No Income Doc Florida Mortgage Lenders

You’re probably Google searching for No Doc Florida mortgage lenders because you are looking for a No income verification Florida mortgage lender. After all, you are self-employed or in another situation that requires you to use alternative income or a no-doc loan that may include using bank statements for income or VOE for income, or even profit and loss, and wondering if these types of no-income verification Florida home loans still exist. For these Florida mortgage lenders, you will not need to provide tax returns or IRS transcripts. So it should be no surprise that this is one of the most popular Florida mortgage loans in today’s real estate market. Mostly because no-doc loans attract self-employed, contractors, entrepreneurs, and real estate investors because they allow them to bypass most of the income documents. For no-income verification investor loans, we can use the rental income to qualify.

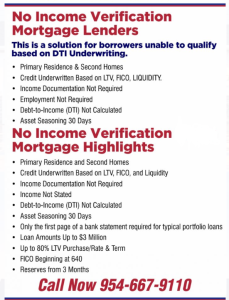

No Income Verification Florida Mortgage Lenders

No Doc Alt Doc Mortgage Lenders Summary

| CASH | Minimum 20% down + 5-6% closing cost + 6-9 months reserves. Florida No Doc Loan allows for up to 6% Seller Paid closing costs. |

| CREDIT | 2025 update must have a 680+ Credit Score for this program, Standard two (2) tradelines reporting for 12+ months or one (1) tradeline reporting for 24+ months with activity in the most recent 12 months. Mortgage History 0 x 30 x 12, Foreclosure Seasoning – Short Sale/DIL Seasoning – BK Seasoning = +24 months |

| CAPACITY/(DTI) | NA – NO income verification loans have no debt-to-income ratio requirements. |

| COLLATERAL | SFR, PUD, Detached Condo (max 75% LTV), Attached Condo (max 70% LTV), Non-Warrantable Condo (max 50% LTV), 2-4 Unit, Modular & Rural Homes. |

| Additional | Primary Residence only, Fixed = Note Rate, No income verification loans over $2,000,000 automatically require two appraisals. |

What Is A Florida No Doc Mortgage Lender?

For Florida mortgage applicants with complex situations, a no-income or no-doc loan can be a great way for you to get a mortgage. You can purchase a Florida home or even cash out refinance without the worry of additional documentation. You call us to review your situation and determine if one of these loans could fit your goals.

What No Doc or Alt Doc Mortgage Loans Are There?

- NO tax return Mortgage Lenders: Non-QM and Private Lenders offer alternative documentation options.

- NO Income Verification Investor Loans: Use the subject property’s income to qualify.

- Foreign National Mortgage Lenders: Nonresidents in the United States can invest using our FN mortgage options.

- Commercial mortgage Lenders: Mortgage options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo Lenders: 55+ Florida Condo owners can reverse mortgage their condo without payments.

- Bad Credit Florida Mortgage Lenders: Bad Credit is based on a common-sense approach based on payment history.

- 1099 Only Mortgage Lenders: Use 1099 Income up to 100% of income can be used with no verified business expenses.

- VOE Florida Mortgage Lenders: Private Mortgage Lenders will allow your VOE to disregard write-offs.

- Bank Statement Mortgage Lenders: Use 12 or 24-month average bank deposits for mortgage income qualifying.

- Asset-Based Mortgage Lenders– Assets in your account to cover the purchase price can be enough with some lenders.

- Self-Employed Mortgage Options – If you write off too much of your income, you may not qualify for the necessary funds.

- P&L Only Mortgage Lenders: Use your licensed Tax preparer to provide a profit and loss statement.

No Doc Pros & Cons of No Doc Mortgage Lenders

Some things are better or worse than they look, but if you don’t have many options.

But everything can’t be that good, can it? Let’s assume that this is what you are thinking about now. Indeed, there are thousands of options when a No Doc Loan in Florida will be the best loan choice for you, ou especially if you can’t quickly prove your income or provide a lot of documentation. But even this type of loan has its pitfalls. Let’s take a closer look at its advantages and disadvantages. After all, there are scenarios when it is more profitable for you to consider a conventional loan.

No Doc Loan Cons:

- No Doc loans require a higher credit score, higher downpayment, and reserves for no Doc Florida mortgage lenders. Borrowers need to have a score of around 680 and be able to afford a 25 to 35%

- Not many Florida mortgage lenders offer no-doc mortgage loans, so you’ll have to go through a lengthy search process. Or, you can simply apply now and get approved today with us.

- No Doc lenders can gouge you. receives less favorable lending conditions. Among them are higher mortgage rates than traditional loans. But remember that the better your credit score and the more cash for downpayment and reserves the better deal you will get.

No Doc Loan Pros:

- No Doc loans are easier to qualify for if you meet the cash and credit requirements.

- No Doc loans usually can close within 30 days.

- We have 30-year fixed mortgage doc mortgage lenders.