No Tax Return Self-Employed Florida Mortgage Lenders

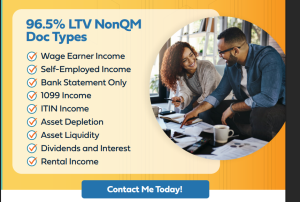

No tax return, Florida mortgage lenders use bank statements or 1099, OR VOE, OR average 3 months of bank statements, OR 12/24 bank statements to calculate your monthly income. Florida self-employed mortgage applicants OR Florida 1099 mortgage applicants can use bank statements to cash out, refinance to consolidate debt, or spend the cash out however they choose. No tax returns, Florida mortgage lenders use alternative ways to document income. These no-tax-return mortgage Florida mortgage lenders do require better credit and 6-12 months of reserves. Also, check out our Rent To Own Florida program, no tax return mortgage allows you to pick the home of your choice. And our 3.5% Down Florida ITIN Mortgage Lenders, or Rent to Own a Florida home.

Contents

- What Mortgage Options Are There For The Self-Employed?

- Why Self-Employed People Have Trouble Getting A Mortgage?

- What Are Self-Employed Mortgage Lenders Looking For?

- Self-Employed Document Checklist

1. What Mortgage Options Are There For The Self-Employed?

- No Income: No doc, stated Florida no Income verification Mortgage Lender

- No tax return: Non-QM and private lenders offer alternative documentation.

- 1099 Only: Use 1099 to report Income up to 100% of deposits if you don’t have any business expenses.

- VOE: Allow your VOE to disregard your tax return write-offs.

- Bank Statement: Use 12 or 24 average bank deposits for mortgage income.

- Asset-Based: Assets in your account to qualify.

- Self-Employed Mortgage: – If you write off too much of your income.

- P&L Only: Use your licensed Tax preparer’s Profit and Loss to qualify.

- NO Income: Use the subject property’s income for your next investment.

- Foreign National: Nonresidents can invest, purchase, or cash out.

- Commercial: Options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo: 55+ Florida Condo mortgages with no monthly payments.

- Bad Credit: Bad Credit mortgage approvals are based on payment history.

- Non-warrantable Florida Condos: that don’t meet Fannie Mae or Freddie Mac specifications.

- Condotel Mortgage Options: Unit owners can rent out their units to short-term guests

- Cross Collateral: qualify for up to 90% financing when pledging more than one property for collateral.

2. Mortgages For Self-Employed, 1099, Gig Workers & Freelancers.

Self-employed individuals often have difficulty qualifying for a mortgage due to writing off business expenses on their income taxes. If this describes you, then we have you covered! Our self-employed Florida mortgage lenders often require proof of Income history, including down payment, closing costs, and reserves. We offer several alternate document solutions for self-employed borrowers as well as contract workers.

3. What Are Self-Employed Lenders Looking For?

You can expect Florida self-mortgage mortgage lenders to request proof of the following, including:

- 2 years of Income stability in the same line of work

- The location and nature of your self-employment

- Document the financial strength of your business

4. What Documents Do Self-Employed Borrowers Need?

Like most lenders, self-employed borrowers will need to document cash, credit, capacity, and collateral.

- CASH – Purchase- Determine is there are enough funds for a Down payment, Closing Costs, and Reserves. Request 60-day bank statements for all asset accounts listed on the loan application. Check the bank statements and confirm the borrower had enough for 1. Down payment, 2. Closing cost, 3. Reserves. to meet the loan program requirements?

Verify there are enough funds for the Occupancy and or Loan Program Requirements. Example = Bank Statement only requires minimum 10% Down + Est 5% Closing Est 5% Reserves, the borrower needs at least 20%. Does the borrower have enough cash? Funds Must Be Sourced or Seasoned? Sourced = (proven) from an acceptable source or seasoned in the bank account 60+ days? Cash Deposits CANNOT be sourced. NSF on bank statements? Cash for Refinance – Is there enough EQUITY IN THE HOME to cover all liens, closing costs, etc? In General, the Max LTV is 75-80% of the Estimated Home value. 75 to 80% must include closing costs. Disqualifiers = Not enough funds or Unsourceable CASH deposits. For a Refinance,e NOT enough equity in the home to cover all refinance costs. If you are not sure, reask. - CREDIT – Is the credit Acceptable? Are there any disqualifiers? If you are uns, ask for help. Disqualifiers = Judgements, Repos, Evictions, 30,60,90 day late pays. Unable to prove financial stability and/or acceptable payment history, and too much debt.

- CAPACITY (DTI) – Verify Stable income, in general max DTI = 35/50 subject to AUS. Housing should be about 35% of your income and housing plus all other payments on your credit should be no more than 50%.

- COLLATERAL – Acceptable collateral for the loan program, livable, habitable, and insurable.

Disqualifiers Include = Will the home appraise? Is the home marketable, move-in ready?

Different types of properties have various down payments, closing costs, and reserve requirements. For Example, Nonwarrantable condos generally require min 25% down + closing cost + reserves. Find out from the lender the minimum down payment, closing costs, and reserves for the property type.

Self-Employed Florida Mortgage With No Tax Returns

No Income+No Doc Florida Mortgage Lenders

No Income Florida Mortgage + No Doc Florida Mortgage Lenders. We do have options for Florida no-doc loans on primary homes, but generally, no-doc mortgages.

1 Year Self-Employed (Alt Doc) Florida Mortgage Lenders

Less Than 1 Year Self-Employed Florida Mortgage Lenders. Yes, that’s right, we have a mortgage program for the self-employed for less than 1 year. The NEW

Private: Non-Warrantable Florida Condo Lenders

Non-Warrantable Condo Lenders – Refinance Non-Warrantable Condo Non-warrantable Florida Condo mortgage lenders help you refinance your Non-warrantable Florida Condo Loans. Florida Mortgages for Non-Warrantable Condos

Co-op Florida Mortgage Lenders- Refinance

Florida Mortgage Lenders For Co-ops If you are searching for Coop Florida mortgage lenders, Refinance Florida Coop, Jumbo Florida Coop mortgage, or No Tax Return.

Stated Income Florida Mortgage Lenders

Stated Florida Mortgage Lenders – Bank Statement Florida Mortgage Lenders A Florida no-income, document mortgage lender must have an exemption from the CDFI. approved

5% Down-Non-US Resident Florida Mortgage Lenders

Non-US Resident Florida Mortgage Program. The NEW Non-US resident structured financing agreement is a unique opportunity in which a purchase transaction is completed by

Cashout Refinance Mortgage Florida

Are you searching for a Cashout Refinance Mortgage in Florida, OR, Mortgage cashout Refinance in Florida, OR, Florida Mortgage Cashout Refinance, Refinance Florida Mortgage?

No Income Verification Florida Mortgage Lenders

No Income Florida Mortgage Lender: A Florida no-income, no-document verification mortgage lender must have an exemption from the CDFI. Approved Florida mortgage lenders are exempt

VOE Florida Mortgage Lenders

Florida Mortgage Lenders That Use a VOE for Income A (VOE) Verification of Employment. Florida Mortgage Lenders is a mortgage program sought after by Florida

P&L Florida Mortgage Lenders

1Y + 2Y P&L Florida Mortgage Lender. Our Non-QM 1-year and 2-year P and L Florida mortgage lenders provide P and L loans that are designed

Self-Employed Florida Mortgage Lenders

Self-Employed Florida Mortgage Lenders – No Doc Florida Mortgage Lenders. If you are self-employed in Florida, you are probably googling Less Than 1 Year Self-Employed

1099 Income Florida Mortgage Lenders

1099 Income Florida Mortgage Lenders – No Tax Return Florida Mortgage Lenders 1099 Mortgage lenders will average 2 years of 1099 and year-to-date income for

5% Down-No Tax Return Florida Mortgage Lenders

No Tax Return Florida Mortgage Lenders – No Income Verification Florida Mortgage Self-Employed – Bank Statement – No Tax Return- -1099 Mortgage -1 Year Self-Employed

ITIN Florida Mortgage Lenders

ITIN Florida Mortgage Lenders W No Tax Returns YES, You Get a Mortgage with NO Tax Returns! Florida Mortgage Lenders specializes in ITIN 1099 and

Jumbo No Tax Return Florida Mortgage Lenders

Jumbo No Tax Return Florida Mortgage Lenders No Tax Return Florida Jumbo Mortgage lenders provide specialty jumbo No Tax Return Florida home loans to self-employed people

Florida Home Loan With No Tax Returns – 5% Down

Florida Home Loan With No Tax Returns– OK Self-Employed Florida Mortgage Lenders Less than 2 years – OK No Doc, No W2, No Tax Returns,

Self-Employed 3 Months Bank Statement Mortgage

If you are self-employed in Florida, you are probably searching for Less Than 1 Year Self-Employed Florida Mortgage Lenders, No Tax Return Florida Mortgage Lenders,

Rent To Own Florida Homes

Rent To Own Florida FHA Mortgage Lenders Program. Our Rent Own FHA Mortgage Lenders program turns renters into future Florida homeowners by offering a lease-to-own

5% Down – ITIN Florida Mortgage Lenders

ITIN Florida Mortgage Lenders or low downpayment Florida ITIN mortgage lendersyou havecomee to the right place. We offer ITIN mortgage loans to help ITIN Florida.

Asset Depletion Florida Mortgage Lenders

Asset-Based Florida Mortgage Lenders. Florida Asset-based Mortgage Lenders will let you qualify for a Florida mortgage using your stocks, bonds, mutual funds, cryptocurrency, savings, and

Florida Jumbo & Super Jumbo Mortgage Lenders

Jumbo & Super Jumbo Florida Mortgage Lenders Florida Jumbo Mortgage lenders provide specialty jumbo Florida home loans to self-employed people with no tax returns, using 1099, VOE,

5% Down Florida Bank Statement Mortgage Lenders

Florida Bank Statement Mortgage Lenders – No Tax Return Florida Mortgage Lenders No Tax Return Florida mortgage lenders use a 3/12/24 months average bank statement