Florida 1099 mortgage lenders allow the self-employed to average their most recent 2 years of 1099 and year-to-date income to mortgage qualify with no tax returns. 1099 Florida mortgage lenders for 1099 self-employed, 1099 gig workers, 1099 independent contractors, 1099 consultants, 1099 freelancers, 1099 Realtors, 1099 rideshare, photographers, income, and cannot qualify for the Florida mortgage they want. You could be an independent contractor, or sole proprietor seeking a Florida jumbo mortgage lender. If so you have to the right site!

1099 Florida Mortgage Lenders 4C Checklist

| 1. CASH | Minimum 10% down payment + closing cost 4-6% of sale price + 3+ 6 months reserves. |

| 2. CREDIT | Minimum 600+ credit score |

| 3. CAPACITY/(DTI) | Max DTI 50-55% with compensating factors. |

| 4. COLLATERAL | single-family homes townhomes, villas, approved condos, manufactured, modular, etc. commercial case by case. |

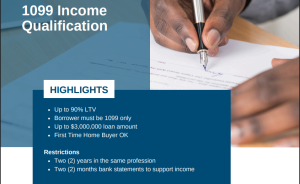

| Summary | 1099 – only mortgage is best for self-employed who get a 1099 but do not show enough income to qualify for the mortgage they want. We have access to Florida mortgage lenders that will let you money based on your average 2-year 1099s and year-to-date income. |

| 1099 Documents For Income | 2 years’ most recent 1099 and year-to-date statement do document continence of income. The lender will average the last 2 years’ income plus the year-to-date income. Asset statements for proof of downpayment closing cost and reserves. |

| Additional Information |

Purchase or Refinancing using 1099’s for income. Depending on the industry, the lender will assign an expense ratio to your business. 1099 mortgage lenders prefer 2 years in the same line of work. You can also add a w2 co-borrower. And if you can prove you were in the same line of work for example a w2 job before your 1099 income the lender may allow you to use your income to qualify. |

1099 Florida Mortgage Lenders Questions

Q: What types of jobs do 1099 mortgage loans work for? Self Employed 1099 and No Income Verification for everyone including Self-employed, Contactors, Business Owners, Entrepreneurs, Realtors, and Photographer., Website designer. ,Virtual assistant., Bookkeeper., Delivery jobs. , Landscaper. , Online writer. , House cleaner.Lawn Care Business, Graphic Design, Web Development, Writing & Editing, Photography, Video Editing, Bookkeeping & Accounting, Customer Service, Human Resources, Payroll, Project Management, Virtual Assistant, IT Consulting, Software Development, Electrician, Plumber, Construction, Cleaning Services, Delivery Services, Rideshare or Taxi Driver, Freight Driver,

Q: Who needs a 1099 mortgage and why? A: This mortgage program is for Florida business owners and contractors who receive Form 1099 and write off all their income and cannot qualify for the loan amount they need.

Q: Can I cash out and refinance my Florida Jumbo Florida mortgage using 1099 only for income? A: Yes, our 1099 mortgage lenders allow you to purchase or cash out refinance jumbo Florida mortgage loans using 1099 and year-to-date income to qualify.

1099 Alternative Mortgage Programs Include:

-

- No Income Florida Mortgage Lenders: No Doc, Stated Florida No Income verification Mortgage Lender

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% income can be used.

- VOE Florida Mortgage Lenders: Use VOE to disregard your tax return write-offs.

- Bank Statement Mortgage Lenders: Avg 12 or 24-month average bank deposits..

- Asset-Based Mortgage Lenders: Assets in your account to average for income.

- Self-Employed Mortgage Options – Too many expenses to show enough income.

- P&L Only Mortgage Lenders: Use Your licensed Tax preparer to provide a profit and loss.

- NO Income Verification Investor Loans: Use the property’s income to qualify.

- Foreign National Mortgage Lenders: mortgage options to purchase or cash out and purchase.

- Commercial mortgage Lenders: Florida office buildings, Rental Units, shopping centers, and warehouses.

- Reverse Mortgage Condo Lenders: 55+ Florida Reverse mortgage for Condos.

- Bad Credit Florida Mortgage Lenders: Bad Credit based on payment history, not credit score driven.

1099 MORTGAGE LENDERS IN ALL OF FLORIDA INCLUDING:

Alachua – Altamonte Springs – Anna Maria -Apalachicola – Apopka – Atlantic Beach – Auburndale – Aventura – Avon Park – Bal Harbour – Bartow – Bay Harbor Islands – Boca Raton – Bonita Springs – Boynton Beach – Bradenton – Brooksville – Cape Canaveral – Cape Coral – Casselberry – Celebration – Chipley – Cinco Bayou – Clearwater – Clermont – Clewiston- Cocoa- Cocoa Beach – Coconut Creek – Coral Gables – Coral Springs – Crystal River – Dania Beach – Davie – Daytona Beach – Deerfield Beach – DeFuniak Springs – DeLand – Delray Beach – Deltona – Destin – Dunedin – Eagle Lake – Edgewater – Edgewood -Eustis – Fort Lauderdale -Fort Meade – Fort Myers – Fort Myers Beach – Fort Pierce – Fort Walton Beach – Fruitland Park – Gainesville – Greenacres – Green Cove Springs – Gulf Breeze – Gulf port – Haines City – Hallandale Beach – Hawthorne – Hialeah – Hialeah Gardens – Highland Beach – Hollywood – Holly Hill – Holmes Beach – Homestead – Hypoluxo – Indialantic – Jacksonville – Juno Beach – Jupiter – Key Biscayne – Key West – Kissimmee – LaBelle – Lady Lake – Lake Alfred – Lakeland – Lake Mary – Lake Park – Lake Wales – Lake Worth – Lantana – Largo – Lauderdale By The Sea – Lauderhill – Leesburg – Lighthouse Point – Long boat Key – Longwood -Maitland – Marco Island – Margate – Melbourne -Melbourne Beach – Miami – Miami Beach Milton – Minneola – Miramar – Mount Dora – Naples – Neptune Beach – New Port Richey – New Smyrna Beach – Niceville – North Miami -North Miami Beach – North Port – Oakland Park – Ocala – Ocean Ridge – Ocoee – Okeechobee – Oldsmar Orange Park – Orlando – Ormond Beach – Oviedo – Palatka – Palm Bay – Palm Beach – Palm Beach Gardens – Palm Coast – Palmetto – Panama City – Panama City Beach – Pembroke Pines – Pensacola – Pinecrest – Pinellas Park – Plant City – Plantation – Pompano Beach – Ponce Inlet – Port Orange – Port St. Lucie – Punta Gorda – Rockledge – Royal Palm Beach – St. Augustine – St. Augustine Beach – St. Cloud – St. Pete Beach – St. Petersburg – Safety Harbor – Sanford – Sanibel – Sarasota – Satellite Beach – Seaside – Sebastiane wall’s Point – Shalimar – Stuart Surfside – Tallahassee – Tamarac – Tampa – Tarpon Springs – Tavares – Temple Terrace – Titusville – Treasure Island – Valparaiso – Venice – Vero Beach Wellington – West Melbourne – West Palm Beach – Weston – Wilton Manors Winter Garden – Winter Haven – Winter Park – Winter Springs –

Alachua County, FL Baker County, FL Bay County, FL Bradford County, FL Brevard County, FL Broward County, FL Calhoun County, FL Charlotte County, FL Citrus County, FL Clay County, FL Collier County, FL Columbia County, FL DeSoto County, FL Dixie County, FL Duval County, FL Escambia County, FL Flagler County, FL Franklin County, FL Gadsden County, FL Gilchrist County, FL Glades County, FL Gulf County, FL Hamilton County, FL Hardee County, FL Hendry County, FL Hernando County, FL Highlands County, FL Hillsborough County, FL Holmes County, FL Indian River County, FL Jackson County, FL Jefferson County, FL Lafayette County, FL Lake County, FL Lee County, FL Leon County, FL Levy County, FL Liberty County, FL Madison County, FL Manatee County, FL Marion County, FL Martin County, FL Miami-Dade County, FL Monroe County, FL Nassau County, FL Okaloosa County, FL Okeechobee County, FL Orange County, FL Osceola County, FL Palm Beach County, FL Pasco County, FL Pinellas County, FL Polk County, FL Putnam County, FL Saint Johns County, FL Saint Lucie County, FL Santa Rosa County, FL Sarasota County, FL Seminole County, FL Sumter County, FL Suwannee County, FL Taylor County, FL Union County, FLVolusia County, FL Wakulla County, FL Walton County, FL Washington County, FL