Use Profit and Loss To Qualify For A Mortgage

Profit and Loss Statement prepared by CPA/Enrolled Agent/Tax Florida Preparer Expenses will be calculated off the Profit and Loss Statement provided by CPA/Enrolled Agent for Florida mortgage applicant that covers the same period as the bank statements being used to qualify. The Profit and Loss Statement provided must support the revenue shown on the bank statements.. The percentage of expenses shown on the Profit and Loss Statement will be used to calculate the qualifying income from the bank statements.

P&L Mortgage Highlights

- P&L Must Be Prepared by a CPA, EA, or CTEC

- Borrower-prepared P&L NOT allowed

- P&L Must Cover 12 months and be Within 3 Months at Funding

- Co-Borrower W2 Income Allowed

- Up to 80% LTV

- Min FICO 660

- Up to $3M loan amount!

- 100% Gift Funds Allowed

- FTHB Allowed

- Primary, 2nd, and Investment Properties Allowed

- 3-12 Months Reserves

- SFH, 2-4 Unit, Condos

- Interest Only Available

- Use any AMC

- Cash-out can be used for reserves

- Min Expense Factor with a P&L is 10% for a service business and 20% for a product business

Tax Preparer Requirements

When using a Tax Preparer to document the expenses via a Profit and Loss Statement or expense. letter, the following is required:

• An expense letter must be on the tax preparer’s letterhead.

• A profit and loss statement must be signed by the tax preparer.

• Tax Preparers verified municipal, state, or federal proof of their business’ existence.

• Signed letter from borrower’s tax preparer affirming that tax preparer has filed the borrower’s tax returns for the previous two years OR that tax preparer has reviewed the previous two years of borrower’s self-prepared taxes.

Tax Preparer Requirements Include:

• An expense letter must be on the tax preparer’s letterhead.

• A profit and loss statement must be signed by the tax preparer.

• Tax Preparers must verify municipal, state, or federal licensing boards or proof of their business’ existence.

• Tax Preparer’s certified affirming that they have filed the borrower’s tax returns for the previous two years OR that the tax preparer has reviewed the previous two years.

By evaluating creditworthiness based on factors such as the business’s profit and loss statement, credit score, and loan-to-value (LTV) ratios, we can provide financing options for a diverse range of mortgage applicants who may not meet the requirements for conventional mortgages. Our P&L Florida mortgage program is designed to be flexible and adaptable, catering to the distinct needs of each situation.

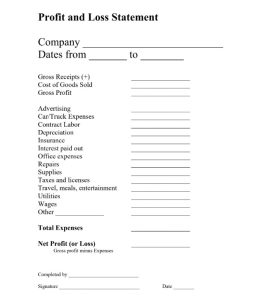

What Is a Profit and Loss (P&L) Statement?

A profit and loss (P&L) statement, also known as an income statement, is a financial statement that summarizes the revenues, costs, expenses, and profits/losses of a company during a specified period. These records provide information about a company’s ability to generate revenues, manage costs, and make profits. These are important to Florida mortgage lenders because they show the borrower’s ability to make the mortgage payments.

How Profit and Loss P&L Loans Work?

The P&L statement is one of three financial statements that every company has, along with the balance sheet and the cash flow statement. It is often the most popular and common financial statement in business because shows how much profit or loss was generated by a business.

P&L statements are also referred to as a(n):

- Statement of profit and loss

- Earnings statement

- Expense statement

- Income statement

- Statement of operations

- Statement of financial results or income

The P&L or income statement, like the cash flow statement, shows changes in accounts over a set period of time. The balance sheet, on the other hand, is a snapshot, showing what the company owns and owes at a single moment. It is important to compare the income statement with the cash flow statement since, under the accrual method of accounting, a company can log revenues and expenses before cash changes hands.

- P&L Only Florida Mortgage: Use Your licensed Tax preparer to provide a profit and loss statement for mortgage income verification.

P&L MortgageTakeaways

- The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

- Statements are prepared using the cash method or accrual method of accounting.

- It is important to compare P&L statements from different accounting periods, as any changes over time become more meaningful than the numbers themselves.

- The P&L statement is one of three financial statements that every public company issues quarterly and annually, along with the balance sheet and the cash flow statement.

- When used together, the P&L statement, balance sheet, and cash flow statement provide an in-depth look at a company’s overall financial performance.

Other Alt Doc Mortgage Programs Include:

- Bank Statement Mortgage Lenders: Use 12 or 24-month average bank deposits for mortgage income qualifying.

- Asset-Based Mortgage Lenders– Assets in your account to cover the purchase price qualify you for enough income to qualify.

- Self-Employed Mortgage Options – If you write off too much of your income to qualify for the necessary funds.

- P&L Only Mortgage Lenders: Use Your licensed Tax preparer to provide a profit and loss statement for mortgage income verification.

- NO Income Verification Investor Loans: Use the subject property’s income to qualify for your next investment property mortgage.

- Foreign National Mortgage Lenders: Nonresidents in the United States can invest using our FN mortgage options to purchase or cash out.

- Commercial mortgage Lenders: Case-by-case mortgage options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo Lenders: 55+ Florida Condo owners can withdraw cash out of their condos without monthly mortgage payments.

- Bad Credit Florida Mortgage Lenders: Bad Credit based on a common sense approach based on payment history, not credit score driven.

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation options for mortgage qualifying.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% income can be used with no verified business expenses.

- VOE Florida Mortgage Lenders: Private Florida Mortgage Lenders will allow your VOE to disregard your tax return write-offs.