Jumbo Mortgage Cross Collateral Mortgage Lenders

The cross-collateral program allows for 90% financing of the eligible property value when ELTV is 5% below published LTV with a maximum of 65% LTV, and, in certain cases (see below), an allowance for the borrower to elect not to make a down payment.

Generally, the minimum cash down payment required is as follows:

• 10% cash down required for owner-occupied cross-collateral properties

• 20% cash down required for second home or investment cross-collateral properties

100% financing may be available if the following three conditions are met:

• Purchase transactions ONLY

• Effective LTV that is AT LEAST 15% below the published threshold for the transaction

• 12 months’ all mortgage payments held in liquid reserves

• No gift funds are part of the transaction

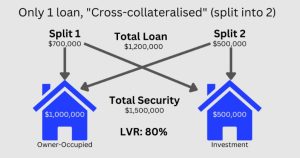

Effective LTV is calculated by dividing the loan amount by the total, summed value of both cross-collateral properties.

Example: Owner Occupied Property

Property A Lesser of Purchase Price or Appraised Value $2,000,000

Property B Appraised Value $ 770,000

TOTAL VALUE $2,770,000

90% of Purchase Price Property A $1,800,000

Loan Amount Requested $1,800,000

Cash Required $ 200,000

Effective LTV 64.98%

Other Cross Collateral Requirements:

• Primary residences, second homes, and investment cross-collateral properties may be crossed with the subject;

o NOTE: cross collateral properties located in Washington DC, West Virginia, and Virginia and Texas Homestead/Texas Home Equity may not be used for a cross.

• The second piece of real estate must be owned by the borrower;

• Florida cross-collateral mortgage lenders should be in the first lien position on both cross-collateral properties (deviations from the guideline are allowed if there is an abundance of equity). These deviations must be reasonable and well-documented;

• An appraisal report will be required for both cross-collateral properties as follows:

o Loan amount $1,000,000 or less – one appraisal is required for the subject property and one for the cross-property.

o Loan amounts between $1,000,000 and $1,500,000 – If the subject property appraisal is ordered through a Florida cross collateral mortgage lenders-approved AMC, then only one full appraisal is required. Otherwise, two full appraisal Reports are required. One for the cross-property.

o For loan amounts over $1.5 million: two reports for the subject property and one for the cross-property.

• A preliminary title report is required with the lender’s coverage on both cross collateral properties;

• Proof of hazard insurance for both cross-collateral properties.

• Proof of flood insurance for both cross collateral properties (if applicable).

• Property taxes due within 60 days must be paid current on both cross collateral properties.

• 2 recording fees if cross collateral properties are located in different counties.

• One note and one mortgage will be executed and will be recorded against both cross-collateral properties for the total loan amount (unless the cross-collateral properties are in different counties in which case 2 mortgages will be recorded – 2 recording fees)

More Florida Mortgage Options Include:

We provide a variety of specialty Alternative Florida mortgage programs including:

- No Income: No doc, stated Florida no Income verification Mortgage Lender

- NO tax return: Non-QM and private lenders offer alternative documentation.

- NO Income:: Use the subject property’s income for your next investment.

- Foreign National: Nonresidents can invest purchase or cash out.

- Commercial: Options for Florida office buildings, shopping centers, and warehouses.

- Reverse Mortgage Condo: 55+ Florida Condo mortgages with no monthly payments.

- Bad Credit: Bad Credit mortgage approvals based on payment history.

- Non-warrantable Florida Condos – that don’t meet Fannie Mae or Freddie Mac specifications.

- Condotel Mortgage Options – unit owners can rent out their units to short-term guests

- Cross Collateral – qualify up to 90% financing when pledging more than one property for collateral.

- 1099 Only: Use 1099 use Income up to 100% deposits if you don’t have any business expenses.

- VOE: Allow your VOE to disregard your tax return write-offs.

- Bank Statement: Use 12 or 24 average bank deposits for mortgage income.

- Asset-Based: Assets in your account to qualify.

- Self-Employed Mortgage: – If you write off too much of your income.

- P&L Only:: Use Your licensed Tax preparer Profit and Loss to qualify.