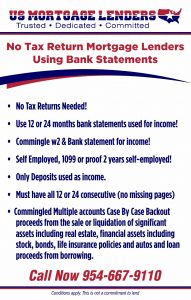

No Tax Return Florida Bank Statement Mortgage Lenders

Florida self-employed business owners and independent contractors and freelancers are taking advantage of using bank statements for income. Many of these smart self-employed mortgage applicants make plenty of money to qualify for a Florida mortgage but after all, deductions are accounted for they are not able to qualify for a conventional mortgage once the lender reviews the tax returns. Without having to show conventional mortgage lenders 1040 tax returns, self-employed Florida mortgage applicants can use bank statements to show a lender they can truly afford the financing.

Types Of Self-Employed Florida Borrowers that Use Bank Statements To Qualify!

No Tax Return Florida Bank Statement Mortgage Lenders Options

- Personal Bank Statements: Qualify with 12 or 24 months of Personal bank statements and use Up To 100 percent of deposits!

- Business Bank Statements: Qualify with 12 or 24 months of Business bank statements and count up to 90% percent of the deposits. A Florida self-employment business questionnaire is required to determine your income. For example, if you are a 1099 realtor with no money for rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: No Tax return Florida 1099 lenders will allow you to average 2 years of 1099s and 2 months of recent bank statements to verify continuance of income.

- Use Lease Agreements: As long as the lease agreements are enough to cover the Florida mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

What If I do NOT show enough Deposits to qualify for Using Bank Statements?

No problem! We have NO Ratio Florida mortgage lenders that allow the purchase or refinance of primary homes with no income verification. These loans are designed for business owners who have not filed tax returns or show a very low net income. No Ratio Florida Mortgage Lenders Approve Borrowers based on Credit, Reserves, and or Equity.

Bank statement mortgage lenders provide alternative financing options for conventional mortgage applicants who can’t provide income with traditional Fannie Mae and Freddie mac income calculations. Bank statement mortgage lenders allow the borrower to use all income after the lender deducts the bare-bone minimum business expenses needed to keep the business operating are deducted.

What Are the Benefits of a Bank Statement Mortgage?

The opportunity to secure a mortgage with bank statements offers a major advantage to self-employed individuals and business owners who have been excluded from home loans previously. In addition to offering an alternative income verification method, there are several other noteworthy benefits of bank statement mortgages in Florida:

- Minimum 350 Credit score for Bad Credit Florida No Tax Return Mortgage Lenders.

- Average 12 or 24 months’ worth of bank statements and add w2 or rental income to help qualify.

- You may be able to put as little as 10% down.

- Cash-out refinances for up to 85% of the home’s value.

- Loan amounts up to $5 million.

How Hard Is It To Get a Bank Statement Loan in Florida?

Bank statement Florida mortgage lenders offer self-employed Florida mortgages the chance to mortgage a Florida home loan when they might not qualify for the other types of Florida home loans. Our team has worked hard to streamline the lending process by allowing borrowers to have their income pre-underwritten before searching for Florida real estate. Contact Us Today to get pre-approved for a bank statement mortgage.