Florida Bank Statement Mortgage Lenders – bank statement Florida Mortgage Lenders

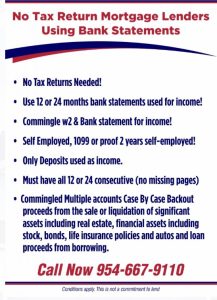

Yes, you can use a bank statement mortgage to qualify for a Florida home mortgage. They allow you to average your income based on either 3 months of bank statements or 12 or 24 months of bank statements, along with a year-to-date income statement. This approach can benefit self-employed individuals or 1099 mortgage applicants in Florida, as well as those applying under the verification of employment (VOE) process. These applicants can qualify for a Florida bank statement mortgage with bank statement s. Additionally, specific no-tax-return Florida lenders are offering Jumbo and Super Jumbo bank statement mortgage options.

- Self-Employed Less than 1 year = OK VOE Only Mortgage = OK Asset Depletion = OK

- No Doc, No W2, bank statement = OK Bank Statement Deposits = OK Jumbo bank statement s = OK

- ITIN bank statement mortgage = OK Nonresident bank statement = OK Pledged Assets = OK

- Asset Depletion or Pledged = OK Business Profit Loss = OK DSCR Rental Income = OK

- Home Loan bank statement s =OK 1099 mortgage Lenders = OK 3 Months Bank Statement = OK

Use Bank Statements For Income:

This program allows personal or business bank statements to calculate income without requiring tax returns. This program is available for purchase, cash-out refinance, or rate-term refinances. Whether you’re a business owner, freelancer, contractor, or gig worker we can help you qualify for a Florida mortgage by averaging your most recent 1 or 2-year deposits for income.

Bank Statement Mortgages Can Be Affordable:

- 10% Down Payment Options – 4-6 months reserves + possible seller-paid closing costs.

- A better option than claiming too much income on your tax returns.

- No Need to Amend Your Taxes! Instead, average 12/24 months deposits for income.

- No other documents like W2s, tax transcripts, or years of financial history.

- Fewer documents make it easier for self-employed borrowers and business owners to qualify.

Bank Statement Mortgages are Flexible:

- Ideal for self-employed, Contractors, Gig workers, and Entrepreneurs.

- Traditional mortgage lenders analyze pages and pages of tax returns, looking for red flags.

- Underwriters focus on simpler documentation.

- Easier for non-traditional borrowers to use more qualifying Income!

Streamlined Bank Statement Mortgage Process:

- bank statement s, tax return, Florida mortgage lenders use bank statements to qualify!

- Use 12-24 months of bank statements.

- 1099 Only Florida mortgage lenders.

- Profit & Loss (P&L) statement for mortgage lenders.

- VOE-only Florida Mortgage Lenders

Bank Statement Questions and Answers

- Q. What are the basic eligibility requirements for a no-tax return mortgage? Eligibility varies by lender and program, but generally includes:Cash: Usually requires a larger down payment than traditional mortgages, potentially ranging from 10% to 30% or more. Credit Score: Often requires a minimum credit score, typically 600 or higher, but some lenders may go lower. Income Verification (Alternative): Instead of tax returns, lenders use methods like bank statements (personal or business, 12-24 months) to average your income. Reserves: Bank statement mortgage lenders require several months of cash reserves to cover mortgage payments, especially for higher loan amounts. Employment History: While traditional employment isn’t the focus, some Bank statement lenders may prefer borrowers to be self-employed or in business for at least two years. We are lenders who will approve you after 6 months.

- Q Can self-employed individuals qualify for a mortgage without tax returns? Yes, bank statement mortgages are often designed for self-employed individuals, freelancers, and business owners whose tax returns might not accurately reflect their income due to deductions and write-offs. Bank statement loans and P&L statement loans are popular options for this group.

- Are there specific professions that are more likely to be approved for this type of bank statement loan? While not exclusive, professionals with non-traditional income streams, such as: Entrepreneurs and Business Owners, Often have complex financial situations. Freelancers and Gig Economy Workers: Income may vary. Real Estate Investors: May qualify based on property cash flow (DSCR loans). Retirees: May use asset depletion to qualify.

- What credit score is typically required for a no-tax return Florida mortgage? Generally, a good credit score is needed, often 600 or higher, with some lenders preferring 700+. Lower scores may be accepted with higher down payments and stricter terms.

- Is there a minimum down payment requirement? If so, what is it? Yes, typically a higher down payment is required compared to conventional loans. This can range from 10% to 30% or even more, depending on the lender, loan program, and borrower’s qualifications. But remember, in addition to the downpayment, you will need closing costs could be another 5%, and reserves, which may maybe another 5%, totaling another 10%.

- Can foreign nationals obtain a mortgage without US tax returns? Yes, some non-QM lenders offer programs for foreign nationals. They may use international credit reports and other financial documentation to assess creditworthiness and ability to repay.

- Are there restrictions on the type of property I can purchase with a no-tax-return mortgage (e.g., primary residence, investment property)? Restrictions can vary. Some programs are available for primary residences, second homes, and investment properties. DSCR loans, for example, are specifically for investment properties.

- Can I refinance my existing mortgage into a no-tax-return loan? Yes, it’s possible to refinance into a non-QM loan, especially if your income situation has changed or you are self-employed.

- Are there limitations on the loan amount for bank statement mortgages? Yes, loan limits exist and can vary by lender and program. They may go up to several million dollars, but this depends on the specific circumstances.

- What factors besides income verification are considered during the underwriting process?Lenders also consider:Credit history and credit score.Assets and reserves.Debt-to-income ratio (DTI), although it may be more flexible than with traditional loans (potentially up to 50%).Property appraisal.Overall financial profile and ability to repay.

- Can I use assets as a basis for qualification instead of income? Yes, asset-based loans or asset depletion loans allow borrowers with significant liquid assets (savings, investments, retirement accounts) to qualify. A portion of these assets is calculated as potential income.

- What types of assets are typically accepted for asset-based Florida mortgage lenders? Commonly accepted assets include: Savings accounts. Investment accounts (stocks, bonds, mutual funds). Retirement accounts (IRAs, 401(k)s).

- How long do I need to have held the assets to use them for qualification? Florida mortgage lenders typically prefer assets to have been held for a certain period, often several months, to demonstrate stability.

- Can I use bank statements to qualify for a mortgage without tax returns?Yes, bank statement loans are a common type of bank statement mortgage. Lenders analyze personal or business bank statements (typically 12-24 months) to determine average monthly deposits and cash flow to assess income.

- If using bank statements, what period do lenders typically review (e.g., 12 or 24 months)? Common review periods are 12 or 24 consecutive months of bank statements from the same account.

- How do lenders analyze bank statements to determine income? Lenders look at consistent deposits and cash flow. For self-employed individuals, they may analyze business bank statements, factoring in an expense ratio to determine net income.

- What kind of documentation is required to support bank statement income? Besides the bank statements themselves, lenders may require:Proof of self-employment (e.g., business license).Personal identification.Potentially a CPA letter confirming the business’s existence.

- Can I use profit and loss statements from my business instead of tax returns? Yes, some non-QM programs allow qualification based on P&L statements, often covering the last 12 months.

- If using profit and loss statements, do they need to be audited or reviewed by a CPA? Requirements vary. Some lenders may accept self-prepared P&L statements, while others might require them to be prepared or reviewed by a Certified Public Accountant (CPA).

- Are there specific requirements for the length of time my business has been operating? Many lenders prefer the business to be operating for at least two years to demonstrate stability. However, some may accept one year with sufficient experience in the same field.

- Can I combine different methods of income verification (e.g., bank statements and P&L)? This can depend on the lender and the specific loan program. It’s best to discuss your situation with a lender to see what options are available.

- What if I have significant income but legally don’t file tax returns? This would be a unique situation requiring careful consideration by a non-QM lender. They would likely rely heavily on bank statements, asset documentation, and other means to verify your ability to repay.

- Are there any circumstances where a lender might still request tax returns even for a “bank statement ” program? In some cases, lenders might request tax returns to clarify specific financial aspects or if the alternative documentation raises questions.

- How does my debt-to-income ratio (DTI) affect my eligibility for this type of loan?DTI is still a factor, but non-QM loans often allow for higher DTI ratios (e.g., up to 50%) compared to traditional mortgages (typically capped around 43%). Are the DTI requirements different for bank statement mortgages compared to traditional mortgages? Yes, non-QM loans generally have more flexible DTI requirements.

- Are the interest rates typically higher for bank statement mortgages compared to traditional mortgages? Yes, interest rates are generally higher because these loans are considered riskier by lenders due to the non-traditional income verification.

- What types of interest rates are available (e.g., fixed-rate, adjustable-rate)? Both fixed-rate and adjustable-rate mortgages (ARMs) are typically available for non-QM loans.

- What are the typical loan terms offered for bank statement mortgages (e.g., 15-year, 30-year)? Common loan terms like 15-year and 30-year fixed-rate options are usually available. Some non-QM loans might even have terms longer than 30 years.

- Are there any prepayment penalties associated with bank statement mortgages? This varies by lender and loan program. Some may have prepayment penalties, while others do not. It’s crucial to check the loan terms.

- What are the closing costs involved in a no-tax return mortgage? Closing costs are similar to traditional mortgages and can include appraisal fees, title insurance, lender fees, and other expenses. However, the total amount might be slightly higher due to additional underwriting involved.

- Are the appraisal requirements different for bank statement loans? Appraisal requirements are generally the same as for traditional mortgages, ensuring the property’s value supports the loan amount.

- Will I need private mortgage insurance (PMI) if my down payment is less than 20%? Not for bank statement loans, but generally, Yes, if your down payment is below 20%, PMI is typically required, similar to conventional loans.

- Is the PMI rate different for bank statement Florida mortgages? PMI rates can vary based on the loan type, down payment, and borrower’s risk profile. It’s possible that PMI rates might be slightly higher for non-QM, including bank statement loans due to the perceived higher risk.

- Are there any additional fees associated with bank statement mortgages? Lenders may charge higher origination or underwriting fees to account for the additional complexity of verifying non-traditional income.

- How can I compare the costs of different Florida bank statement mortgage lenders’ options? Compare the Annual Percentage Rate (APR), which includes the interest rate and other fees, to get a comprehensive view of the bank statement loan’s cost. Also, ask for a detailed breakdown of all fees involved.

Florida Bank Statement Mortgage Locations:

| Alachua | Alachua County |

| Alford | Jackson County |

| Altamonte Springs | Seminole County |

| Altha | Calhoun County |

| Anna Maria | Manatee County |

| Apalachicola | Frankin County |

| Apopka | Orange County |

| Arcadia | DeSoto County |

| Archer | Alachua County |

| Astatula | Lake County |

| Atlantic Beach | Duval County |

| Atlantis | Palm Beach County |

| Auburndale | Polk County |

| Aventura | Miami-Dade County |

| Avon Park | Highlands County |

| Bal Harbor | Miami-Dade County |

| Baldwin | Duval County |

| Bartow | Polk County |

| Bascom | Jackson County |

| Bay Harbor Islands | Miami-Dade County |

| Bay Lake | Orange County |

| Bell | Gilchrist County |

| Belle Glade | Palm Beach County |

| Belle Isle | Orange County |

| Belleair | Pinellas County |

| Belleair Beach | Pinellas County |

| Belleair Bluffs | Pinellas County |

| Belleair Shore | Pinellas County |

| Belleview | Marion County |

| Beverly Beach | Flagler County |

| Biscayne Park | Miami-Dade County |

| Blountstown | Calhoun County |

| Boca Raton | Palm Beach County |

| Bonifay | Holmes County |

| Bonita Springs | Lee County |

| Bowling Green | Hardee County |

| Boynton Beach | Palm Beach County |

| Bradenton Beach | Manatee County |

| Bradenton | Manatee County |

| Branford | Suwannee County |

| Briny Breezes | Palm Beach County |

| Bristol | Liberty County |

| Bronson | Levy County |

| Brooker | Bradford County |

| Brooksville | Hernando County |

| Bunnell | Flagler County |

| Bushnell | Sumter County |

| Callahan | Nassau County |

| Callaway | Bay County |

| Cambelton | Jackson County |

| Cape Canaveral | Brevard County |

| Cape Coral | Lee County |

| Carrabelle | Frankin County |

| Caryville | Washington County |

| Casselberry | Seminole County |

| Cedar Grove | Bay County |

| Cedar Key | Levy County |

| Center Hill | Sumter County |

| Century | Escambia County |

| Chattahoochee | Gadsden County |

| Chiefland | Levy County |

| Chipley | Washington County |

| Cinco Bayou | Okaloosa County |

| Clearwater | Pinellas County |

| Clermont | Lake County |

| Clewiston | Hendry County |

| Cloud Lake | Palm Beach County |

| Cocoa | Brevard County |

| Cocoa Beach | Brevard County |

| Coconut Creek | Broward County |

| Coleman | Sumter County |

| Cooper City | Broward County |

| Coral Gables | Miami-Dade County |

| Coral Springs | Broward County |

| Cottondale | Jackson County |

| Crawfordville | Wakulla County |

| Crescent City | Putnam County |

| Crestview | Okaloosa County |

| Cross City | Dixie County |

| Crystal River | Citrus County |

| Dade City | Pasco County |

| Dania Beach | Broward County |

| Davenport | Polk County |

| Davie | Broward County |

| Daytona Beach | Volusia County |

| Daytona Beach Shores | Volusia County |

| DeBary | Volusia County |

| Deerfield Beach | Broward County |

| DeFuniak Springs | Walton County |

| DeLand | Volusia County |

| Delray Beach | Palm Beach County |

| Deltona | Volusia County |

| Destin | Okaloosa County |

| Doral | Miami-Dade County |

| Dundee | Polk County |

| Dunedin | Pinellas County |

| Dunnellon | Marion County |

| Eagle Lake | Polk County |

| Eatonville | Orange County |

| Ebro | Washington County |

| Edgewater | Volusia County |

| Edgewood | Orange County |

| El Portal | Miami-Dade County |

| Esto | Holmes County |

| Eustis | Lake County |

| Everglades City | Collier County |

| Fanning Springs | Gilchrist County |

| Fanning Springs | Levy County |

| Fellsmere | Indian River County |

| Fernandina Beach | Nassau County |

| Flagler Beach | Flagler County |

| Florida City | Miami-Dade County |

| Fort Lauderdale | Broward County |

| Fort Meade | Polk County |

| Fort Myers Beach | Lee County |

| Fort Myers | Lee County |

| Fort Pierce | St. Lucie County |

| Fort Walton Beach | Okaloosa County |

| Fort White | Columbia County |

| Freeport | Walton County |

| Frostproof | Polk County |

| Fruitland Park | Lake County |

| Gainesville | Alachua County |

| Glen Ridge | Palm Beach County |

| Glen Saint Mary | Baker County |

| Golden Beach | Miami-Dade County |

| Golf | Palm Beach County |

| Golfview | Palm Beach County |

| Graceville | Jackson County |

| Grand Ridge | Jackson County |

| Green Cove Springs | Clay County |

| Greenacres | Palm Beach County |

| Greensboro | Gadsden County |

| Greenvilee | Madison County |

| Greenwood | Jackson County |

| Gretna | Gadsden County |

| Groveland | Lake County |

| Gulf Breeze | Santa Rosa County |

| Gulf Stream | Palm Beach County |

| Gulfport | Pinellas County |

| Haines City | Polk County |

| Hallandale | Broward County |

| Hampton Beach | Bradford County |

| Hastings | St. Johns County |

| Havana | Gadsden County |

| Haverhill | Palm Beach County |

| Hawthorne | Alachua County |

| Hialeah | Miami-Dade County |

| Hialeah Gardens | Miami-Dade County |

| High Springs | Alachua County |

| Highland Beach | Palm Beach County |

| Highland Park | Polk County |

| Hillcrest Heights | Polk County |

| Hilliard | Nassau County |

| Hillsboro Beach | Broward County |

| Holly Hill | Volusia County |

| Hollywood | Broward County |

| Holmes Beach | Manatee County |

| Homestead | Miami-Dade County |

| Horseshoe Beach | Dixie County |

| Howey-in-the-Hills | Lake County |

| Hupoluxo | Palm Beach County |

| Indialantic | Brevard County |

| Indian Creek | Miami-Dade County |

| Indian Harbour Beach | Brevard County |

| Indian River Shores | Indian River County |

| Indian Rocks Beach | Pinellas County |

| Indian Shores | Pinellas County |

| Inglis | Levy County |

| Interlachen | Putnam County |

| Inverness | Citrus County |

| Islamorada | Monroe County |

| Islandia | Miami-Dade County |

| Jacksonville Beach | Duval County |

| Jacksonville | Duval County |

| Jacob | Jackson County |

| Jasper | Hamilton County |

| Jay | Santa Rosa County |

| Jennings | Hamilton County |

| Juno Beach | Palm Beach County |

| Jupiter | Palm Beach County |

| Jupiter Inlet Colony | Palm Beach County |

| Jupiter Island | Martin County |

| Kenneth City | Pinellas County |

| Key Biscayne | Miami-Dade County |

| Key Colony Beach | Monroe County |

| Key West | Monroe County |

| Keystone Heights | Clay County |

| Kissimmee | Osceola County |

| La Crosse | Alachua County |

| LaBelle | Hendry County |

| Lady Lake | Lake County |

| Lake Alfred | Polk County |

| Lake Buena Vista | Orange County |

| Lake Butler | Union County |

| Lake City | Columbia County |

| Lake Clarke Shores | Palm Beach County |

| Lake Hamilton | Polk County |

| Lake Helen | Volusia County |

| Lake Mary | Seminole County |

| Lake Park | Palm Beach County |

| Lake Placid | Highlands County |

| Lake Wales | Polk County |

| Lake Worth | Palm Beach County |

| Lakeland | Polk County |

| Lantana | Palm Beach County |

| Largo | Pinellas County |

| Lauderdale Lakes | Broward County |

| Lauderdale-by-the-Sea | Broward County |

| Lauderhill | Broward County |

| Laurel Hill | Okaloosa County |

| Lawtey | Bradford County |

| Layton | Monroe County |

| Lazy Lake | Broward County |

| Lee | Madison County |

| Leesburg | Lake County |

| Lighthouse Point | Broward County |

| Live Oak | Suwannee County |

| Longboat Key | Sarasota County |

| Longboat Key | Manatee County |

| Longwood | Seminole County |

| Lynn Haven | Bay County |

| Macclenny | Baker County |

| Madeira Beach | Pinellas County |

| Madison | Madison County |

| Maitland | Orange County |

| Malabar | Brevard County |

| Malone | Jackson County |

| Manalapan | Palm Beach County |

| Mangonia Park | Palm Beach County |

| Marathon | Monroe County |

| Marco Island | Collier County |

| Margate | Broward County |

| Marianna | Jackson County |

| Marineland | St. Johns County |

| Marineland | Flagler County |

| Mary Esther | Okaloosa County |

| Mascotte | Lake County |

| Mayo | Lafayette County |

| McIntosh | Marion County |

| Medley | Miami-Dade County |

| Melbourne | Brevard County |

| Melbourne Beach | Brevard County |

| Melbourne Village | Brevard County |

| Mexico Beach | Bay County |

| Miami Beach | Miami-Dade County |

| Miami Gardens | Miami-Dade County |

| Miami Lakes | Miami-Dade County |

| Miami Shores Village | Miami-Dade County |

| Miami Springs | Miami-Dade County |

| Miami | Miami-Dade County |

| Micanopy | Alachua County |

| Midway | Gadsden County |

| Milton | Santa Rosa County |

| Minneola | Lake County |

| Miramar | Broward County |

| Monticello | Jefferson County |

| Montverde | Lake County |

| Moore Haven | Glades County |

| Mount Dora | Lake County |

| Mulberry | Polk County |

| Naples | Collier County |

| Neptune Beach | Duval County |

| New Port Richey | Pasco County |

| New Smyrna Beach | Volusia County |

| Newberry | Alachua County |

| Niceville | Okaloosa County |

| Noma | Holmes County |

| North Bay Village | Miami-Dade County |

| North Lauderdale | Broward County |

| North Miami | Miami-Dade County |

| North Miami Beach | Miami-Dade County |

| North Palm Beach | Palm Beach County |

| North Port | Sarasota County |

| North Redington Beach | Pinellas County |

| Oak Hill | Volusia County |

| Oakland | Orange County |

| Oakland Park | Broward County |

| Ocala | Marion County |

| Ocean Breeze Park | Martin County |

| Ocean Ridge | Palm Beach County |

| Ocoee | Orange County |

| Okeechobee | Okeechobee County |

| Oldsmar | Pinellas County |

| Opa-locka | Miami-Dade County |

| Orange City | Volusia County |

| Orange Park | Clay County |

| Orchid | Indian River County |

| Orlando | Orange County |

| Ormond Beach | Volusia County |

| Otter Creek | Levy County |

| Oviedo | Seminole County |

| Pahokee | Palm Beach County |

| Palatka | Putnam County |

| Palm Bay | Brevard County |

| Palm Beach | Palm Beach County |

| Palm Beach Shores | Palm Beach County |

| Palm Beach Gardens | Palm Beach County |

| Palm Coast | Flagler County |

| Palm Shores | Brevard County |

| Palm Springs | Palm Beach County |

| Palmetto | Manatee County |

| Palm Harbor | Pinellas County |

| Palmetto Bay | Miami-Dade County |

| Panama City | Bay County |

| Panama City Beach | Bay County |

| Parker | Bay County |

| Parkland | Broward County |

| Paxton | Walton County |

| Pembroke Park | Broward County |

| Pembroke Pines | Broward County |

| Penney Farms | Clay County |

| Pensacola | Escambia County |

| Perry | Taylor County |

| Pierson | Volusia County |

| Pine Crest | Miami-Dade County |

| Pinellas Park | Pinellas County |

| Plant City | Hillsborough County |

| Plantation | Broward County |

| Polk City | Polk County |

| Pomona Park | Putnam County |

| Pompano Beach | Broward County |

| Ponce De Leon | Holmes County |

| Ponce Inlet | Volusia County |

| Port Ornage | Volusia County |

| Port Richey | Pasco County |

| Port St. Lucie | St. Lucie County |

| Port St. Joe | Gulf County |

| Punta Gorda | Charlotte County |

| Quincy | Gadsden County |

| Raiford | Union County |

| Reddick | Marion County |

| Redington Beach | Pinellas County |

| Redington Shores | Pinellas County |

| Riviera Beach | Palm Beach County |

| Rockledge | Brevard County |

| Royal Palm Beach | Palm Beach County |

| Safety Harbor | Pinellas County |

| Saint Leo | Pasco County |

| San Antonio | Pasco County |

| Sanford | Seminole County |

| Sanibel | Lee County |

| Sarasota | Sarasota County |

| Satellite Beach | Brevard County |

| Sea Ranch Lakes | Broward County |

| Sebastian | Indian River County |

| Seabring | Highlands County |

| Seminole | Pinellas County |

| Sewall’s Point | Martin County |

| Shalimar | Okaloosa County |

| Sneads | Jackson County |

| Sopchoppy | Wakulla County |

| South Bay | Palm Beach County |

| South Daytona | Volusia County |

| Sounty Miami | Miami-Dade County |

| South Palm Beach | Palm Beach County |

| South Pasadena | Pinellas County |

| Southwest Ranches | Bay County |

| Springfield | Bay County |

| St. Augustine Beach | St. Johns County |

| St. Augustine | St. Johns County |

| St. Cloud | Osceola County |

| St. Lucie Village | St. Lucie County |

| St. Marks | Wakulla County |

| St. Pete Beach | Pinellas County |

| St. Petersburg | Pinellas County |

| Starke | Bradford County |

| Stuart | Martin County |

| Sun City Center | Hillsborough County |

| Sunny Hills | Washington County |

| Sunny Isles Beach | Miami-Dade County |

| Sunrise | Broward County |

| Surfside | Miami-Dade County |

| Sweetwater | Miami-Dade County |

| Tallahassee | Leon County |

| Tamarac | Broward County |

| Tampa | Hillsborough County |

| Tarpon Springs | Pinellas County |

| Tavares | Lake County |

| Temple Terrace | Hillsborough County |

| Tequesta | Palm Beach County |

| Titusville | Brevard County |

| Treasure Island | Pinellas County |

| Trenton | Gilchrist County |

| Umatilla | Lake County |

| Valpariso | Okaloosa County |

| Venice | Sarasota County |

| Vernon | Washington County |

| Vero Beach | Indian River County |

| Virginia Gardens | Miami-Dade County |

| Waldo | Alachua County |

| Wauchula | Hardee County |

| Wausau | Washington County |

| Webster | Sumter County |

| Weeki Wachee | Hernando County |

| Welaka | Putnam County |

| Wellington | Palm Beach County |

| West Melbourne | Brevard County |

| West Miami | Miami-Dade County |

| West Palm Beach | Palm Beach County |

| Weston | Broward County |

| Westville | Holmes County |

| Wewahitchka | Gulf County |

| White Springs | Hamilton County |

| Wildwood | Sumter County |

| Williston | Levy County |

| Wilton Manors | Broward County |

| Windermere | Orange County |

| Winter Garden | Orange County |

| Winter Haven | Polk County |

| Winter Park | Orange County |

| Winter Springs | Seminole County |

| Worthington Springs | Union County |

| Yankeetown | Levy County |

| Youngstown | Bay County |

| Zephyrhills | Pasco County |

| Zolfo Springs | Hardee County |