Bank Statement Mortgage Lenders in Florida

Personal or Business Bank Statement mortgage Lenders Average 12 or 24 months!

FLORIDA BANK STATEMENT MORTGAGE LENDERS TO PURCHASE OR REFINANCE A FLORIDA MORTGAGE

If you are self-employed in Florida or have a different source of income that is not easy to document by way of Tax returns then a bank statement mortgage lender might be right for you. We help Florida self-employed business owners every day qualify for a mortgage using bank statements for income in order to purchase or refinance the Florida home of their choice.

You’re not alone. According to the State of Florida business report, there are more than 2.5 million businesses in the state of Florida. Many Florida self-employed borrowers or those who work on commission or other types of structures have issues getting banks and other Florida mortgage lenders to pay attention to them simply because their tax returns after deductions do not show enough income to qualify for the home they need. Most Florida mortgage lenders are conservative and or cannot sell the loan unless strict Fannie Mae Income guidelines are met. But in this hot, ultra-competitive Florida real estate market, that can mean the difference between getting the home of your dreams and getting left behind.

NO TAX RETURN FL BANK STATEMENT MORTGAGE LENDER’S – INCOME OPTIONS

- Personal Bank Statements: Qualify with 12 or 24 months of Personal bank statements and use Up To 100 percent of deposits!

- Business Bank Statements: Qualify with 12 or 24 months of Business bank statements and count up to 90% percent of the deposits. A Florida self-employment business questionnaire is required to determine your income. For example, if you are a 1099 realtor with no money for rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: No Tax return Florida 1099 lenders will allow you to average 2 years of 1099s and 2 months of recent bank statements to verify continuance of income.

- Use Lease Agreements: As long as the lease agreements are enough to cover the Florida mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

- Use Assets and Credit To Qualify: Our no-ratio Florida mortgage lenders allow no income verification using credit and reserves.

BANK STATEMENT MORTGAGE LENDER’S – PROPERTY TYPES:

● SFRs, Condos, (Warrantable & Non-Warrantable), PUDs, 2-4 units, Townhomes

● No below-average properties

● Minimum $50,000 equity required

INELIGIBLE PROPERTIES FOR BANK STATEMENTS ONLY:

● Site>10 Acres, High-rise Condo in Dade/Broward Counties, Florida (8+ stories)

LOAN TERMS:

● 30-Year Fixed

● 10 Year/40 Year Term IO – CASE BY CASE.

● All loans require impounds for tax and insurance

LOAN AMOUNTS:

● $100,000—$3,000,000

HOUSING HISTORY/CREDIT EVENT SEASONING:

● Housing history—0x30. For housing delinquency, CONTACT US FOR PROGRAM UPDATES.

● Bankruptcy/Foreclosure—2-year seasoning. For less than 2 years, pricing adjustments apply.

● Short Sale/Deed-in-Lieu/Modification—2-year seasoning. For less than 2 years, see pricing adjustments.

● Forbearance <1 Year—See Loan Program Description

INCOME/DTI:

● Max of 50% DTI, 55% allowed with LTV up to 80%, $4,000 disposable and 0x30 mortgage

● Residual Income—$1,500 per household plus $500 1st child, $250 thereafter. Child maximum $1,500.

LISTED PROPERTIES:

● For Refinance transactions properties must be off the market for 6 months

PAYMENT SHOCK:

● Maximum 500% or TBD based on lender’s criteria.

TAX LIENS AND JUDGMENTS:

● All tax liens and judgments must be paid at closing.

COLLECTION/CHARGE-OFF ACCOUNTS:

● Collections and charge-offs need to be paid off except:

– Medical Collections.

– Collection accounts older than 2 years.

CREDIT SCORE/TRADELINE REQUIREMENTS:

● 3 trade lines reporting for ≥ 12 months; or 2 trade lines reporting for ≥ 24 months with activity

in the past 12 months. For borrowers without a housing history, one of the tradelines must be at least $5000 high credit/limit .

● Credit Score: Minimum 600+ Credit Score. The middle score of the primary wage-earner is used for pricing and LTV

purposes.

INCOME DOCUMENTATION:

● Alt Doc – 12 or 24 months personal or business bank statements or 1099’s, 12-month cash low.

3 months business bank statements, Profit and Loss (P&L) Only.

Min. 2 years history of self-employment required, except for the 12-month cash low option where

the min. is 1 year. Also available for gratuity earners

● AssetONLY Program—100% of the amount needed to amortize loan plus monthly debts for 60 months OR

125% of the new loan amount.

● Asset Assist—Assets divided by 60 is added to income.

● Lease agreements USED FOR INCOME as ALT Doc.

ASSETS / RESERVES:

● <75% LTV—None Required; >75% LTV—6 mos.; Loan Amount >$2M—12 Mos.

● Cash-out may be used to satisfy reserve requirements.

● Gift funds are allowed:

>80% LTV Borrower must contribute 5% own funds;

≤80% LTV 100% of down payment and closing costs may come from gift funds.

Note: Gift funds may not be used to satisfy reserves requirements

OCCUPANCY:

● Owner Occupied and 2nd Home

● First-time Homebuyers allowed, see program guidelines

LENDER CREDIT:

● Bank Statement Mortgage Lenders will allow the application of Lender Credit to be used for recurring and nonrecurring closing costs.

● Any overages will be applied to principal reduction.

● Lender Credit can be used on Lender Paid and Borrower Paid Loans

● Lender Credit cannot be used to pay broker compensation.

2ND APPRAISAL:

● Purchase and Rate & Term Rei: 2nd Appraisal Required for loan amounts >$2M

● Cash-out Rei: 2nd Appraisal Required for loan amounts > $1.5M

NPRA:

● NOTE: ALL INFORMATION IS SUBJECT TO CHANGE WITHOUT NOTICE- CONTACT US FOR UPDATED PROGRAMS!

How Does a Florida Bank Statement Mortgage Work?

A Florida bank statement mortgage lender allows you to get qualified for a home loan by averaging your most recent 12 or 24 months of bank statements without the need for tax returns. These types of loans have amounts up to $3 million and can be used to purchase or refinance a primary residence, second home, or investment property.

Bank statement mortgage lenders will calculate your qualified income by adding up the total of your bank statements across 12 to 24 months, and then dividing that number to get an approximate amount for your monthly income. That figure can then be used to determine how much you may qualify for a Florida Mortgage.

Bank Statement Florida Mortgage Lenders Features

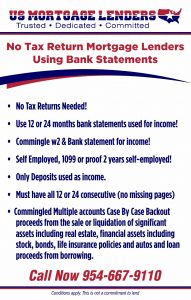

- No tax returns required

- Qualified based on Personal or business statements for the most recent 12 or 24 months

- Add separate w2 income to increase purchasing power.

- Loan amount up to $3 million

- 10% Down payment with NO mortgage insurance

- Owner occupied, 2nd home, Investment Property

- 30-year fixed option available

- Non-Perfect Credit OK

- Gift Funds for Down Payment

- Retirement income is usable with verification (1099, award letter, etc)

Bank Statement Lenders Requirements:

- 2 years of self-employment verified through CPA or business license

- limited NSF or O/Ds OK

- 12 months of mortgage or rental history

- 4-6 month reserves

How Can Florida Mortgage Lenders Help?

At US Mortgage Lenders LLC we have years of experience helping self-employed Florida mortgage applicants get a great deal on their home loans. We work with a vast network of nationwide bank statement mortgage lenders who understand the unique needs of non-traditional borrowers such as the self-employed or those who have issues with their income documentation. To that end, we’re prepared to do the research and legwork needed to help you get the best possible deal on your bank statement loan mortgage in Florida.

That means taking the time to understand your goals for homeownership as well as your budget and other unique circumstances. It also means answering all of your questions to the best of our abilities. Even if you’ve been turned down by traditional Florida mortgage lenders and other lending institutions, we invite you to contact us. we may be able to help finance many borrowers that others could not.

Bank Statement Florida Mortgage Coverage Areas

Alachua Alachua Florida

Alford Jackson Florida

Altamonte Springs Seminole Florida

Altha Calhoun Florida

Anna Maria Manatee Florida

Apalachicola Franklin Florida

Apopka Orange Florida

Arcadia DeSoto Florida

Archer Alachua Florida

Astatula Lake Florida

Atlantic Beach Duval Florida

Atlantis Palm Beach Florida

Auburndale Polk Florida

Aventura Miami-Dade Florida

Avon Park Highlands Florida

Bal Harbour Miami-Dade Village

Baldwin Duval Florida

Bartow Polk Florida

Bascom Jackson Florida

Bay Harbor Islands Miami-Dade Florida

Bay Lake Orange Florida

Bell Gilchrist Florida

Belle Glade Palm Beach Florida

Belle Isle Orange Florida

Belleair Pinellas Florida

Belleair Beach Pinellas Florida

Belleair Bluffs Pinellas Florida

Belleair Shore Pinellas Florida

Belleview Marion Florida

Beverly Beach Flagler Florida

Biscayne Park Miami-Dade Village

BlountsFlorida Calhoun Florida

Boca Raton Palm Beach Florida

Bonifay Holmes Florida

Bonita Springs Lee Florida

Bowling Green Hardee Florida

Boynton Beach Palm Beach Florida

Bradenton Manatee Florida

Bradenton Beach Manatee Florida

Branford Suwannee Florida

Briny Breezes Palm Beach Florida

Bristol Liberty Florida

Bronson Levy Florida

Brooker Bradford Florida

Brooksville Hernando Florida

Bunnell Flagler Florida

Bushnell Sumter Florida

Callahan Nassau Florida

Callaway Bay Florida

Campbellton Jackson Florida

Cape Canaveral Brevard Florida

Cape Coral Lee Florida

Carrabelle Franklin Florida

Caryville Washington Florida

Casselberry Seminole Florida

Cedar Key Levy Florida

Center Hill Sumter Florida

Century Escambia Florida

Chattahoochee Gadsden Florida

Chiefland Levy Florida

Chipley Washington Florida

Cinco Bayou Okaloosa Florida

Clearwater Pinellas Florida

Clermont Lake Florida

Clewiston Hendry Florida

Cloud Lake Palm Beach Florida

Cocoa Brevard Florida

Cocoa Beach Brevard Florida

Coconut Creek Broward Florida

Coleman Sumter Florida

Cooper Florida Broward Florida

Coral Gables Miami-Dade Florida

Coral Springs Broward Florida

Cottondale Jackson Florida

Crescent Florida Putnam Florida

Crestview Okaloosa Florida

Cross Florida Dixie Florida

Crystal River Citrus Florida

Cutler Bay Miami-Dade Florida

Dade Florida Pasco Florida

Dania Beach Broward Florida

Davenport Polk Florida

Davie Broward Florida

Daytona Beach Volusia Florida

Daytona Beach Shores Volusia Florida

DeBary Volusia Florida

Deerfield Beach Broward Florida

DeFuniak Springs Walton Florida

DeLand Volusia Florida

Delray Beach Palm Beach Florida

Deltona Volusia Florida

Destin Okaloosa Florida

Doral Miami-Dade Florida

Dundee Polk Florida

Dunedin Pinellas Florida

Dunnellon Marion Florida

Eagle Lake Polk Florida

Eatonville Orange Florida

Ebro Washington Florida

Edgewater Volusia Florida

Edgewood Orange Florida

El Portal Miami-Dade Village

Estero Lee Village

Esto Holmes Florida

Eustis Lake Florida

Everglades Florida Collier Florida

Fanning Springs “Levy

Gilchrist” Florida

Fellsmere Indian River Florida

Fernandina Beach Nassau Florida

Flagler Beach Flagler Florida

Florida Florida Miami-Dade Florida

Fort Lauderdale Broward Florida

Fort Meade Polk Florida

Fort Myers Lee Florida

Fort Myers Beach Lee Florida

Fort Pierce St. Lucie Florida

Fort Walton Beach Okaloosa Florida

Fort White Columbia Florida

Freeport Walton Florida

Frostproof Polk Florida

Fruitland Park Lake Florida

Gainesville Alachua Florida

Glen Ridge Palm Beach Florida

Glen St. Mary Baker Florida

Golden Beach Miami-Dade Florida

Golf Palm Beach Village

Graceville Jackson Florida

Grand Ridge Jackson Florida

Grant-Valkaria Brevard Florida

Green Cove Springs Clay Florida

Greenacres Palm Beach Florida

Greensboro Gadsden Florida

Greenville Madison Florida

Greenwood Jackson Florida

Gretna Gadsden Florida

Groveland Lake Florida

Gulf Breeze Santa Rosa Florida

Gulf Stream Palm Beach Florida

Gulfport Pinellas Florida

Haines Florida Polk Florida

Hallandale Beach Broward Florida

Hampton Bradford Florida

Havana Gadsden Florida

Haverhill Palm Beach Florida

Hawthorne Alachua Florida

Hialeah Miami-Dade Florida

Hialeah Gardens Miami-Dade Florida

High Springs Alachua Florida

Highland Beach Palm Beach Florida

Highland Park Polk Village

Hillcrest Heights Polk Florida

Hilliard Nassau Florida

Hillsboro Beach Broward Florida

Holly Hill Volusia Florida

Hollywood Broward Florida

Holmes Beach Manatee Florida

Homestead Miami-Dade Florida

Horseshoe Beach Dixie Florida

Howey-in-the-Hills Lake Florida

Hypoluxo Palm Beach Florida

Indialantic Brevard Florida

Indian Creek Miami-Dade Village

Indian Harbour Beach Brevard Florida

Indian River Shores Indian River Florida

Indian Rocks Beach Pinellas Florida

Indian Shores Pinellas Florida

IndianFlorida Martin Village

Inglis Levy Florida

Interlachen Putnam Florida

Inverness Citrus Florida

Islamorada Monroe Village

Jacksonville Duval Florida

Jacksonville Beach Duval Florida

Jacob Florida Jackson Florida

Jasper Hamilton Florida

Jay Santa Rosa Florida

Jennings Hamilton Florida

Juno Beach Palm Beach Florida

Jupiter Palm Beach Florida

Jupiter Inlet Colony Palm Beach Florida

Jupiter Island Martin Florida

Kenneth Florida Pinellas Florida

Key Biscayne Miami-Dade Village

Key Colony Beach Monroe Florida

Key West Monroe Florida

Keystone Heights “Clay

Bradford” Florida

Kissimmee Osceola Florida

LaBelle Hendry Florida

LaCrosse Alachua Florida

Lady Lake Lake Florida

Lake Alfred Polk Florida

Lake Buena Vista Orange Florida

Lake Butler Union Florida

Lake Florida Columbia Florida

Lake Clarke Shores Palm Beach Florida

Lake Hamilton Polk Florida

Lake Helen Volusia Florida

Lake Mary Seminole Florida

Lake Park Palm Beach Florida

Lake Placid Highlands Florida

Lake Wales Polk Florida

Lake Worth Beach Palm Beach Florida

Lakeland Polk Florida

Lantana Palm Beach Florida

Largo Pinellas Florida

Lauderdale Lakes Broward Florida

Lauderdale-by-the-Sea Broward Florida

Lauderhill Broward Florida

Laurel Hill Okaloosa Florida

Lawtey Bradford Florida

Layton Monroe Florida

Lazy Lake Broward Village

Lee Madison Florida

Leesburg Lake Florida

Lighthouse Point Broward Florida

Live Oak Suwannee Florida

Longboat Key “Manatee

Sarasota” Florida

Longwood Seminole Florida

Loxahatchee Groves Palm Beach Florida

Lynn Haven Bay Florida

Macclenny Baker Florida

Madeira Beach Pinellas Florida

Madison Madison Florida

Maitland Orange Florida

Malabar Brevard Florida

Malone Jackson Florida

Manalapan Palm Beach Florida

Mangonia Park Palm Beach Florida

Marathon Monroe Florida

Marco Island Collier Florida

Margate Broward Florida

Marianna Jackson Florida

Marineland “Flagler

St. Johns” Florida

Mary Esther Okaloosa Florida

Mascotte Lake Florida

Mayo Lafayette Florida

McIntosh Marion Florida

Medley Miami-Dade Florida

Melbourne Brevard Florida

Melbourne Beach Brevard Florida

Melbourne Village Brevard Florida

Mexico Beach Bay Florida

Miami Miami-Dade Florida

Miami Beach Miami-Dade Florida

Miami Gardens Miami-Dade Florida

Miami Lakes Miami-Dade Florida

Miami Shores Miami-Dade Village

Miami Springs Miami-Dade Florida

Micanopy Alachua Florida

Midway Gadsden Florida

Milton Santa Rosa Florida

Minneola Lake Florida

Miramar Broward Florida

Monticello Jefferson Florida

Montverde Lake Florida

Moore Haven Glades Florida

Mount Dora Lake Florida

Mulberry Polk Florida

Naples Collier Florida

Neptune Beach Duval Florida

New Port Richey Pasco Florida

New Smyrna Beach Volusia Florida

Newberry Alachua Florida

Niceville Okaloosa Florida

Noma Holmes Florida

North Bay Village Miami-Dade Florida

North Lauderdale Broward Florida

North Miami Miami-Dade Florida

North Miami Beach Miami-Dade Florida

North Palm Beach Palm Beach Village

North Port Sarasota Florida

North Redington Beach Pinellas Florida

Oak Hill Volusia Florida

Oakland Orange Florida

Oakland Park Broward Florida

Ocala Marion Florida

Ocean Breeze Martin Florida

Ocean Ridge Palm Beach Florida

Ocoee Orange Florida

Okeechobee Okeechobee Florida

Oldsmar Pinellas Florida

Opa-locka Miami-Dade Florida

Orange Florida Volusia Florida

Orange Park Clay Florida

Orchid Indian River Florida

Orlando Orange Florida

Ormond Beach Volusia Florida

Otter Creek Levy Florida

Oviedo Seminole Florida

Pahokee Palm Beach Florida

Palatka Putnam Florida

Palm Bay Brevard Florida

Palm Beach Palm Beach Florida

Palm Beach Gardens Palm Beach Florida

Palm Beach Shores Palm Beach Florida

Palm Coast Flagler Florida

Palm Shores Brevard Florida

Palm Springs Palm Beach Village

Palmetto Manatee Florida

Palmetto Bay Miami-Dade Village

Panama Florida Bay Florida

Panama Florida Beach Bay Florida

Parker Bay Florida

Parkland Broward Florida

Paxton Walton Florida

Pembroke Park Broward Florida

Pembroke Pines Broward Florida

Penney Farms Clay Florida

Pensacola Escambia Florida

Perry Taylor Florida

Pierson Volusia Florida

Pinecrest Miami-Dade Village

Pinellas Park Pinellas Florida

Plant Florida Hillsborough Florida

Plantation Broward Florida

Polk Florida Polk Florida

Pomona Park Putnam Florida

Pompano Beach Broward Florida

Ponce de Leon Holmes Florida

Ponce Inlet Volusia Florida

Port Orange Volusia Florida

Port Richey Pasco Florida

Port St. Joe Gulf Florida

Port St. Lucie St. Lucie Florida

Punta Gorda Charlotte Florida

Quincy Gadsden Florida

Raiford Union Florida

Reddick Marion Florida

Redington Beach Pinellas Florida

Redington Shores Pinellas Florida

Riviera Beach Palm Beach Florida

Rockledge Brevard Florida

Royal Palm Beach Palm Beach Village

Safety Harbor Pinellas Florida

San Antonio Pasco Florida

Sanford Seminole Florida

Sanibel Lee Florida

Sarasota Sarasota Florida

Satellite Beach Brevard Florida

Sea Ranch Lakes Broward Village

Sebastian Indian River Florida

Sebring Highlands Florida

Seminole Pinellas Florida

Sewall’s Point Martin Florida

Shalimar Okaloosa Florida

Sneads Jackson Florida

Sopchoppy Wakulla Florida

South Bay Palm Beach Florida

South Daytona Volusia Florida

South Miami Miami-Dade Florida

South Palm Beach Palm Beach Florida

South Pasadena Pinellas Florida

Southwest Ranches Broward Florida

Springfield Bay Florida

St. Augustine St. Johns Florida

St. Augustine Beach St. Johns Florida

St. Cloud Osceola Florida

St. Leo Pasco Florida

St. Lucie Village St. Lucie Florida

St. Marks Wakulla Florida

St. Pete Beach Pinellas Florida

St. Petersburg Pinellas Florida

Starke Bradford Florida

Stuart Martin Florida

Sunny Isles Beach Miami-Dade Florida

Sunrise Broward Florida

Surfside Miami-Dade Florida

Sweetwater Miami-Dade Florida

Tallahassee # Leon Florida

Tamarac Broward Florida

Tampa Hillsborough Florida

Tarpon Springs Pinellas Florida

Tavares Lake Florida

Temple Terrace Hillsborough Florida

Tequesta Palm Beach Village

Titusville Brevard Florida

Treasure Island Pinellas Florida

Trenton Gilchrist Florida

Umatilla Lake Florida

Valparaiso Okaloosa Florida

Venice Sarasota Florida

Vernon Washington Florida

Vero Beach Indian River Florida

Virginia Gardens Miami-Dade Village

Waldo Alachua Florida

Wauchula Hardee Florida

Wausau Washington Florida

Webster Sumter Florida

Welaka Putnam Florida

Wellington Palm Beach Village

Westlake Palm Beach Florida

West Melbourne Brevard Florida

West Miami Miami-Dade Florida

West Palm Beach Palm Beach Florida

West Park Broward Florida

Weston Broward Florida

Westville Holmes Florida

Wewahitchka Gulf Florida

White Springs Hamilton Florida

Wildwood Sumter Florida

Williston Levy Florida

Wilton Manors Broward Florida

Windermere Orange Florida

Winter Garden Orange Florida

Winter Haven Polk Florida

Winter Park Orange Florida

Winter Springs Seminole Florida

Worthington Springs Union Florida

YankeeFlorida Levy Florida

Zephyrhills Pasco Florida

Zolfo Springs Hardee Florida