Florida Land Lenders For Vacant Residential Land, we have land lenders for the refinance cashout or purchase using residential land for collateral.

What is Zoned Residential? In Florida, “zoned residential” means a property designated for residential use, typically including single-family homes, apartments, townhouses, and other dwelling types, with specific zoning regulations governing land use and development.

Vacant Florida Land Lenders

You’ve found the perfect piece of land and we have financing solutions to help make it yours! As a nationwide Florida Land Loan Orginatgors our vacant residential land loans can meet your needs no matter where the property is located in the United States. Our team has the experience to help you turn ownership dreams into a reality.

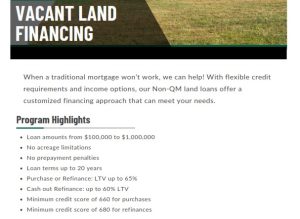

At Florida Residential Land Lenders, our Non-QM land loans offer flexibility that is not available with traditional vacant land financing. From loan terms to credit requirements and income documentation, we provide a customized financing approach that tailors to non-traditional borrowers.

Florida land loans can accommodate individual buildable lots, investment, income-producing property with acreage, recreational properties (ex. hunting) and much more!

Vacant Land Loan Lenders Options:

- Land loans in Florida with no acreage limitations

- ITIN and SSN borrowers are eligible.

- Purchase 35% Downpayment or cash-out refinance: up to 65% LTV.

- Loan terms up to 20 years.

- Credit score min 660 for land purchases and 680 for land refinances.

- No Tax Return Florida Land Loan Options.

- Bank Statement Florida Land Lenders.

- 1099 Florida Land L0an Lenders.

- Self-Employed Florida Land Loan Lenders.

- Minimum loan amount of $100,000.

- Maximum loan amount of $825,000.

Mortgage for Unique Properties

Florida Mortgage Lenders offers customized mortgage solutions for unique property types. Whether you’re thinking about buying a mobile home, vacant land, or a non-warrantable condo/townhome, Our Florida land lenders come through with a solution that best fits you.

Loans With or Without the Land!

You just found a mobile home on a little bit of land that you would like to call home, we have financing solutions that can help make it possible! Our loan programs can meet your Florida mobile home loan needs no matter where you are. Our team has the experience to help you turn ownership dreams into a reality. Getting a Florida land loan can be a bit more complex than getting a traditional mortgage, but it’s achievable. Here’s a breakdown of the process and things to consider:

1. Define Your Purpose and Property:

What will you use the land for? This is crucial. Will you build a home? Farm it? Use it for recreation? Your plans heavily influence the type of loan and lender you’ll need.

What type of land is it?

Raw land: Undeveloped with no utilities or road access. Hardest to finance.

Unimproved land: Some basic utilities may be present, but still likely no structures.

Improved land: Has access to utilities, and roads, and may even have some structures. Easiest to finance.

2. Research Florida Land Lenders:

Not all Florida lenders offer land loans. Start with local banks and credit unions, as they may be more familiar with the area and land values.

Specialty lenders: Look into Farm Credit Services or other lenders specializing in land loans.

Online lenders: Compare rates and terms from various online lenders.

3. Understand the Loan Requirements:

Higher down payment: Expect to put down 20-50% of the purchase price, as land is seen as a riskier investment than a house.

Higher interest rates: Land loans typically have higher interest rates than mortgages due to the increased risk.

Shorter loan terms: Repayment periods may be shorter, such as 5-15 years, compared to 30-year mortgages.

Credit score: Lenders will want to see a good to excellent credit score, generally 680 or higher.

Debt-to-income ratio (DTI): Your DTI should be low, showing you can manage debt.

Land appraisal: The lender will likely require an appraisal to determine the land’s value.

Development plan: Be prepared to present a detailed plan for how you intend to use the land, especially if you plan to build.

4. Gather Documentation:

Financial statements: Prepare income statements, balance sheets, and cash flow projections.

Tax returns: Provide recent tax returns to demonstrate your income and financial history.

Credit report: Obtain a copy of your credit report to review for any errors.

Business plan (if applicable): If you plan to use the land for commercial purposes, a solid business plan is essential.

Land survey: You may need a survey to define property boundaries.

Environmental assessments: Depending on the land and your plans, environmental assessments may be required.

5. Apply for the Loan:

Complete the application: Fill out the loan application accurately and provide all necessary information.

Submit documentation: Submit all required documents to the lender for review.

Communicate with the lender: Stay in contact with the lender throughout the application process and address any questions or concerns promptly.

6. Loan Approval and Closing:

Underwriting process: The Florida land loan lender will review your application and assess your creditworthiness and financial stability.

Loan approval: If approved, you’ll receive a loan offer outlining the terms and conditions.

Closing process: Review the loan documents carefully and finalize the loan agreement.

Tips for Getting a Florida Land Loan:

Improve your credit score: A higher score increases your chances of approval and better interest rates.

Save for a larger down payment: This reduces the lender’s risk and can lead to better loan terms.

Develop a clear land use plan: Show lenders you have a well-thought-out plan for the property.

Consider a co-signer: A co-signer with strong credit can strengthen your application.

Shop around for the best rates: Compare loan offers from multiple lenders to find the most competitive terms.

Work with a land loan specialist: They understand the unique requirements of land loans and can guide you through the process.

Important Note: Land loans are more complex than mortgages. Be prepared for a more rigorous application process, higher costs, and stricter requirements. Do your research, plan carefully, and work with experienced professionals to navigate the process successfully.

Call 954-667-9110 For More Information!

- NO Income Verification Investor Loans: Use the subject property’s income to qualify for your next investment property mortgage.

- Foreign National Mortgage Lenders: Nonresidents in the United States can invest using our FN mortgage options to purchase or cash out.

- Commercial mortgage Lenders: Case-by-case mortgage options for Florida office buildings, shopping centers, and warehouses.

- Bad Credit Florida Mortgage Lenders: Bad Credit based on a common sense approach based on payment history, not credit score driven.

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation options for mortgage qualifying.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% income can be used with no verified business expenses.

- VOE Florida Mortgage Lenders: Private Florida Mortgage Lenders will allow your VOE to disregard your tax return write-offs.

- Bank Statement Mortgage Lenders: Use 12 or 24-month average bank deposits for mortgage income qualifying.

- Asset-Based Mortgage Lenders– Assets in your account to cover the purchase price qualify you for enough income to qualify.

- Self-Employed Mortgage Options – If you write off too much of your income to qualify for the necessary funds.

- P&L Only Mortgage Lenders: Use Your licensed Tax preparer to provide a profit and loss statement for mortgage income verification.