Florida Mortgage Lenders For Florida Co-ops

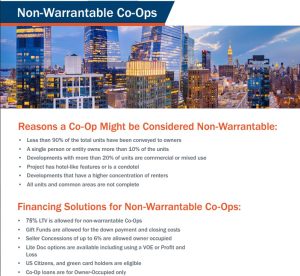

Refinance or purchase a Florida coop – co-op or cash-out refinance a Florida co-op with Florida mortgage lenders. When you buy into a coop or co-op, you purchase shares in the corporation that owns the property. All residents in the building are shareholders and they all share in the expenses and maintenance of the property. And, when you purchase a co-op you purchase shares of the corporation that owns the building. So in reality you are a shareholder in the corporation, versus a typical homeowner. With a Co-op, each participant is a shareholder and gets to occupy a unit in the condo or housing complex. Co-op properties are often funded by non-mortgage or private mortgage lenders because Fannie Mae does not purchase coop loans in Florida.

Standard – Co-op Mortgage Options Include:

- 30 year fixed

- Up to 80% Loan To Value

- Up To 1 MM

- Minimum 660+ Credit Scores

Jumbo – Florida Co-op Loan to Value

- 1,500,000 = 80% LTV

- 2,000,000 = 75% LTV

- 2,500,000 = 70% LTV

- 3,000,000 = 65% LTV

- 3,500,000 = 60% LTV

- 4,000,000 = 55% LTV

- 4,500,000= 50% LTV

- 5,000,000= 50% LTV

Co-op Approval Checklist:

We request these 3 documents on checklists first to confirm that the building meets the loan Coop specifications.

- Questionnaire – Completed by the managing agent to assess the building’s financial health and suitability for financing.

- Master Insurance policy – is a building-wide policy purchased by the co-op or condo association, covering common areas and the building structure

- Budget – Income / Expenses needed to operate and maintain the building, including utilities, insurance, and staff salaries, as well as improvements.

Co-op Restrictions

•Title Insurance policy issued through a title company or closing attorney must be issued on the Co-op certificate.

•Borrower paid attorney review of all applicable co-op documents or other pertinent items required before funding

•Leaseholds allowed with 30 years or more remaining on lease. Leases with 15 years or more remaining allowed on investment properties only

Co-op Reserve Requirements:

The current reserve balance meets or exceeds 2 months of the subject property’s HOA dues in reserves multiplied by all units in the project or 10% or more reserve allocation designated in the most recent budget.

Not allowed:

- NO Co-op Manufactured Homes

- No Structural deficiencies or pending litigation

- Incomplete construction of the subject phase

- Units without a stovetop and oven – must have both

- Homeowners Association with No reserves

- Homeowners Association limits the number of days the property can be accessed

Co-op Questions And Answers

Q – Do we approve loans in coop projects that have re-sale, age, income, or any other owner-related restrictions?

A – Florida Coop with any sort of re-sale restrictions presents a severely negative impact on the marketability of the unit in the event the borrower defaults and this becomes an REO. It is important to identify what the restrictions are to determine project warrant ability and eligibility:

- If the only restriction is the “Right of First Refusal”, this is okay and the project can still be eligible as Warrantable.

- For projects with age restrictions, such as 55-and-older communities, we will allow financing to these projects as long as:

- Borrower meets the age requirements, and;

- The project must not have any rehabilitation, medical treatment, or elder-care facilities (for example, nursing homes).

- The project will only be considered eligible as a Non-Warrantable. If both the above conditions are not met, the loan will be ineligible under all loan programs.

- For projects with income restrictions, such as low-to-moderate income (LMI), we will allow financing to these projects as long as:

- the subject unit is NOT one of the LMI or income-restricted units.

- The project will only be considered eligible as a Non-Warrantable. If the above condition is not met, the loan will be ineligible under all loan programs.

- For all other re-sale or owner-related restrictions not identified above, the loan will be deemed ineligible under all loan programs.

Q –What Cities Do you Offer Co-op Loans in? Florida Coop Lenders in Palm Beach, Fort Lauderdale, Hallandale, Panama city, Naples, Clearwater, Gainesville, Jacksonville, Miami, Tampa, Orlando, St. Petersburg, Tallahassee, Port St. Lucie, Sarasota, Fort Myers, Daytona Beach, Sunny Isles, Bal Harbor, Aventura, Key Biscayne, juno beach, North Miami, and everywhere in Florida.

Q- Does Fannie Mae Buy Co-op loans from lenders in Florida?

A – On the Fannie Mae it says they will fund loans in Florida but when I ask Florida mortgage lenders why they don’t make these loans they say that NO coops in Florida meet Fannie Mae’s specifications. This is why most Florida coop loans are harder to come by and funded only by private non-QM Florida mortgage lenders.

Q- What Cities Do You Service?

A – All of Florida including Jacksonville, Miami, Fort Lauderdale, Tampa, Palm Beach, Naples, Orlando, St Petersburg, Port St. Lucie, Cape Coral, Tallahassee, Fort Lauderdale, Hallandale, Aventura, Sunny Isles, and all Florida.