge | Ebro | Lake Belvedere Estates | Osprey |

| DeBary | Raiford | Tyndall AFB | Crystal Lake |

| Eustis | Goodland | Roosevelt Gardens | Jan Phyl Village |

| Holiday | Campbellton | El Portal | Combee Settlement |

| Liberty Triangle | Glen Ridge and Highland Park | Tropical Park | Fort Meade |

| Lynn Haven | Nobleton | Trenton | Naples Park |

| Sweetwater | Fort Green | Oak Hill | Tequesta |

| Palm Valley | Berrydale | Washington Park | South Gate Ridge |

| Bayshore Gardens | Fidelis | Gotha | Newberry |

| Cocoa | Captiva | Fort Denaud | Mascotte |

| Punta Gorda | Aucilla | Grove City | Lake Alfred |

| Hunters Creek | Charleston Park | Century | Ocean City |

| Belle Glade | Morriston | Tavernier | Cocoa West |

| Bartow | Day | Hillsboro Beach | High Springs |

| Englewood | Aripeka | Chuluota | South Highpoint |

| Midway CDP | Okahumpka | Lake Mary Jane and Montverde | Bay Harbor Islands |

| Bradfordville | Sorrento | Desoto Lakes | Ellenton |

| Pinecrest | Mount Carmel | Atlantis | Palm Springs North |

| Marion Oaks | Otter Creek | Charlotte Park | Fellsmere |

| World Golf Village | West Canaveral Groves | Wabasso Beach | Valparaiso |

| Seminole | Pine Level | South Palm Beach | Surfside |

| Country Walk | Lloyd | Lake Kerr | Rio Pinar |

| San Carlos Park | Mulat | Interlachen | Siesta Key |

| Upper Grand Lagoon | Sumatra | Howey-in-the-Hills | Okeechobee |

| Gibsonton | Layton | Homosassa | Whiskey Creek |

| Marco Island | Bascom | Heritage Pines | Davenport |

| Safety Harbor | Belleair Shore | Pine Ridge | Starke |

| Maitland | Springhill | Inglis | Zephyrhills West |

| Lake Butler CDP | Horseshoe Beach | Wewahitchka | Tice |

| Glenvar Heights | Altoona | Crescent City and Limestone Creek |

Three Oaks and River Ridge

|

| Brownsville | Dickerson City | Lacoochee | Warm Mineral Springs |

| Tavares | Istachatta | Oriole Beach | Zephyrhills South |

| Vero Beach | Lake Harbor | Key Vista | The Meadows |

| Myrtle Grove | Pine Island | Plantation Mobile Home Park | Port LaBelle |

| Pinewood | Cobbtown | Boulevard Gardens | LaBelle |

| Lake Mary | Tildenville and Bay Lake | Patrick AFB and Ocean Ridge | Floral City |

| Ojus | Indian Creek and Dixonville | East Palatka | Pensacola Station |

| Nocatee | Lamont | Palm Shores | Kenneth City |

| South Venice | Lazy Lake | Royal Palm Estates | South Brooksville |

| New Port Richey | Plantation Island | Christmas | White City |

| Lake Wales | Marineland | Timber Pines | South Pasadena |

| Palmetto Estates | Lake Buena Vista | Flagler Beach | Cortez |

| Stuart | Weeki Wachee | Belleview | Stuart |