Florida 100% No Money Down Florida Mortgage Lenders

To Learn About Florida Downpayment Assistance Options, Please Click Here

FHA Mortgage Lenders’ Minimum Requirements

| 1. Cash | Min 600 credit score with AUS approval qualifies you for 100% FHA financing. |

| 2. Credit | Minimum 600+ credit score – based on payment history, not credit score driven. |

| 3. Capacity/DTI | Gernally 31/43 but with AUA approval, Max DTI 46.9/56.9%. |

| 4. Collateral | Single Family, multi-2-4 units, townhomes, villas, FHA condos, manufactured, modular. |

| Summary | FHA mortgage loans are the easiest loans to qualify for. Must fully document all income and assets. |

No Money Down Payment Mortgage Overview

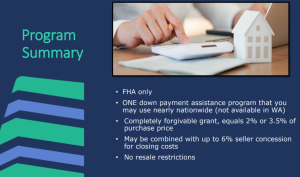

FHA 100% FHA mortgage lenders with no down payment needed. With this program, the seller needs to pay the closing costs up to 6% of the closing cost. Credit scores 600+ Scores can qualify; Repayable 2nd mortgage;- max DTI 47/57% ratios acceptable = as long as the AUS is Approved/Eligible. Increase homeownership opportunities for borrowers with low income with the FHA 100% CLTV Combo loan program from Florida FHA mortgage lenders. This program offers 100% financing by combining a standard FHA mortgage first lien at 96.5% and a concurrent second mortgage lien of up to 3.5% to assist with down payment. You will also need to pay the FHA allowable 6% seller-paid closing costs negotiated in your purchase and sale contract.

What Are the No-Money-Down Payment Specifics?

- FHA first lien 96.5% + concurrent second lien 3.5% = 100% CLTV

- Minimum 600 FICO

- Standard 30-year fixed-rate FHA first lien

- No First-Time Home Buyer requirement

- No Income Limits

- AUS approval required (660+ for manual underwriting)

- No prepayment penalty

- May be combined with up to 6% seller concession for closing costs.

- No resale restrictions

Who Is Eligible For No Down Payment Mortgage?

Any Borrower on the loan application is a first-home buyer who meets the following criteria:

- Is purchasing the Subject Property;

- Will reside in the Subject Property as their principal residence;

- Has had no ownership interest during the three years preceding the date of the application.

- Primary FHA first-time home buyers are equal to or less than 140% of the state or county median income search tool.

• What if the Borrower’s paystub reflects overtime income? Is this required to be counted towards the 140%?

• If the overtime income is not used to qualify the Borrower, then the overtime income does not have to count towards the 140%.

• The income that the underwriter will use to qualify the Borrower is what will be compared to the 140%.

• Any Borrower on the loan application is a current, retired, volunteer, or unpaid:

• First responder (police officer, firefighter, public safety officer, paramedic, emergency medical technician (EMT), or similar

• Educator (Sunday school teacher, tutor, daycare provider)

• Medical personnel (nurse, doctor, phlebotomist, health ambassador, hospital, American Red Cross worker, or similar)

• Civil servant in a Federal, state, or local municipality

• 30-year fixed

What are the benefits of a no-money-down mortgage?

- Home buyers can use FHA-approved gift funds to help with the down payment and closing costs.

- FHA Closing costs can also be paid by the seller of the home, up to 6% of the home’s sale price.

- FHA loans offer secure 30-year fixed interest rates set by Florida FHA mortgage lenders, banks, and mortgage companies. FHA mortgage interest rates are often lower than conventional loans that require a larger down payment.

- No minimum or maximum income restrictions.

- The FHA mortgage can be used for any new & existing single-family residence, townhome, or FHA-approved condo list. The property being purchased can be a regular sale, short sale, foreclosure home, etc, that meets FHA maximum property standards.

- FHA allows co-borrowers and Co-signers and non-occupying home buyers to help qualify for an FHA mortgage.

- Most FHA programs do not have a first-time buyer class, and FHA Mortgage applicants can apply and get pre-approved all day.

- The Newly increased Florida FHA loan limit for 2025 to $524,225. Monroe County Florida holds the highest FHA loan limit of $967,150.

- The FHA Good Neighbor Next Door is great for public service workers like FHA Teachers, Firefighters, and Police Officers.

- Qualifying for an FHA Mortgage loan with bad credit or even no credit score is possible. Note that the current minimum FHA mortgage credit score requirement is 580+ for the maximum financing of 96.5%. Some borrowers with a good payment history can still qualify with credit scores as low as 500 and a 10% down payment. Without any compensation factors, the maximum debt-to-income ratio is capped at 31/43 on a manual underwrite.

- FHA will allow the gift of equity to provide equity credit as a gift on the property being sold to other Family Members to cover downpayment and closing costs.

- The FHA Mortgage offers flexible FHA mortgage refinancing and is sometimes the only option for existing Florida homeowners.

- Some Florida FHA mortgage lenders offer Special FHA Florida down payment assistance programs that can help eligible Florida 100% FHA Mortgage financing.

- FHA mortgage loans are backed by the US Government and have NO prepayment penal, ty meaning you cpayPay off the mortgage anytime.

Florida No Tax Return FHA Mortgage Lenders

To qualify for an FHA mortgage loan without tax returns, you must be a W2 employee, and your commission and bonus income must be less than 25% of your total income, and you should NOT own any rental properties. If your bonus or overtime exceeds 25% of your total income or you own investment properties, you must submit tax returns. Florida FHA mortgage lenders make homeownership exciting because, as a W2 employee, you do NOT need to provide your tax returns to qualify for an FHA mortgage. For W2 employees, income qualifying requires 2 years of W2s, 30 days of pay stubs, and 2 months of bank statements

100% Florida FHA Mortgage Lenders

Yes, a 100% no-down-payment, no money down, Florida FHA mortgage. No money down Florida FHA mortgage offers 96.5% 1st mortgage and 3.5% 2nd mortgage = 100%. Florida FHA mortgage lenders. Or with 3.5% downpayment assistance or 3.5% 2nd mortgage = 100% Florida mortgage lenders. To make this a true 100% financing option. Your purchase contract must request the Sellers to pay 6% to cover your closing costs. To find Florida downpayment assistance programs, click here.

Florida No Money Down Mortgage Locations:

| Alachua | Alachua County |

| Alford | Jackson County |

| Altamonte Springs | Seminole County |

| Altha | Calhoun County |

| Anna Maria | Manatee County |

| Apalachicola | Frankin County |

| Apopka | Orange County |

| Arcadia | DeSoto County |

| Archer | Alachua County |

| Astatula | Lake County |

| Atlantic Beach | Duval County |

| Atlantis | Palm Beach County |

| Auburndale | Polk County |

| Aventura | Miami-Dade County |

| Avon Park | Highlands County |

| Bal Harbor | Miami-Dade County |

| Baldwin | Duval County |

| Bartow | Polk County |

| Bascom | Jackson County |

| Bay Harbor Islands | Miami-Dade County |

| Bay Lake | Orange County |

| Bell | Gilchrist County |

| Belle Glade | Palm Beach County |

| Belle Isle | Orange County |

| Belleair | Pinellas County |

| Belleair Beach | Pinellas County |

| Belleair Bluffs | Pinellas County |

| Belleair Shore | Pinellas County |

| Belleview | Marion County |

| Beverly Beach | Flagler County |

| Biscayne Park | Miami-Dade County |

| Blountstown | Calhoun County |

| Boca Raton | Palm Beach County |

| Bonifay | Holmes County |

| Bonita Springs | Lee County |

| Bowling Green | Hardee County |

| Boynton Beach | Palm Beach County |

| Bradenton Beach | Manatee County |

| Bradenton | Manatee County |

| Branford | Suwannee County |

| Briny Breezes | Palm Beach County |

| Bristol | Liberty County |

| Bronson | Levy County |

| Brooker | Bradford County |

| Brooksville | Hernando County |

| Bunnell | Flagler County |

| Bushnell | Sumter County |

| Callahan | Nassau County |

| Callaway | Bay County |

| Cambelton | Jackson County |

| Cape Canaveral | Brevard County |

| Cape Coral | Lee County |

| Carrabelle | Frankin County |

| Caryville | Washington County |

| Casselberry | Seminole County |

| Cedar Grove | Bay County |

| Cedar Key | Levy County |

| Center Hill | Sumter County |

| Century | Escambia County |

| Chattahoochee | Gadsden County |

| Chiefland | Levy County |

| Chipley | Washington County |

| Cinco Bayou | Okaloosa County |

| Clearwater | Pinellas County |

| Clermont | Lake County |

| Clewiston | Hendry County |

| Cloud Lake | Palm Beach County |

| Cocoa | Brevard County |

| Cocoa Beach | Brevard County |

| Coconut Creek | Broward County |

| Coleman | Sumter County |

| Cooper City | Broward County |

| Coral Gables | Miami-Dade County |

| Coral Springs | Broward County |

| Cottondale | Jackson County |

| Crawfordville | Wakulla County |

| Crescent City | Putnam County |

| Crestview | Okaloosa County |

| Cross City | Dixie County |

| Crystal River | Citrus County |

| Dade City | Pasco County |

| Dania Beach | Broward County |

| Davenport | Polk County |

| Davie | Broward County |

| Daytona Beach | Volusia County |

| Daytona Beach Shores | Volusia County |

| DeBary | Volusia County |

| Deerfield Beach | Broward County |

| DeFuniak Springs | Walton County |

| DeLand | Volusia County |

| Delray Beach | Palm Beach County |

| Deltona | Volusia County |

| Destin | Okaloosa County |

| Doral | Miami-Dade County |

| Dundee | Polk County |

| Dunedin | Pinellas County |

| Dunnellon | Marion County |

| Eagle Lake | Polk County |

| Eatonville | Orange County |

| Ebro | Washington County |

| Edgewater | Volusia County |

| Edgewood | Orange County |

| El Portal | Miami-Dade County |

| Esto | Holmes County |

| Eustis | Lake County |

| Everglades City | Collier County |

| Fanning Springs | Gilchrist County |

| Fanning Springs | Levy County |

| Fellsmere | Indian River County |

| Fernandina Beach | Nassau County |

| Flagler Beach | Flagler County |

| Florida City | Miami-Dade County |

| Fort Lauderdale | Broward County |

| Fort Meade | Polk County |

| Fort Myers Beach | Lee County |

| Fort Myers | Lee County |

| Fort Pierce | St. Lucie County |

| Fort Walton Beach | Okaloosa County |

| Fort White | Columbia County |

| Freeport | Walton County |

| Frostproof | Polk County |

| Fruitland Park | Lake County |

| Gainesville | Alachua County |

| Glen Ridge | Palm Beach County |

| Glen Saint Mary | Baker County |

| Golden Beach | Miami-Dade County |

| Golf | Palm Beach County |

| Golfview | Palm Beach County |

| Graceville | Jackson County |

| Grand Ridge | Jackson County |

| Green Cove Springs | Clay County |

| Greenacres | Palm Beach County |

| Greensboro | Gadsden County |

| Greenvilee | Madison County |

| Greenwood | Jackson County |

| Gretna | Gadsden County |

| Groveland | Lake County |

| Gulf Breeze | Santa Rosa County |

| Gulf Stream | Palm Beach County |

| Gulfport | Pinellas County |

| Haines City | Polk County |

| Hallandale | Broward County |

| Hampton Beach | Bradford County |

| Hastings | St. Johns County |

| Havana | Gadsden County |

| Haverhill | Palm Beach County |

| Hawthorne | Alachua County |

| Hialeah | Miami-Dade County |

| Hialeah Gardens | Miami-Dade County |

| High Springs | Alachua County |

| Highland Beach | Palm Beach County |

| Highland Park | Polk County |

| Hillcrest Heights | Polk County |

| Hilliard | Nassau County |

| Hillsboro Beach | Broward County |

| Holly Hill | Volusia County |

| Hollywood | Broward County |

| Holmes Beach | Manatee County |

| Homestead | Miami-Dade County |

| Horseshoe Beach | Dixie County |

| Howey-in-the-Hills | Lake County |

| Hupoluxo | Palm Beach County |

| Indialantic | Brevard County |

| Indian Creek | Miami-Dade County |

| Indian Harbour Beach | Brevard County |

| Indian River Shores | Indian River County |

| Indian Rocks Beach | Pinellas County |

| Indian Shores | Pinellas County |

| Inglis | Levy County |

| Interlachen | Putnam County |

| Inverness | Citrus County |

| Islamorada | Monroe County |

| Islandia | Miami-Dade County |

| Jacksonville Beach | Duval County |

| Jacksonville | Duval County |

| Jacob | Jackson County |

| Jasper | Hamilton County |

| Jay | Santa Rosa County |

| Jennings | Hamilton County |

| Juno Beach | Palm Beach County |

| Jupiter | Palm Beach County |

| Jupiter Inlet Colony | Palm Beach County |

| Jupiter Island | Martin County |

| Kenneth City | Pinellas County |

| Key Biscayne | Miami-Dade County |

| Key Colony Beach | Monroe County |

| Key West | Monroe County |

| Keystone Heights | Clay County |

| Kissimmee | Osceola County |

| La Crosse | Alachua County |

| LaBelle | Hendry County |

| Lady Lake | Lake County |

| Lake Alfred | Polk County |

| Lake Buena Vista | Orange County |

| Lake Butler | Union County |

| Lake City | Columbia County |

| Lake Clarke Shores | Palm Beach County |

| Lake Hamilton | Polk County |

| Lake Helen | Volusia County |

| Lake Mary | Seminole County |

| Lake Park | Palm Beach County |

| Lake Placid | Highlands County |

| Lake Wales | Polk County |

| Lake Worth | Palm Beach County |

| Lakeland | Polk County |

| Lantana | Palm Beach County |

| Largo | Pinellas County |

| Lauderdale Lakes | Broward County |

| Lauderdale-by-the-Sea | Broward County |

| Lauderhill | Broward County |

| Laurel Hill | Okaloosa County |

| Lawtey | Bradford County |

| Layton | Monroe County |

| Lazy Lake | Broward County |

| Lee | Madison County |

| Leesburg | Lake County |

| Lighthouse Point | Broward County |

| Live Oak | Suwannee County |

| Longboat Key | Sarasota County |

| Longboat Key | Manatee County |

| Longwood | Seminole County |

| Lynn Haven | Bay County |

| Macclenny | Baker County |

| Madeira Beach | Pinellas County |

| Madison | Madison County |

| Maitland | Orange County |

| Malabar | Brevard County |

| Malone | Jackson County |

| Manalapan | Palm Beach County |

| Mangonia Park | Palm Beach County |

| Marathon | Monroe County |

| Marco Island | Collier County |

| Margate | Broward County |

| Marianna | Jackson County |

| Marineland | St. Johns County |

| Marineland | Flagler County |

| Mary Esther | Okaloosa County |

| Mascotte | Lake County |

| Mayo | Lafayette County |

| McIntosh | Marion County |

| Medley | Miami-Dade County |

| Melbourne | Brevard County |

| Melbourne Beach | Brevard County |

| Melbourne Village | Brevard County |

| Mexico Beach | Bay County |

| Miami Beach | Miami-Dade County |

| Miami Gardens | Miami-Dade County |

| Miami Lakes | Miami-Dade County |

| Miami Shores Village | Miami-Dade County |

| Miami Springs | Miami-Dade County |

| Miami | Miami-Dade County |

| Micanopy | Alachua County |

| Midway | Gadsden County |

| Milton | Santa Rosa County |

| Minneola | Lake County |

| Miramar | Broward County |

| Monticello | Jefferson County |

| Montverde | Lake County |

| Moore Haven | Glades County |

| Mount Dora | Lake County |

| Mulberry | Polk County |

| Naples | Collier County |

| Neptune Beach | Duval County |

| New Port Richey | Pasco County |

| New Smyrna Beach | Volusia County |

| Newberry | Alachua County |

| Niceville | Okaloosa County |

| Noma | Holmes County |

| North Bay Village | Miami-Dade County |

| North Lauderdale | Broward County |

| North Miami | Miami-Dade County |

| North Miami Beach | Miami-Dade County |

| North Palm Beach | Palm Beach County |

| North Port | Sarasota County |

| North Redington Beach | Pinellas County |

| Oak Hill | Volusia County |

| Oakland | Orange County |

| Oakland Park | Broward County |

| Ocala | Marion County |

| Ocean Breeze Park | Martin County |

| Ocean Ridge | Palm Beach County |

| Ocoee | Orange County |

| Okeechobee | Okeechobee County |

| Oldsmar | Pinellas County |

| Opa-locka | Miami-Dade County |

| Orange City | Volusia County |

| Orange Park | Clay County |

| Orchid | Indian River County |

| Orlando | Orange County |

| Ormond Beach | Volusia County |

| Otter Creek | Levy County |

| Oviedo | Seminole County |

| Pahokee | Palm Beach County |

| Palatka | Putnam County |

| Palm Bay | Brevard County |

| Palm Beach | Palm Beach County |

| Palm Beach Shores | Palm Beach County |

| Palm Beach Gardens | Palm Beach County |

| Palm Coast | Flagler County |

| Palm Shores | Brevard County |

| Palm Springs | Palm Beach County |

| Palmetto | Manatee County |

| Palm Harbor | Pinellas County |

| Palmetto Bay | Miami-Dade County |

| Panama City | Bay County |

| Panama City Beach | Bay County |

| Parker | Bay County |

| Parkland | Broward County |

| Paxton | Walton County |

| Pembroke Park | Broward County |

| Pembroke Pines | Broward County |

| Penney Farms | Clay County |

| Pensacola | Escambia County |

| Perry | Taylor County |

| Pierson | Volusia County |

| Pine Crest | Miami-Dade County |

| Pinellas Park | Pinellas County |

| Plant City | Hillsborough County |

| Plantation | Broward County |

| Polk City | Polk County |

| Pomona Park | Putnam County |

| Pompano Beach | Broward County |

| Ponce De Leon | Holmes County |

| Ponce Inlet | Volusia County |

| Port Ornage | Volusia County |

| Port Richey | Pasco County |

| Port St. Lucie | St. Lucie County |

| Port St. Joe | Gulf County |

| Punta Gorda | Charlotte County |

| Quincy | Gadsden County |

| Raiford | Union County |

| Reddick | Marion County |

| Redington Beach | Pinellas County |

| Redington Shores | Pinellas County |

| Riviera Beach | Palm Beach County |

| Rockledge | Brevard County |

| Royal Palm Beach | Palm Beach County |

| Safety Harbor | Pinellas County |

| Saint Leo | Pasco County |

| San Antonio | Pasco County |

| Sanford | Seminole County |

| Sanibel | Lee County |

| Sarasota | Sarasota County |

| Satellite Beach | Brevard County |

| Sea Ranch Lakes | Broward County |

| Sebastian | Indian River County |

| Seabring | Highlands County |

| Seminole | Pinellas County |

| Sewall’s Point | Martin County |

| Shalimar | Okaloosa County |

| Sneads | Jackson County |

| Sopchoppy | Wakulla County |

| South Bay | Palm Beach County |

| South Daytona | Volusia County |

| Sounty Miami | Miami-Dade County |

| South Palm Beach | Palm Beach County |

| South Pasadena | Pinellas County |

| Southwest Ranches | Bay County |

| Springfield | Bay County |

| St. Augustine Beach | St. Johns County |

| St. Augustine | St. Johns County |

| St. Cloud | Osceola County |

| St. Lucie Village | St. Lucie County |

| St. Marks | Wakulla County |

| St. Pete Beach | Pinellas County |

| St. Petersburg | Pinellas County |

| Starke | Bradford County |

| Stuart | Martin County |

| Sun City Center | Hillsborough County |

| Sunny Hills | Washington County |

| Sunny Isles Beach | Miami-Dade County |

| Sunrise | Broward County |

| Surfside | Miami-Dade County |

| Sweetwater | Miami-Dade County |

| Tallahassee | Leon County |

| Tamarac | Broward County |

| Tampa | Hillsborough County |

| Tarpon Springs | Pinellas County |

| Tavares | Lake County |

| Temple Terrace | Hillsborough County |

| Tequesta | Palm Beach County |

| Titusville | Brevard County |

| Treasure Island | Pinellas County |

| Trenton | Gilchrist County |

| Umatilla | Lake County |

| Valpariso | Okaloosa County |

| Venice | Sarasota County |

| Vernon | Washington County |

| Vero Beach | Indian River County |

| Virginia Gardens | Miami-Dade County |

| Waldo | Alachua County |

| Wauchula | Hardee County |

| Wausau | Washington County |

| Webster | Sumter County |

| Weeki Wachee | Hernando County |

| Welaka | Putnam County |

| Wellington | Palm Beach County |

| West Melbourne | Brevard County |

| West Miami | Miami-Dade County |

| West Palm Beach | Palm Beach County |

| Weston | Broward County |

| Westville | Holmes County |

| Wewahitchka | Gulf County |

| White Springs | Hamilton County |

| Wildwood | Sumter County |

| Williston | Levy County |

| Wilton Manors | Broward County |

| Windermere | Orange County |

| Winter Garden | Orange County |

| Winter Haven | Polk County |

| Winter Park | Orange County |

| Winter Springs | Seminole County |

| Worthington Springs | Union County |

| Yankeetown | Levy County |

| Youngstown | Bay County |

| Zephyrhills | Pasco County |

| Zolfo Springs | Hardee County |