What Is A Cash-Out Refinance? The cash-out FHA mortgage refinance option allows Florida homeowners to pay off their existing Florida mortgage to lower their current interest rate and/or get cash out. The new loan amount depends on the amount of equity built up in your home’s value. To qualify for an FHA cash-out mortgage refinance will need at least 25-30 percent equity in the home based on the FHA appraised value. Equity is the difference between the current value of a property and the amount owed on the Florida mortgage.

Key Points

- You don’t need an existing FHA loan to qualify for an FHA cash-out mortgage refinance

- An FHA cash-out refinance enables you to access your home equity and pull cash out by replacing your current mortgage with a new mortgage.

- FHA mortgage applicants must meet FHA qualifying guidelines, including payment history, credit, and a maximum loan-to-value (LTV) ratio.

- The FHA refinance can be great for lowering monthly obligations and taking cash out of your home.

How Does An FHA Cash-Out Work?

An FHA cash-out refinance loan is a mortgage refinancing option insured by the Federal Housing Administration (FHA). This program enables homeowners to replace their current mortgage with a new one for a larger amount, receiving the difference as cash to use as they see fit. It’s a practical way to access your home’s equity without selling your property.

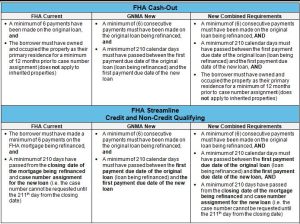

Unlike other FHA programs, such as the FHA streamline refinance, which is focused on reducing interest rates or monthly payments, the cash-out refinance option is open to all borrowers—even those who don’t currently have an FHA loan.

Other key features of this refinance loan type include:

- It allows you to cash out up to 80% of your home’s appraised value.

- The cash can be used for a variety of purposes, including consolidating high-interest debt, funding home improvements, covering medical bills, or even paying for educational expenses.

- FHA loans often have more lenient credit requirements, making this option appealing to those who may not qualify for conventional loans.

FHA Cash Out Refinancing Cons Guidelines

- Credit Scores- According to FHA guidelines, applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance. Most FHA insured lenders, however, set their own limits higher to include a minimum score of 600 – 620, since cash-out refinancing is more carefully approved than even a home purchase. Some companies require at least one credit score for all qualifying borrowers. Others require that you use the middle score if there are three applicable scores, or use the lower in case of two. The lowest credit score would be used for qualification purposes. Consult your licensed loan officer regarding the lending institution’s credit requirements in such cases.

- Debt-to-Income Ratio- The FHA has guidelines regarding an applicant’s debt-to-income ratio in order to keep people from entering into mortgage agreements that they cannot afford. Therefore, many borrowers choose to pay off certain debts to keep the ratio low. There are two different calculations to take into account:

- Maximum Loan to Value- FHA cash-out refinance loans have a maximum loan-to-value of 80 percent of the home’s current value. The 80% loan will include cashout and closing cost associated with the FHA refinance transaction. The LTV ratio is calculated by dividing the loan amount requested by the FHA appraised value.

- Payment History Requirements- Documentation is required to prove that the borrower has made all the monthly payments for the previous 12 months, or since the borrower obtained the loan, whichever is less. Mortgaged properties must have a minimum of 6 months of payments made before you are able to apply for a refinance. If you own your home free and clear, it may be refinanced as a cash-out transaction.

Benefits of the FHA Cash-Out Florida Mortgage

Whether you’re aiming to consolidate debt, fund major expenses, or invest in home improvements, the FHA cash-out refinance option opens up opportunities and allows you to benefit from a smooth and quick refinancing timeline.

Below are some of the key reasons why this program stands out:

- Lower credit score requirements: FHA cash-out refi loans generally have more lenient credit score requirements than other refinancing options, making this option accessible to more borrowers.

- Various use of funds: Use the funds for various purposes, including home improvements, medical bills, education costs, or paying off high-interest debt.

- Access to home equity: With this program, you can access up to 80% of your home’s appraised value, giving you significant financial flexibility.

- Competitive interest rates: FHA mortgage cash-out refi loans often have lower interest rates compared to other cash-out refinancing options.

FHA Cash-Out Refinance Requirements

Understanding these FHA cash-out refinance guidelines and requirements is crucial for determining your eligibility and successfully preparing your application. By meeting the requirements set by the FHA, you can access your home’s equity for various financial needs.

To qualify for an FHA cash-out refinance, borrowers must meet the following criteria:

- Primary residence: The property must be your primary residence, meaning vacation homes and investment properties do not qualify for this program.

- Property appraisal:An FHA appraisal is required to determine your home’s current market value, which directly impacts the amount you can borrow.

- Time in the home: You must have lived in your Florida home for at least 12 months to be eligible for the FHA refinance program.

- Payment history: You must have made at least 12 months of timely payments history.

- (DTI) Debt-to-Income: FHA mortgage lenders assess your DTI ratio to confirm that you can manage your new FHA loan payments with current obligations.

- Credit score: A minimum credit score of 500 is required, though a higher score may help you secure more favorable interest rates and loan terms. Borrowers with strong credit profiles are often viewed as lower risk by lenders.

- Loan-to-value (LTV) ratio: The new loan amount cannot exceed 75-80% of your home’s appraised value. This limit ensures you retain some equity in your property after refinancing.

How Much Cash Can You Get with an FHA Cash-Out Refinance?

Contact Us to see if an FHA Cash-Out Refinance Is Right for You

Deciding whether an FHA cash-out refinance aligns with your financial goals depends on a variety of factors. If you’re aiming to lower your interest rate, consolidate debt, or fund significant expenses like home improvements or education, this program could be the perfect solution.

If you’re a Florida homeowner who wants to tap into your equity or a Florida first-time buyer looking to secure an FHA purchase mortgage, we can help. We specialize in helping homeowners navigate the FHA process.

- FHA: loans have easier qualifications – Check FHA Florida Loan Limits

- FHA 100% mortgage options