Bank Statement Mortgage Lenders in Fort Myers Florida

Personal or Business Bank Statement mortgage Lenders Average 12 or 24 months!

If you are self-employed in Florida or have a different source of income that is not easy to document by way of Tax returns then a bank statement mortgage lender might be right for you. We help Florida self-employed business owners every day qualify for a mortgage using bank statements for income in order to purchase or refinance the Florida home of their choice.

You’re not alone. According to the State of Florida business report, there are more than 2.5 million businesses in the state of Florida. Many Florida self-employed borrowers or those who work on commission or other types of structures have issues getting banks and other Florida mortgage lenders to pay attention to them simply because their tax returns after deductions do not show enough income to qualify for the home they need. Most Florida mortgage lenders are conservative and or cannot sell the loan unless strict Fannie Mae Income guidelines are met. But in this hot, ultra-competitive Florida real estate market, that can mean the difference between getting the home of your dreams and getting left behind.

BANK STATEMENT MORTGAGE LENDER’S – PROPERTY TYPES:

● SFRs, Condos, (Warrantable & Non-Warrantable), PUDs, 2-4 units, Townhomes

● No below average properties

● Minimum $50,000 equity required

INELIGIBLE PROPERTIES FOR BANK STATEMENT ONLY:

● Site>10 Acres, High-rise Condo in Dade/Broward Counties, Florida (8+ stories)

LOAN TERMS:

● 30 Year Fixed

● 10 Year/40 Year Term IO – CASE BY CASE.

● All loans require impounds for tax and insurance

LOAN AMOUNTS:

● $100,000—$3,000,000

HOUSING HISTORY/CREDIT EVENT SEASONING:

● Housing history—0x30. For housing delinquency, CONTACT US FOR PROGRAM UPDATES.

● Bankruptcy/Foreclosure—2-year seasoning. For less than 2 years, pricing adjustments apply.

● Short Sale/Deed-in-Lieu/Modification—2-year seasoning. For less than 2 years, see pricing adjustments.

● Forbearance <1 Year—See Loan Program Description

INCOME/DTI:

● Max of 50% DTI, 55% allowed with LTV up to 80%, $4,000 disposable and 0x30 mortgage

● Residual Income—$1,500 per household plus $500 1st child, $250 thereafter. Child maximum $1,500.

LISTED PROPERTIES:

● For Reinance transactions properties must be off market for 6 months

PAYMENT SHOCK:

● Maximum 500% or TBD based on lender’s criteria.

TAX LIENS AND JUDGMENTS:

● All tax liens and judgments must be paid at closing.

COLLECTION/CHARGE-OFF ACCOUNTS:

● Collections and charge-offs need to be paid off except:

– Medical Collections.

– Collection accounts older than 2 years.

CREDIT SCORE/TRADELINE REQUIREMENTS:

● 3 trade lines reporting for ≥ 12 months; or 2 trade lines reporting for ≥ 24 months with activity

in the past 12 months. For borrowers without a housing history, one of the tradelines must be at least $5000 high credit/limit .

● Credit Score: Minimum 600+ Credit Score. The middle score of the primary wage-earner is used for pricing and LTV

purposes.

INCOME DOCUMENTATION:

● Alt Doc – 12 or 24 months personal or business bank statements or 1099’s, 12-month cash low.

3 months business bank statements, Profit and Loss (P&L) Only.

Min. 2 years history of self-employment required, except for the 12-month cash low option where

the min. is 1 year. Also available for gratuity earners

● AssetONLY Program—100% of the amount needed to amortize loan plus monthly debts for 60 months OR

125% of the new loan amount.

● Asset Assist—Assets divided by 60 is added to income.

● Lease agreements USED FOR INCOME as ALT Doc.

ASSETS / RESERVES:

● <75% LTV—None Required; >75% LTV—6 mos.; Loan Amount >$2M—12 Mos.

● Cash-out may be used to satisfy reserve requirements.

● Gift funds are allowed:

>80% LTV Borrower must contribute 5% own funds;

≤80% LTV 100% of down payment and closing costs may come from gift funds.

Note: Gift funds may not be used to satisfy reserves requirements

OCCUPANCY:

● Owner Occupied and 2nd Home

● First-time Homebuyers allowed, see program guidelines

LENDER CREDIT:

● Bank Statement Mortgage Lenders will allow the application of Lender Credit to be used for recurring and nonrecurring closing costs.

● Any overages will be applied to principal reduction.

● Lender Credit can be used on Lender Paid and Borrower Paid Loans

● Lender Credit cannot be used to pay broker compensation.

2ND APPRAISAL:

● Purchase and Rate & Term Rei: 2nd Appraisal Required for loan amounts >$2M

● Cash-out Rei: 2nd Appraisal Required for loan amounts > $1.5M

NPRA:

● NOTE: ALL INFORMATION IS SUBJECT TO CHANGE WITHOUT NOTICE- CONTACT US FOR UPDATED PROGRAMS!

How Does a Florida Bank Statement Mortgage Work?

A Florida bank statement mortgage lender allows you to get qualified for a home loan by averaging your most recent 12 or 24 months of bank statements without the need for tax returns. These types of loans have amounts up to $3 million and can be used to purchase or refinance a primary residence, second home, or investment property.

Bank statement mortgage lenders will calculate your qualified income by adding up the total of your bank statements across 12 to 24 months, and then dividing that number to get an approximate amount for your monthly income. That figure can then be used to determine how much you may qualify for a Florida Mortgage.

Bank Statement Florida Mortgage Lenders Features

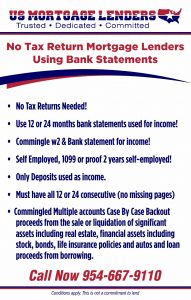

- No tax returns required

- Qualified based on Personal or business statements for the most recent 12 or 24 months

- Add separate w2 income to increase purchasing power.

- Loan amount up to $3 million

- 10% Down payment with NO mortgage insurance

- Owner occupied, 2nd home, Investment Property

- 30-year fixed option available

- Non-Perfect Credit OK

- Gift Funds for Down Payment

- Retirement income is usable with verification (1099, award letter, etc)

Bank Statement Lenders Requirements:

- 2 years of self-employment verified through CPA or business license

- limited NSF or O/Ds OK

- 12 months of mortgage or rental history

- 4-6 month reserves

How Can Florida Mortgage Lenders Help?

At US Mortgage Lenders LLC we have years of experience helping self-employed Florida mortgage applicants get a great deal on their home loans. We work with a vast network of nationwide bank statement mortgage lenders who understand the unique needs of non-traditional borrowers such as the self-employed or those who have issues with their income documentation. To that end, we’re prepared to do the research and legwork needed to help you get the best possible deal on your bank statement loan mortgage in Florida.

That means taking the time to understand your goals for homeownership as well as your budget and other unique circumstances. It also means answering all of your questions to the best of our abilities. Even if you’ve been turned down by traditional Florida mortgage lenders and other lending institutions, we invite you to contact us. we may be able to help finance many borrowers that others could not.