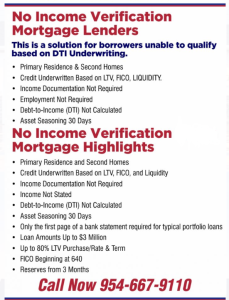

No Income Verification Florida Mortgage Lenders

People are asking around the web whether getting a home loan without income verification is possible in 2025. And, there are only a few exceptions. A Florida no-income verification mortgage loan originated by CDFI-approved Florida mortgage lenders is exempt from the Ability-to-Repay (“ATR”) rules outlined in Section 1411 of the Dodd-Frank Act and Regulation Z. Accordingly, Florida no-income verification mortgage lenders shall not have any liability concerning claims based on the lender’s failure to comply with the ATR requirement. With a no income verification or “No Ratio Mortgage” Florida mortgage lenders will not calculate your debt-to-income. This program is not even a stated income loan because you don’t have to verify your employment.

Florida Mortgage Options For No Income

- 30-Year Fixed Rate

- UP to 2MM / Min 25% Down + Closing Cost + Reserves / Sourced and seasoned for 30 days

- Loan Term 360 months 30-year fixed options.

- No Prepayment Penalty

- Balloon Payment None

- Escrow Account collects 1/12 monthly tax insurance account required

- Minimum Loan Amount $100,000

Purchase / Refinance

| Primary | LTV | FICO | Reserves |

| Purchase / Rate and Term | 75 | 680 | 6-9 months reserves |

| Primary residence | 75 | 680 | 6-9 months reserves |

| Cash Out | 70 | 680 | 6-9 months reserves |

No Income Approval Process

No Income Verification Florida lenders often need credit underwriters to consider compensating factors and or alternative documentation due to limited or irrelevant quantitative underwriting factors to establish a reasonable expectation of repayment in the following areas:

- Character & Credit History – Credit underwriting seeks to understand a borrower’s character as part of the process. To approve no income verification the borrower may need to provide a letter of explanation on how the income will be derived to make the mortgage payments. This may include reference letters, community activities, and reputation as well as credit history. Certain no-income mortgage applicants with limited FICO score alternative credit to evaluate the borrower’s reliability and reasonable expectation of repayment.

- Reserves- 6-24 months of future payments in your account at closing after downpayment and closing cost.

- Income =no income mortgage applicants who meet the Community no income mortgage eligibility requirements are not required to provide income documentation. Income is therefore not calculated nor stated on the loan application (1008/URLA) nor is a debt-toincome ratio calculated as part of the program’s established reasonable expectation of repayment.

- Loan Documentation – Credit underwriting will often use a “common sense” approach and use alternative and compensating forms of documentation to evaluate a reasonable expectation of repayment.

Refinance With No Income verification maximum Cash-out refinance

• Maximum Florida Cash-out seasoning of less than (6) months is not permitted unless the borrower acquired the property through an inheritance or was legally awarded the property (divorce, separation).

A prior No Income verification maximum cash-out refinance transaction within the last 12 months unless a documented benefit exists

No Income Verification Florida Maximum Rate & Term Refinance

Maximum Florida Cashout No Income verification mortgage proceeds are limited

Closed-end loan, at least 12 months seasoning has occurred; or

HELOC, at least 12 months of seasoning has occurred and total draws over the most recent 12 months are less than $2,000. HELOC must be closed.

Cashout For Debt Consolidation

Cash-out transactions meeting the following additional requirements may be treated and priced as Rate & Term transactions:

The borrower is solely paying off debt and can receive up to $2,000 in incidental cash in hand.

The Closing Disclosure must reflect the paid-off debts

Eligible Properties

Primary Home Residences

1-4 Unit Residential Properties

Florida Condominiums

o Fannie Mae warrantable

o Detached Condos

o Non-Warrantable

Agriculturally/Rural Zoned Properties

o Working farms, ranches, or orchards are ineligible.

No Income Mortgage Questions & Answers!

When it comes to “no income verification” Florida mortgage lenders there are some very common questions that arise, here they are:

Q: Are the interest rates higher on no-income verification mortgage loans?

A: Yes, depending on your credit score you can expect to pay 1-2% more than traditional full documented mortgage loans.

Q: What exactly is a “no income verification” mortgage?

A: These no-income verification loans, are often called “non-QM” loans but only very Florida Florida mortgage lenders can make these loans due to the ability to repay laws. These mortgage loans allow borrowers to qualify without providing traditional income documentation like W-2s or tax returns. Florida ATR-exempt mortgage lenders enders instead use alternative methods, such as Credit, Reserves, and Downpayment, to assess the borrower’s ability to repay.

Q: Who typically uses no-income verification loans?

A: Common users include: Self-employed, Gig Workers, Real estate investors. Business owners. Those with fluctuating or non-traditional income. retirees.

Q: How do lenders determine my ability to repay without income documents?

A: Asset-based loans: Using assets like investment accounts as collateral. DSCR (Debt Service Coverage Ratio) loans: Primarily for investment properties, focusing on the property’s rental income.

Q: Are interest rates higher for these loans in Florida?

A: Yes. Because these loans are considered higher risk for lenders, they typically come with higher interest rates and fees compared to traditional mortgages.

Q: What are the typical credit score and down payment requirements in Florida?

A: Requirements vary, but generally: Higher credit scores are needed (often 640 or higher, and sometimes 700+). Larger down payments are usually required (often 20% or more).

Q: Are these loans available for investment properties in Florida?

A: Yes, they are very popular for investment properties, especially in Florida’s rental market. DSCR loans are frequently used in these situations.

Q: Where can I find no income verification lenders in Florida?

A: These loans are typically offered by only Non-bank lenders with the federal government exception.

Q: What are the risks involved?

A: Risks include:Higher interest rates and fees.Potential for higher monthly payments.Increased risk of default.

Key Considerations for Florida:

Florida’s strong mortgage, real estate and investment market makes these loans particularly relevant. Florida has a large population of self-employed individuals also contributes to the demand.It is very important to work with a reputable Florida mortgage lender, due to the complexity of these loan products.I hope this information is helpful.

Alternate Document Florida Mortgage Programs You May Be Interested In:

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation options for mortgage qualifying.

- NO Income Verification Investor Loans: Use the subject property’s income to qualify for your next investment property mortgage.

- Foreign National Mortgage Lenders: Nonresidents in the United States can invest using our FN mortgage options to purchase or cash out.

- Commercial mortgage Lenders: Case-by-case mortgage options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo Lenders: 55+ Florida Condo owners can withdraw cash out of their condos without monthly mortgage payments.

- Bad Credit Florida Mortgage Lenders: Bad Credit based on a common sense approach based on payment history, not credit score driven.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% income can be used with no verified business expenses.

- VOE Florida Mortgage Lenders: Private Florida Mortgage Lenders will allow your VOE to disregard your tax return write-offs.

- Bank Statement Mortgage Lenders: Use 12 or 24-month average bank deposits for mortgage income qualifying.

- Asset-Based Mortgage Lenders– Assets in your account to cover the purchase price qualify you for enough income to qualify.

- Self-Employed Mortgage Options – If you write off too much of your income to qualify for the necessary funds.

- P&L Only Mortgage Lenders: Use Your licensed Tax preparer to provide a profit and loss statement for mortgage income verification.