Florida ITIN Mortgage Lenders or low downpayment Florida ITIN mortgage lenders you came to the right place. We offer ITIN mortgage loans to help ITIN Florida business owners purchase a home. 3.5% Down Bank Statment Florida Mortgage Lenders are great if you searching for Mortgage for gig workers, ITIN-DACA Florida mortgage lenders, no tax return Florida mortgage lenders then you came to the right place. ITIN Florida mortgage applicants including non-immigrants including B-1 (business visitor) and B-2 (tourist) visas, followed by the F-1 (student) and H-1B (specialty occupation) visas. This owner financing program only requires only 3.5% Down, up to 6% seller paid closing cost, 3 months’ bank statements, YTD Profit loss, and last year’s tax return show just to prove you made income. This allows you to owner-finance any home that qualifies for an FHA mortgage loan. The Govt entity will pay off the seller of the home you choose and the owner finance the house to you for 40 years. It might seem complicated but it’s not that bad. Call me I’m here to help tie it together.

Seller Financing FHA Conditions

•Minimum 3.5% down payment up to FHA loan limits – FHA Lending LIMITS listed Below

• Borrowers facing credit challenges 40-year amortization with an equity option.

• Seller must pay closing cost up to 6% if you don’t have closing cost.

• First-time homebuyers

• Self-employed individuals

• 1099 and gig workers

• Those relocating or starting a new job

• Recent college graduates

• Individuals with student loan debt

• ITIN/DACA borrowers

•A minimum credit score of 600 is required (ITIN borrowers exempt from credit score requirement)

•Roof under 10 years old appraisal must be – c3 or c4 condition indicating a well-maintained property with some minor deferred maintenance or physical deterioration due to normal wear

Eligible Borrowers

Maximum two applicants per financing

• U.S Citizens

• Individuals or Inter Vivos (Living) Trusts; DACA ok

• Non-U. S Citizens (no exceptions made on documentation needed below)

o Lawful Permanent Residents

▪ Eligible with a green card, requires a U.S. social security number

o Non-Permanent Resident Aliens

▪ Eligible with proof of employment and Individual TaxpayerIdentification Number (ITIN)

or

▪ Eligible with a U.S. social security card (that is valid for work only with DHS authorization) and

Employment Authorization card

o Borrower(s) with Diplomatic Immunity

▪ Not eligible

• Non-occupant co-borrower allowed

o Must sign the loan documents as an additional guarantor

o Income may be used for qualifying income

o Occupancy is not required

o Must have no interest in the transaction as a seller

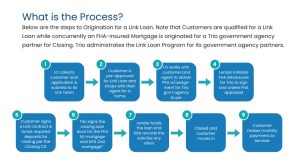

Steps To ITIN Florida Owner Financing

- Complete Mortgage Application Pull Credit get pre-approved for seller financing.

- Once approved you have a maximum approved monthly payment, home price, and maximum monthly payment.

- The ITIN mortgage applicant is the borrower on the Link financing agreement and Trio is the Lender on the Link transaction

- Government Entity – Instrumentality of Government (IOG) is the borrower on the FHA loan

- ITIN mortgage applicant shop for a home with their Agent

- Agent uploads accepted contract

- prices the Link payment and issues the Link disclosures

- Trio accepts the assignment and submits it to The Florida Mortgage Lenders who then order the appraisal

- Trio and The Florida Mortgage Lenders work together to clear both the Link Loan and FHA loan to close

- The ITIN mortgage applicant signs a Link agreement and pays the required costs

- The agreement is signed a day before FHA settlement

- The link agreement is signed a day before the FHA settlement

o See Cash Required - Trio uses its pre-approved government agency entities as borrowers

o Closing is guaranteed provided:

▪ Purchase price value is supported by the FHA appraisal

▪ The purchase contract has been assigned properly

▪ Title has been reviewed and accepted

o Chain of title subject – no 90-day flips

▪ LDP / GSA meets FHA requirements

▪ Consumer meets and performs under Link Loan guidelines

• The transaction closes, the home is purchased, and the ITIN mortgage applicant moves in!

• The Florida Mortgage Lenders will service the Link transaction and underlying FHA loan.

ITIN Florida Owner Financing Option Specifications

A transaction giving a borrower that does not qualify for a standard agency mortgage a path to homeownership The borrower (itin mortgage applicant ) qualifies for a:

– 40-year Seller Financing Agreement qualified for the home of their choice

– A contract for Deed is signed which gives the borrower equitable title interest

– This is NOT a loan. The itin mortgage applicant is not borrowing any funds Then the Seller Finance Agreement in linked with an FHA purchase loan utilizing a government entity as the borrower and owner of the subject property.

ITIN Seller Financing Process for FHA-Approved Properties

1. (MLO) mortgage loan originator collects itin mortgage applicant loan applications & submits them to its underwriting team.

2. ITIN mortgage applicant is approved for an Owner Financing Loan and shops with their Realtor for a home.

3. LO works with itin mortgage applicant and agent to obtain a Purchase Sale agreement w/assign-ment for Govt agency buyer.

4. Lender initiates FHA disclosures for Seller financing to sign and orders FHA appraisal.

5. ITIN mortgage applicant signs a government agency contract & funds required deposits for closing per the Closing CD.

6. Government agency contract signs the closing loan docs for the FHA 1st mortgage.

7. The lender funds the loan and the title records the sale like any other.

8. Closed and the ITIN mortgage applicant moves in.

9. The mortgage applicant makes monthly payments to the servicer.

ITIN Seller Financing Submission Checklist

Signed Purchase Contract with All Addendums

Addendum Assignment of Purchase Contract to Government Entity

60 Days of Paystubs

60 Days Banks Statements showing deposits

Completed Wage Earner Income Calculator

Prior Year and YTD P&L Statement

90 Days Business Banks Statements showing deposits

Prior Year Income Tax Return (all schedules)

Completed Self Employment Income Calculator

Business License or Proof License Not Required

Bank Statements must reflect all funds required

Living Rent Free, not allowed

Cash Payments or Money Order Payment, are not allowed

Home Inspection Acknowledgment

Home Inspection and Paid Invoice

Roof Inspection / Certificate (if the home is older than 10 years and/or appraisal rating of C3 or C4)

Insect Inspection

Home Warranty

Renter Insurance Deck Page

Two (2) forms of Government IDs (per borrower)

Homebuyer Education Certificate

Home Payment Protection Plan Quote

HOA Compliance Tracking (if Applicable)

Hillsborough County, FL Holmes County, FL River County, FL Jackson County, FL Jefferson County, FL Lafayette County, FL Lake County, FL Lee County, FL Leon County, FL Levy County, FL Liberty County, FL Madison County, FL Manatee County, FL Marion County, FL County, FL -Dade County, FL Monroe County, FL Nassau County, FL Okaloosa County, FL Okeechobee County, FL Orange County, FL Osceola County, FL County, FL Pasco County, FL Pinellas County, FL Polk County, FL Putnam County, FL Saint Johns County, FL Saint Lucie County, FL Santa Rosa County, FL Sarasota County, FL Seminole County, FL Sumter County, FL Suwannee County, FL Taylor County, FL Union County, FL Volusia County, FL Wakulla County, FL Walton County, FL Washington County, FL

| FHA Loan Limits | County Name | State | One-Family | Last Revised | Limit Year |

| GAINESVILLE, FL | ALACHUA | FL | $524,225 | 01/01/2025 | CY2025 |

| JACKSONVILLE, FL | BAKER | FL | $580,750 | 01/01/2025 | CY2025 |

| PANAMA CITY, FL | BAY | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | BRADFORD | FL | $524,225 | 01/01/2025 | CY2025 |

| PALM BAY-MELBOURNE-TITUSVILLE, FL | BREVARD | FL | $524,225 | 01/01/2025 | CY2025 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | BROWARD | FL | $654,350 | 01/01/2025 | CY2025 |

| NON-METRO | CALHOUN | FL | $524,225 | 01/01/2025 | CY2025 |

| PUNTA GORDA, FL | CHARLOTTE | FL | $524,225 | 01/01/2025 | CY2025 |

| HOMOSASSA SPRINGS, FL | CITRUS | FL | $524,225 | 01/01/2025 | CY2025 |

| JACKSONVILLE, FL | CLAY | FL | $580,750 | 01/01/2025 | CY2025 |

| NAPLES-MARCO ISLAND, FL | COLLIER | FL | $764,750 | 01/01/2025 | CY2025 |

| LAKE CITY, FL | COLUMBIA | FL | $524,225 | 01/01/2025 | CY2025 |

| ARCADIA, FL | DESOTO | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | DIXIE | FL | $524,225 | 01/01/2025 | CY2025 |

| JACKSONVILLE, FL | DUVAL | FL | $580,750 | 01/01/2025 | CY2025 |

| PENSACOLA-FERRY PASS-BRENT, FL | ESCAMBIA | FL | $524,225 | 01/01/2025 | CY2025 |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL | FLAGLER | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | FRANKLIN | FL | $524,225 | 01/01/2025 | CY2025 |

| TALLAHASSEE, FL | GADSDEN | FL | $524,225 | 01/01/2025 | CY2025 |

| GAINESVILLE, FL | GILCHRIST | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | GLADES | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | GULF | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | HAMILTON | FL | $524,225 | 01/01/2025 | CY2025 |

| WAUCHULA, FL | HARDEE | FL | $524,225 | 01/01/2025 | CY2025 |

| CLEWISTON, FL | HENDRY | FL | $524,225 | 01/01/2025 | CY2025 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL | HERNANDO | FL | $524,225 | 01/01/2025 | CY2025 |

| SEBRING-AVON PARK, FL | HIGHLANDS | FL | $524,225 | 01/01/2025 | CY2025 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL | HILLSBOROUGH | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | HOLMES | FL | $524,225 | 01/01/2025 | CY2025 |

| SEBASTIAN-VERO BEACH, FL | INDIAN RIVER | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | JACKSON | FL | $524,225 | 01/01/2025 | CY2025 |

| TALLAHASSEE, FL | JEFFERSON | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | LAFAYETTE | FL | $524,225 | 01/01/2025 | CY2025 |

| ORLANDO-KISSIMMEE-SANFORD, FL | LAKE | FL | $524,225 | 01/01/2025 | CY2025 |

| CAPE CORAL-FORT MYERS, FL | LEE | FL | $524,225 | 01/01/2025 | CY2025 |

| TALLAHASSEE, FL | LEON | FL | $524,225 | 01/01/2025 | CY2025 |

| GAINESVILLE, FL | LEVY | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | LIBERTY | FL | $524,225 | 01/01/2025 | CY2025 |

| NON-METRO | MADISON | FL | $524,225 | 01/01/2025 | CY2025 |

| NORTH PORT-SARASOTA-BRADENTON, FL | MANATEE | FL | $547,400 | 01/01/2024 | CY2025 |

| OCALA, FL | MARION | FL | $524,225 | 01/01/2025 | CY2025 |

| PORT ST. LUCIE, FL | MARTIN | FL | $596,850 | 01/01/2025 | CY2025 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | MIAMI-DADE | FL | $654,350 | 01/01/2025 | CY2025 |

| KEY WEST, FL | MONROE | FL | $967,150 | 01/01/2025 | CY2025 |

| JACKSONVILLE, FL | NASSAU | FL | $580,750 | 01/01/2025 | CY2025 |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL | OKALOOSA | FL | $603,750 | 01/01/2023 | CY2025 |

| OKEECHOBEE, FL | OKEECHOBEE | FL | $524,225 | 01/01/2025 | CY2025 |

| ORLANDO-KISSIMMEE-SANFORD, FL | ORANGE | FL | $524,225 | 01/01/2025 | CY2025 |

| ORLANDO-KISSIMMEE-SANFORD, FL | OSCEOLA | FL | $524,225 | 01/01/2025 | CY2025 |

| MIAMI-FORT LAUDERDALE-POMPANO BEACH, FL | PALM BEACH | FL | $654,350 | 01/01/2025 | CY2025 |