Self-Employed Florida Mortgage Lenders

As the economy for self-employed and other small-business economies more, business owners are in need of self-employed financing but are often turned away because they don’t qualify with their tax return income Most Florida mortgage lenders and banks will require 2 years of tax returns along with a year to date profit and loss. For the self-employed borrower that wants to keep as much income as possible, this can be a contradiction when you go to purchase a home.

Bad Credit Florida No Tax Return Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were

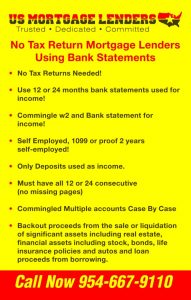

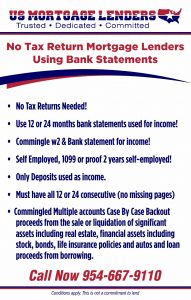

Florida Mortgage Lenders Using Bank Statements For Income!

Florida Mortgage Lenders Use Bank Statements For Income! The Bank Statement Only mortgage is often the only option for self-employed borrowers to get the funding Read More »

24 Months Bank Statement Florida Mortgage Lenders

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements: Read More »

12 Months Bank Statement Florida Mortgage Lenders

12 Months Bank Statement Florida Mortgage Lenders Business Statements: Qualify 12 months’ Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Read More »

Self-Employed Florida No Tax Return Mortgage Lenders

NO TAX RETURN FLORIDA MORTGAGE LENDER’S Cash – Minimum 10% Down.Credit – Minimum 350 Credit score.Capacity – Maximum 55% Collateral – Single-family homes, Townhomes, Villas, Condos, Read More »

Florida Mortgage Lenders Using Bank Statements For Income!

Florida Mortgage Lenders Use Bank Statements For Income! The Bank Statement Only mortgage is often the only option for self-employed borrowers to get the funding

Read More »

No Doc And Stated Florida Mortgage Lenders

Florida No Doc, No Income verification mortgage programs. No No Doc, Florida No income verification mortgage program used to purchase a primary residence home or

Read More »

How do I get a Florida mortgage with No Tax Returns?

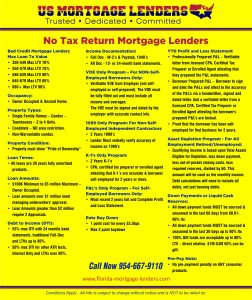

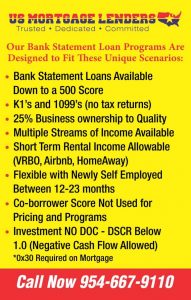

Bank statement loans have taken over the traditional Bank Statement income loans as an alternative for self-employed Florida mortgage applicants who are unable to verify their income by providing the previous two years’ tax returns, W2s, and pay stubs. These loans are called non-QM loans, nontraditional loans, or expanded criteria loans that allow other forms of documentation to prove the ability to repay. Just as it sounds, a bank statement loan allows the borrower to verify his or her income with bank statements instead of using tax returns!

What Are The Eligibility Requirements for a No Tax Return Bank Statement Mortgage?

Eligibility for a bank statement requires total deposits minus disallowed deposits. This amount is then divided by the number of bank statements, whether it is the 12 or 24 months statement.

Another option is that if the co-borrower is a W2 employee you can use a hybrid of W2 and tax return income from the co-borrower and bank statement income from the borrower or assets from the co-borrower and bank statements from the borrower. Non-QM loans can use multiple sources of blended incomes to qualify.

Deposits that are disallowed in regards to a bank statement loan include transfers between bank accounts and cash or large deposits, which can raise a level of concern and may require a letter of explanation.

Bad Credit Florida No Tax Return Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were

What Documents Do I Need For A No-Tax Return Florida Mortgage?

- Proof of income = Your most recent 12- or 24-month bank Statements Business or Personal bank statements EVERY PAGE EVEN BLANKS in PDF labeled by month.

- PDF proof of down payment statement= 2 Months Bank Statements to source funds..

- Proof of 2 years in the same business or line of work = To include business licenses or satisfactory evidence of self-employed to cover previous 24 months that could include: Articles of incorporation, 2 years of 1099 s, Business license more than 2 years or accountant letter stating more than 2 years in the same business.

- Obligations = Divorce decree, Child support or court order required payment statements. Only if applies.

- ID = Driver’s license, SS Card.

- Mortgage Statements = For rental properties including taxes and insurance statements. Only if applies.

- W2 or 1099= If you have separate W2 or 1099 income you would like to use to qualify please provide it.

- Purchase and Sale Contact. Only if you have one.

- Verified Timely Rent Payments- For Purchases Only – Please send front and back of checks clearing your account or wire transfer’s for the most recent 12 months to verify timely rental payments.

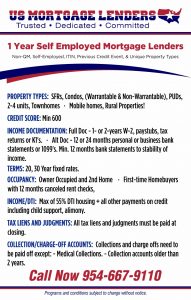

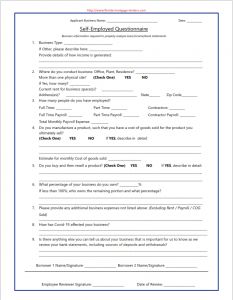

Self-Employed Florida Bank Statement Mortgage Lenders Questionaire

What Does The Application Process Look Like for a No Tax Return Florida mortgage?

To apply for a bank statement loan you would fill out our full mortgage application. Then provide your last 12 or 24 months’ worth of bank statements from a personal or business bank account. Bank statement mortgage loans are processed through a manual underwriting process. This means the income is calculated by a person so the process can take 24 -48 hours.

Am I Eligible for a mortgage with No Tax Returns? What is Required?

- You must prove self-employment for a minimum of 2 years.

- Must provide proof of 12-month rental history or 3-6 months of future payments in reserves.

- You must have at least 10% down.

- You must have 4-6 months of PITI reserves

- You may qualify with as little as a 12-months bank statement.

- You must have a credit score of 600 or above to qualify.

- The minimum loan amount is $100,000, and the maximum loan is $5,000,000.

What Are the Advantages of a Bank Statement Mortgage Loan?

In summary, these are the advantages of a bank statement loan:

- The lender can look at 12 or 24-month bank statements.

- 30-Year Fixed Options.

- Bank statement-only mortgage lenders do not need to look at your tax returns.

- Your income statements are made up of the average monthly income deposits.

- You can get a bank statement home loan for as little as 10 percent down.

- You can do a cash-out refinance.

- You can borrow up to $5 million.

- Debt to income ratio up to 55 percent.

Are There Any Special Considerations By Florida Bank Statement Mortgage Lenders?

- You can use either business or personal no commingling.

- Use 12 monthly business bank accounts or personal accounts depending on the lender.

- Deposits which are transferred from a business account into a personal account are OK.

- You may combine W2 income with bank statement income as long as the income is not counted twice.

- Foreign Bank Statements and Foreign Assets may be considered and must be translated to English.

FLORIDA SELF-EMPLOYED MORTGAGE LENDERS EXPLAINED

If you’re a self-employed mortgage applicant seeking a Florida mortgage can be difficult if you write off most of your income. Here’s what you need to know if you’re looking to qualify for a Florida mortgage without providing your last 2 years’ tax returns and year-to-date profit and loss that is required by most Florida banks!

If it is your desire to try to qualify for a Florida mortgage without providing tax returns without meeting mentioned items you will need to apply for Bank Statement only loan. Your other option may be to pay off debt or obtain a co-signor if you do not show enough income

If you are a W-2 employee and you don’t receive social security or rental income and you do not have any other side businesses you need not worry about providing your tax returns to Florida mortgage qualify. Supplying your last 2 years’ w2s and your most recent 30 days of pay stubs will work instead of tax returns. Fannie Mae and Freddie Mac, FHA, and VA will allow w2 only and paystubs without the last 2 years tax returns. However, the Florida mortgage lender may still require IRS 4506T.

FLORIDA SELF-EMPLOYED ACCOUNTANT LETTERS

Many Florida self-employed mortgage applicants registered throughout the state of Florida and other states need self-employment verification letters to qualify for a Florida mortgage.

Due to the mortgage crisis that happened several years ago and covid-19, there have been several changes in the mortgage lender’s approval process with respect to obtaining financing to mortgage a primary residence, second home, or investment property for applicants who are self-employed including small business owners, schedule c, sole proprietors, S corporation, partners of partnerships. One of the biggest changes is that Florida mortgage lenders now require more documentation to verify the borrower’s ATR ability to repay the mortgage loans via Proof of verification of income, self-employment verification to cover self employed Florida verification lenders, verification of ownership, from a certified public accountant than ever from self-employed small business owners individuals to approve a mortgage or loan to finance a Florida mortgage loan. The purpose of all this documentation requested by Florida mortgage lenders is to provide independent 3rd party verification of a self-employed borrowers income from his or her business which will enable Florida mortgage lenders to determine the amount of mortgage loan to approve for the self-employed person to purchase a primary residence, secondary residence, or investment property.

Florida self-employed mortgage lenders to request confirmation of the percentage of businesses owned by self-employed mortgage applicants as part of the mortgage approval process. Verifying the percentage of ownership by a self-employed person is a relatively simple process and this can be accomplished by reviewing financial documents provided by the self-employed mortgage applicant.

CPAs are trusted individuals that provide Florida mortgage lenders third party self-employed Florida verification letters in order to approve a mortgage or loan for a self-employed mortgage applicants. When a self-employed person applies for a mortgage to purchase a primary or secondary (investment) property, this is a unique situation for mortgage lenders. A mortgage applicant who is an employee has documents such as W-2 provided by a third party (employer) that is used to verify their work history. A self-employed mortgage applicant requires confirmation (verification) of several items that are vital in order to approve a mortgage by an independent party. This is where CPAs are needed in the mortgage application process for a self-employed person.

The new income verification requirements by mortgage lenders for people who are self-employed can be especially challenging, especially if the self-employed person (small business owners) does not have a relationship with a Certified Public Accountant (CPA). Not every self-employed person uses a Certified Public Accountant (CPA) to prepare his or her Individual Federal Income Tax Return and there is no requirement for self-employed individuals to use a CPA for preparing their tax returns. Some self-employed individuals prepare their own tax returns or they may use a tax preparer who is not a CPA. For mortgage (home loans) lending purposes anyone who owns more than 20% of a business that is the primary source of his or her income is considered self-employed. For self-employed people who have a relationship with a CPA, do not be surprised if your CPA refuses to provide some or all of the confirmations requested by your lender. Most self-employed individuals who apply for a mortgage do not find out about the lenders requirements for self-employed people to confirm (verify) certain items (income, ownership percentage, length of self-employment, use of business funds) with a CPA until their loan is being reviewed by the underwriter. It comes as a total surprise to the self-employed applicant just as the loan is about to close.

If you are considered self-employed your Florida mortgage lender will ask for your personal tax return and business tax return for at least the past two years. Lenders will also request a self-employed mortgage applicant to obtain a self-employed Florida verification letter from a CPA confirming (verify) how long the mortgage applicant has been self-employed, the percentage of the business owned by the self-employed mortgage applicant. Typically most lenders will require a self-employed person to have been self-employed for at least two years. This self-employed Florida verification letter serves as verification of the length of your self-employment and an indication that your self-employment history is satisfactory to qualify for a mortgage. Verifying a mortgage applicant’s employment is a standard part of the application process for any mortgage applicant whether self-employed or an employee.

Your mortgage lender will inform the self-employed home loan applicant of the type of items that the CPA should confirm (verify) in the self-employment verification letter issued by the CPA on his or her letterhead. Once we know the things that your mortgage lender wants us to verify in a self-employed CPA self-employed Florida verification letter we will request the self-employed mortgage applicant to provide his or her tax returns so that we can issue the self-employment verification mortgage letter requested by your mortgage lender. It is not unusual for the mortgage lender’s underwriting department to request revisions to a self-employment verification letter from a CPA after it has been submitted.

Some mortgage lenders may require self-employed (small business owners) individuals applying for a home loan to provide a year-to-date income statement (profit or loss statement) prepared by a Certified Public Accountant (CPA) as part of the home loan application process, however, this request is rare. A year-to-date income statement prepared by a CPA is routine if you already have monthly write-up service (bookkeeping) for the business being performed by a CPA, however, if this service is not being performed then your home loan application may be in jeopardy until you find A CPA.

If a self-employed mortgage applicant intends to withdraw funds from his or her business for a downpayment, the mortgage lender will ask a CPA to include a paragraph in the self-employment verification mortgage letter stating whether the withdrawal of funds by the self-employed mortgage applicant from his or her business will have a negative impact on the business operations. The last thing a mortgage lender wants to happen is for a self-employed applicant to default on a mortgage because the self-employed mortgage applicant withdrew too much money from the business and caused it to fail. This verification of the use of business funds on the self-employed mortgage applicant’s business is routine and easily accomplished using financial documents from the self-employed person.

Search Florida By Entity Name

- Officer/Registered Agent

- FEI/EIN

- Detail by Document Number

- Zip Code

- Street Address

- Registered Agent Name

- Trademark Name

- Trademark Owner Name

One of the new requests from mortgage lenders is to confirm whether a self-employed person’s business is active or was negatively affected by covid. Due to covid-19 which affected all businesses but especially small businesses, some lenders are now requiring verification by a CPA, that a self-employed mortgage applicant’s business is active or operating in as part of the mortgage approval process.

Florida mortgage lenders will request self-employed profit and loss including operating expense ratios for self-employed individuals over 12 or 24-month time frame. An operating expense ratio is calculated by dividing the total expense for a specified period by the total revenue for the same period. An operating expense ratio can be calculated using an income statement or a profit and loss statement. Typically operating expense ratios are requested for self-employed mortgage applicants who operate their business as a sole proprietor and apply for a bank statement loan. Some Florida mortgage lenders expect operating expense ratios to be below a certain percentage in order to approve a mortgage.

If a self-employed person applies for a Florida bank statement loan the lender will more than likely require a self-employed verification letter from a CPA letter in order to approve the loan. A bank statement loan is a mortgage loan that is based on the bank statements of a self-employed Florida mortgage applicant’s business rather than the self-employed applicant’s individual tax return.

If a self-employed mortgage applicant already has a relationship with a CPA then he or she will be able to obtain a self-employment verification CPA letter easily. On the other hand, if a self-employed Florida mortgage applicant does not have a relationship with a CPA then finding a CPA to issue a self-employment verification mortgage letter could be challenging.

FLORIDA SELF-EMPLOYED MORTGAGE COVERAGE AREAS:

Alachua Alachua Florida

Alford Jackson Florida

Inverness Citrus Florida

Islamorada Monroe Village

Jacksonville Duval Florida

Jacksonville Beach Duval Florida

Jacob Florida Jackson Florida

Jasper Hamilton Florida

Jay Santa Rosa Florida

Jennings Hamilton Florida

Juno Beach Palm Beach Florida

Jupiter Palm Beach Florida

Jupiter Inlet Colony Palm Beach Florida

Jupiter Island Martin Florida

Kenneth Florida Pinellas Florida

Key Biscayne Miami-Dade Village

Key Colony Beach Monroe Florida

Key West Monroe Florida

Keystone Heights “Clay

Bradford” Florida

Kissimmee Osceola Florida

LaBelle Hendry Florida

LaCrosse Alachua Florida

Lady Lake Lake Florida

Lake Alfred Polk Florida

Lake Buena Vista Orange Florida

Lake Butler Union Florida

Lake Florida Columbia Florida

Lake Clarke Shores Palm Beach Florida

Lake Hamilton Polk Florida

Lake Helen Volusia Florida

Lake Mary Seminole Florida

Lake Park Palm Beach Florida

Lake Placid Highlands Florida

Lake Wales Polk Florida

Lake Worth Beach Palm Beach Florida

Lakeland Polk Florida

Lantana Palm Beach Florida

Largo Pinellas Florida

Lauderdale Lakes Broward Florida

Lauderdale-by-the-Sea Broward Florida

Lauderhill Broward Florida

Laurel Hill Okaloosa Florida

Lawtey Bradford Florida

Layton Monroe Florida

Lazy Lake Broward Village

Lee Madison Florida

Leesburg Lake Florida

Lighthouse Point Broward Florida

Live Oak Suwannee Florida

Longboat Key “Manatee

Sarasota” Florida

Longwood Seminole Florida

Loxahatchee Groves Palm Beach Florida

Lynn Haven Bay Florida

Macclenny Baker Florida

Madeira Beach Pinellas Florida

Madison Madison Florida

Maitland Orange Florida

Malabar Brevard Florida

Malone Jackson Florida

Manalapan Palm Beach Florida

Mangonia Park Palm Beach Florida

Marathon Monroe Florida

Marco Island Collier Florida

Margate Broward Florida

Marianna Jackson Florida

Marineland “Flagler

St. Johns” Florida

Mary Esther Okaloosa Florida

Mascotte Lake Florida

Mayo Lafayette Florida

McIntosh Marion Florida

Medley Miami-Dade Florida

Melbourne Brevard Florida

Melbourne Beach Brevard Florida

Melbourne Village Brevard Florida

Mexico Beach Bay Florida

Miami Miami-Dade Florida

Miami Beach Miami-Dade Florida

Miami Gardens Miami-Dade Florida

Miami Lakes Miami-Dade Florida

Miami Shores Miami-Dade Village

Miami Springs Miami-Dade Florida

Micanopy Alachua Florida

Midway Gadsden Florida

Milton Santa Rosa Florida

Minneola Lake Florida

Miramar Broward Florida

Monticello Jefferson Florida

Montverde Lake Florida

Moore Haven Glades Florida

Mount Dora Lake Florida

Mulberry Polk Florida

Naples Collier Florida

Neptune Beach Duval Florida

New Port Richey Pasco Florida

New Smyrna Beach Volusia Florida

Newberry Alachua Florida

Niceville Okaloosa Florida

Noma Holmes Florida

North Bay Village Miami-Dade Florida

North Lauderdale Broward Florida

North Miami Miami-Dade Florida

North Miami Beach Miami-Dade Florida

North Palm Beach Palm Beach Village

North Port Sarasota Florida

North Redington Beach Pinellas Florida

Oak Hill Volusia Florida

Oakland Orange Florida

Oakland Park Broward Florida

Ocala Marion Florida

Ocean Breeze Martin Florida

Ocean Ridge Palm Beach Florida

Ocoee Orange Florida

Okeechobee Okeechobee Florida

Oldsmar Pinellas Florida

Opa-locka Miami-Dade Florida

Orange Florida Volusia Florida

Orange Park Clay Florida

Orchid Indian River Florida

Orlando Orange Florida

Ormond Beach Volusia Florida

Otter Creek Levy Florida

Oviedo Seminole Florida

Pahokee Palm Beach Florida

Palatka Putnam Florida

Palm Bay Brevard Florida

Palm Beach Palm Beach Florida

Palm Beach Gardens Palm Beach Florida

Palm Beach Shores Palm Beach Florida

Palm Coast Flagler Florida

Palm Shores Brevard Florida

Palm Springs Palm Beach Village

Palmetto Manatee Florida

Palmetto Bay Miami-Dade Village

Panama Florida Bay Florida

Panama Florida Beach Bay Florida

Parker Bay Florida

Parkland Broward Florida

Paxton Walton Florida

Pembroke Park Broward Florida

Pembroke Pines Broward Florida

Penney Farms Clay Florida

Pensacola Escambia Florida

Perry Taylor Florida

Pierson Volusia Florida

Pinecrest Miami-Dade Village

Pinellas Park Pinellas Florida

Plant Florida Hillsborough Florida

Plantation Broward Florida

Polk Florida Polk Florida

Pomona Park Putnam Florida

Pompano Beach Broward Florida

Ponce de Leon Holmes Florida

Ponce Inlet Volusia Florida

Port Orange Volusia Florida

Port Richey Pasco Florida

Port St. Joe Gulf Florida

Port St. Lucie St. Lucie Florida

Punta Gorda Charlotte Florida

Quincy Gadsden Florida

Raiford Union Florida

Reddick Marion Florida

Redington Beach Pinellas Florida

Redington Shores Pinellas Florida

Riviera Beach Palm Beach Florida

Rockledge Brevard Florida

Royal Palm Beach Palm Beach Village

Safety Harbor Pinellas Florida

San Antonio Pasco Florida

Sanford Seminole Florida

Sanibel Lee Florida

Sarasota Sarasota Florida

Satellite Beach Brevard Florida

Sea Ranch Lakes Broward Village

Sebastian Indian River Florida

Sebring Highlands Florida

Seminole Pinellas Florida

Sewall’s Point Martin Florida

Shalimar Okaloosa Florida

Sneads Jackson Florida

Sopchoppy Wakulla Florida

South Bay Palm Beach Florida

South Daytona Volusia Florida

South Miami Miami-Dade Florida

South Palm Beach Palm Beach Florida

South Pasadena Pinellas Florida

Southwest Ranches Broward Florida

Springfield Bay Florida

St. Augustine St. Johns Florida

St. Augustine Beach St. Johns Florida

St. Cloud Osceola Florida

St. Leo Pasco Florida

St. Lucie Village St. Lucie Florida

St. Marks Wakulla Florida

St. Pete Beach Pinellas Florida

St. Petersburg Pinellas Florida

Starke Bradford Florida

Stuart Martin Florida

Sunny Isles Beach Miami-Dade Florida

Sunrise Broward Florida

Surfside Miami-Dade Florida

Sweetwater Miami-Dade Florida

Tallahassee # Leon Florida

Tamarac Broward Florida

Tampa Hillsborough Florida

Tarpon Springs Pinellas Florida

Tavares Lake Florida

Temple Terrace Hillsborough Florida

Tequesta Palm Beach Village

Titusville Brevard Florida

Treasure Island Pinellas Florida

Trenton Gilchrist Florida

Umatilla Lake Florida

Valparaiso Okaloosa Florida

Venice Sarasota Florida

Vernon Washington Florida

Vero Beach Indian River Florida

Virginia Gardens Miami-Dade Village

Waldo Alachua Florida

Wauchula Hardee Florida

Wausau Washington Florida

Webster Sumter Florida

Welaka Putnam Florida

Wellington Palm Beach Village

Westlake Palm Beach Florida

West Melbourne Brevard Florida

West Miami Miami-Dade Florida

West Palm Beach Palm Beach Florida

West Park Broward Florida

Weston Broward Florida

Westville Holmes Florida

Wewahitchka Gulf Florida

White Springs Hamilton Florida

Wildwood Sumter Florida

Williston Levy Florida

Wilton Manors Broward Florida

Windermere Orange Florida

Winter Garden Orange Florida

Winter Haven Polk Florida

Winter Park Orange Florida

Winter Springs Seminole Florida

Worthington Springs Union Florida

YankeeFlorida Levy Florida

Zephyrhills Pasco Florida

Zolfo Springs Hardee Florida

Altamonte Springs Seminole Florida

Altha Calhoun Florida

Anna Maria Manatee Florida

Apalachicola Franklin Florida

Apopka Orange Florida

Arcadia DeSoto Florida

Archer Alachua Florida

Astatula Lake Florida

Atlantic Beach Duval Florida

Atlantis Palm Beach Florida

Auburndale Polk Florida

Aventura Miami-Dade Florida

Avon Park Highlands Florida

Bal Harbour Miami-Dade Village

Baldwin Duval Florida

Bartow Polk Florida

Bascom Jackson Florida

Bay Harbor Islands Miami-Dade Florida

Bay Lake Orange Florida

Bell Gilchrist Florida

Belle Glade Palm Beach Florida

Belle Isle Orange Florida

Belleair Pinellas Florida

Belleair Beach Pinellas Florida

Belleair Bluffs Pinellas Florida

Belleair Shore Pinellas Florida

Belleview Marion Florida

Beverly Beach Flagler Florida

Biscayne Park Miami-Dade Village

BlountsFlorida Calhoun Florida

Boca Raton Palm Beach Florida

Bonifay Holmes Florida

Bonita Springs Lee Florida

Bowling Green Hardee Florida

Boynton Beach Palm Beach Florida

Bradenton Manatee Florida

Bradenton Beach Manatee Florida

Branford Suwannee Florida

Briny Breezes Palm Beach Florida

Bristol Liberty Florida

Bronson Levy Florida

Brooker Bradford Florida

Brooksville Hernando Florida

Bunnell Flagler Florida

Bushnell Sumter Florida

Callahan Nassau Florida

Callaway Bay Florida

Campbellton Jackson Florida

Cape Canaveral Brevard Florida

Cape Coral Lee Florida

Carrabelle Franklin Florida

Caryville Washington Florida

Casselberry Seminole Florida

Cedar Key Levy Florida

Center Hill Sumter Florida

Century Escambia Florida

Chattahoochee Gadsden Florida

Chiefland Levy Florida

Chipley Washington Florida

Cinco Bayou Okaloosa Florida

Clearwater Pinellas Florida

Clermont Lake Florida

Clewiston Hendry Florida

Cloud Lake Palm Beach Florida

Cocoa Brevard Florida

Cocoa Beach Brevard Florida

Coconut Creek Broward Florida

Coleman Sumter Florida

Cooper Florida Broward Florida

Coral Gables Miami-Dade Florida

Coral Springs Broward Florida

Cottondale Jackson Florida

Crescent Florida Putnam Florida

Crestview Okaloosa Florida

Cross Florida Dixie Florida

Crystal River Citrus Florida

Cutler Bay Miami-Dade Florida

Dade Florida Pasco Florida

Dania Beach Broward Florida

Davenport Polk Florida

Davie Broward Florida

Daytona Beach Volusia Florida

Daytona Beach Shores Volusia Florida

DeBary Volusia Florida

Deerfield Beach Broward Florida

DeFuniak Springs Walton Florida

DeLand Volusia Florida

Delray Beach Palm Beach Florida

Deltona Volusia Florida

Destin Okaloosa Florida

Doral Miami-Dade Florida

Dundee Polk Florida

Dunedin Pinellas Florida

Dunnellon Marion Florida

Eagle Lake Polk Florida

Eatonville Orange Florida

Ebro Washington Florida

Edgewater Volusia Florida

Edgewood Orange Florida

El Portal Miami-Dade Village

Estero Lee Village

Esto Holmes Florida

Eustis Lake Florida

Everglades Florida Collier Florida

Fanning Springs “Levy

Gilchrist” Florida

Fellsmere Indian River Florida

Fernandina Beach Nassau Florida

Flagler Beach Flagler Florida

Florida Florida Miami-Dade Florida

Fort Lauderdale Broward Florida

Fort Meade Polk Florida

Fort Myers Lee Florida

Fort Myers Beach Lee Florida

Fort Pierce St. Lucie Florida

Fort Walton Beach Okaloosa Florida

Fort White Columbia Florida

Freeport Walton Florida

Frostproof Polk Florida

Fruitland Park Lake Florida

Gainesville Alachua Florida

Glen Ridge Palm Beach Florida

Glen St. Mary Baker Florida

Golden Beach Miami-Dade Florida

Golf Palm Beach Village

Graceville Jackson Florida

Grand Ridge Jackson Florida

Grant-Valkaria Brevard Florida

Green Cove Springs Clay Florida

Greenacres Palm Beach Florida

Greensboro Gadsden Florida

Greenville Madison Florida

Greenwood Jackson Florida

Gretna Gadsden Florida

Groveland Lake Florida

Gulf Breeze Santa Rosa Florida

Gulf Stream Palm Beach Florida

Gulfport Pinellas Florida

Haines Florida Polk Florida

Hallandale Beach Broward Florida

Hampton Bradford Florida

Havana Gadsden Florida

Haverhill Palm Beach Florida

Hawthorne Alachua Florida

Hialeah Miami-Dade Florida

Hialeah Gardens Miami-Dade Florida

High Springs Alachua Florida

Highland Beach Palm Beach Florida

Highland Park Polk Village

Hillcrest Heights Polk Florida

Hilliard Nassau Florida

Hillsboro Beach Broward Florida

Holly Hill Volusia Florida

Hollywood Broward Florida

Holmes Beach Manatee Florida

Homestead Miami-Dade Florida

Horseshoe Beach Dixie Florida

Howey-in-the-Hills Lake Florida

Hypoluxo Palm Beach Florida

Indialantic Brevard Florida

Indian Creek Miami-Dade Village

Indian Harbour Beach Brevard Florida

Indian River Shores Indian River Florida

Indian Rocks Beach Pinellas Florida

Indian Shores Pinellas Florida

IndianFlorida Martin Village

Inglis Levy Florida

Interlachen Putnam Florida

Serving All Florida Cities Within Counties – Alachua Baker Bay Brevard Broward Calhoun Charlotte Citrus Clay Collier Columbia Desoto Dixie Duval Escambia Flagler Franklin Gadsden Gilchrist Glades Gulf Hamilton Hardee Hendry Hernando Highlands Hillsborough Holmes Indian River Jackson Jefferson Lafayette Lake Lee Leon Levy Liberty Madison Manatee Marion Martin Miami-Dade Monroe Nassau Okaloosa Okeechobee Orange Osceola Palm Beach Pasco Pinellas Polk Putnam Santa Rosa Sarasota Seminole St. Johns St. Lucie Sumter Suwannee Taylor Union Volusia Wakulla Walton Washington