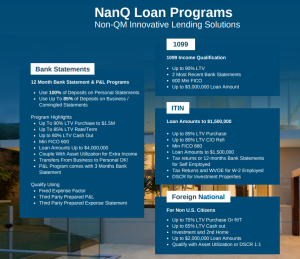

Non-QM Florida mortgage lenders offer nonqm mortgages including bank statement mortgages, 1099, no tax return, voe, self-employed, no income, profit loss, Foreign National, ITIN, No Doc Investor, P&L Coop loans, Cross collateral, pledged Assets, bad credit Florida mortgage lenders as classified as NON-qualified mortgage lenders that don’t adhere to the strict standards set by the Consumer Financial Protection Bureau (CFPB) for qualified mortgages (QMs), providing flexibility for borrowers with unique financial situations including cashout refinance Florida home listed for sale on the MLS.

Non-QM Mortgage Lenders In Florida

We offer a wide range of alternative mortgage programs from a network of national mortgage lenders that specialize in NON-QM mortgage loans. For various reasons, many Florida mortgage applicants do not fit into traditional conventional mortgage guidelines. NON-QM mortgage loans help fill the gap and offer alternative mortgage options for clients who do NOT qualify under traditional mortgage guidelines. NON-QM loans are loans that do NOT meet CFPB requirements for QM loans. Non-loans that do not fit the standard guidelines present a greater risk for mortgage lenders and require a larger downpayment and better credit scores.

NON-QM Florida Mortgage Options

| Self-employed | 1 YR Self-employed |

| Bank statement | VOE Only |

| No Income verification | Profit & Loss |

| No Doc | Non-resident |

| 1099 Only | ITIN Mortgage |

| 3-Month Bank Statement | Asset Depletion |

NON-QM Programs Include:

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation options.

- NO Income Verification Investor Loans: Use the subject property’s income to qualify.

- Foreign National Mortgage Lenders: Nonresidents in the United States can invest using our FN mortgage options.

- Commercial mortgage Lenders: Mortgage options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo Lenders: 55+ Florida Condo owners can reverse mortgage their condo without payments.

- Bad Credit Florida Mortgage Lenders: Bad Credit based on a common sense approach based on payment history.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% income can be used with no verified business expenses.

- VOE Florida Mortgage Lenders: Private Mortgage Lenders will allow your VOE to disregard to write-offs.

- Bank Statement Mortgage Lenders: Use 12 or 24-month average bank deposits for mortgage income qualifying.

- Asset-Based Mortgage Lenders– Assets in your account to cover the purchase price can be enough with some lenders.

- Self-Employed Mortgage Options – If you write off too much of your income to qualify for the necessary funds.

- P&L Only Mortgage Lenders: Use Your licensed Tax preparer to provide a profit and loss statement.

Our network of Florida mortgage lenders has years of experience in non-QM mortgage loans are is licensed to originate Non-QM and Non-Conforming Florida mortgages. We take pride in our clients getting the mortgage they desire, making us the go-to for non-QM mortgages in Florida.

Frequently Asked Questions & Answers!

Q: Can you explain what a non-QM mortgage is? A: A non-QM (Non-Qualified Mortgage) is a type of mortgage that does not meet the standards set by the Consumer Financial Protection Bureau for Qualified Mortgages. These loans are designed to help mortgage applicants with unique financial circumstances, such as self-employed individuals or real estate investors, who may not meet the conventional Fannie Mae mortgage requirements.

Q: Do you have any non-QM lenders in the rural Florida areas? A: Yes, our nonqm lenders offer a variety of Florida non-QM loan options serving all Rural Florida areas.

Q: Do traditional banks offer non-QM loans? A: Generally no many local banks do NOT offer non-QM mortgages.

Q: Is a non-QM mortgage considered hard money lending? A: No, a non-QM mortgage is not considered hard money lending. While both non-QM mortgages and hard money loans serve borrowers who may not qualify for traditional financing, they are not the same. Hard money loans are typically short-term loans secured by real estate, often used for investment purposes. Non-QM mortgages, however, are more similar to traditional mortgages and are used for home purchases or refinances.

Q: Who can benefit from a non-QM loan? A: Non-QM loans can benefit a variety of borrowers who may not meet the traditional lending requirements. This includes self-employed individuals, real estate investors, foreign nationals, and borrowers with significant assets. Non-QM loans can also be beneficial for those with unique income situations or those who have a high debt-to-income ratio.

Q: What is the difference between QM and non-QM mortgages? A: QM (Qualified Mortgages) are home loans that meet specific standards set by the Consumer Financial Protection Bureau. These standards include certain income and credit requirements, and they are designed to ensure that borrowers can repay their loans. Non-QM mortgages, on the other hand, do not meet these standards. They are designed for borrowers with unique income situations or other circumstances that may not fit within the traditional lending criteria.