How To Get A Florida Mortgage With ITIN Number and No Tax Returns?

Some Florida ITIN Mortgage Lenders Allow Multiple SS Numbers OK! Mismatch SS numbers OK for mortgage qualifying

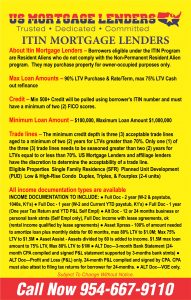

If you are undocumented with an ITIN seeking Florida mortgage lenders and do not have a social security number we can help. ITIN Florida mortgage lenders use the average bank statement deposits to calculate income for self-employed ITIN Florida mortgage applicants. All you need is your ITIN Card (Individual Tax Identification Number) and you could qualify for a Florida mortgage assuming your cash, credit, and debt to income ratios meet the Florida mortgage lender’s specifications.

What is an ITIN used for?

IRS issues ITINs to help Self-employed Florida business owners individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

Allowable Properties By ITIN Florida Mortgage Lenders

Eligible: Single Family Residences, PUDs, Townhouses, Condominiums (warrantable only)

Ineligible: 2-4 Units • Non-Warrantable condos • Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural zoned property • Condo

hotel • Co-ops • Hobby Farms • Income producing properties with acreage • Leaseholds • Log Homes • Manufactured housing • Mixed use properties • Modular

homes • Properties subject to oil and/or gas leases •Unique properties • Working farms, ranches or orchards. Property Types – All Condos including FNMA Warrantable Only; Warrantable Types S, T or U • New condominium projects (Type R) with Condo Project Manager (“CPM”) or PERS approval • Site

(Detached) Florida Condos • Limited Review is not eligible

Basic Needs List for Submission – ITIN (Purchase & Refinance):

Basic ITIN Submission Needs List – ITIN (Purchase & Refinance):

- Borrower(s) dated and signed ITIN FL Mortgage Lenders Certification & Authorization – attached

- Completed 1003 –does NOT have to be signed by the borrower

- Color Copy of Unexpired Driver’s License

- Copy of Unexpired Passport from Country of Origin

- Copy of IRS ITIN Notification (ALL pages)

- PURCHASE:

o Copy of Fully Executed Purchase Agreement with ALL Addendums and Counter Offers

o Asset Statements – Two (2) Months (ALL pages) – sufficient to support down payment, closing costs, and reserves

o Please coach your client to begin shopping for homeowners insurance coverage

- REFINANCE:

o Copy of current mortgage statement

o Copy of homeowners insurance declaration page

o Copy of current tenant lease if leased

o Name and contact information for Title/Closing to be used

- INCOME DOCUMENTATION either Full Doc (W2s, paystubs, tax returns) or 24-Month Bank Statements ALL pages

- Full Doc

- IF, Vesting in LLC

o Articles of Organization

o Operating Agreement

o SOS Required Annual filings

o Certificate of Good Standing dated with 30 days

Max DTI- For ITIN Florida Mortgage Lenders

Qualifying Rate and Ratios

• Fixed Rate – Qualify at the Note rate DTI Ratio – 55% For housing + all other minimum payments on the credit report!

ITIN Mortgage Lenders for Self Employed

If you are self-employed, you can get an ITIN loan. You will need to have been self-employed for at least two years. You may also be an independent contractor who receives a 1099 form. Tax returns are not required but will need to provide 12 or 24 months’ bank statements to show deposits into your accounts. We can use up to 90% of your deposits for income depending on your business.

ITIN Mortgage Lenders for First-Time Home Buyers

The following requirements apply to first-time Florida home buyer transactions:

• Primary residence only

• Minimum 6 months of reserves

ITIN Loan Down Payment Requirement

The minimum down payment requirement for an ITIN loan is 15% with excellent credit. Your credit score and the loan amount are the most important things that lenders consider when determining your down payment. The higher your credit score and the larger the loan amount, the greater the chances to reduce your down payment.

The minimum down payment will be 15%. Let us help you to determine what your down payment will be based on your loan scenario.

What is an ITIN Loan

ITIN Florida mortgage loans are designed for Florida ITIN mortgage applicants who do not have a social security number but can provide an ITIN number. You can expect a down payment of 10-25% Down depending on your credit score and 6-12 months of reserves.

ITIN Loan Requirements

These are the basic requirements needed to qualify for an ITIN loan

- You must have at least 15% down payment depending upon your credit score. Gift funds may be accepted

- You need a minimum of two-year work history (wither W2 or self-employed) and one year of proof of income.

- Provide pay stubs for the past 30 days for W2 employees

- Self-employed can qualify using bank statements instead of tax returns. This is called a bank statement loan.

- Some lenders will allow your debt-to-income ratio to be as high as 55%

- A minimum credit score of 600. You can still qualify without a credit score.

Assets, Down Payments, Closing Cost, Reserves

Down payment funds should be documented for 60 days per the Fannie Mae Verification of Deposits and Assets guidelines with the documentation included in

the loan file.

In addition to documenting the down payment, closing costs, and minimum PITIA reserve requirements, all borrowers must disclose and verify all other liquid

assets.

Use 100% of cash and cash equivalents

Use 80% of face value of for non-retirement asset accounts

Use 70% of retirement assets if Applicant is under 59.5, 80% if over

If Applicant is liquidating funds from non-retirement sources, document liquidation If Applicant is liquidating from retirement accounts, document the

liquidation

1031 exchanges eligible but cannot be used for the reserve requirements.

Business funds may be used provided the Applicant(s) own(s) a minimum of 51% combined ownership of the business. The amount of funds that may be

utilized is based on the Applicant’s percentage of ownership. Applicant(s) must provide either:

o A letter from CPA, EA or licensed tax preparer stating that the Applicant(s) may access the business funds and that the withdrawal will have

no adverse impact; or

o A letter from the Applicant(s) stating that they may access the business funds and Cash Flow Analysis to document that the withdrawal will

have no adverse impact.

Non-regulated Financial Assets

o Crypto Currency – Bitcoin and Ethereum are eligible sources of funds for the down payment, closing costs and reserves. Crypto is not an

eligible liquid asset for asset utilization/depletion.

Down payment and closing costs: currency must be liquidated and deposited into an established US bank account.

Reserves: Loan file must include a statement meeting the requirements under account statements to document ownership of the

crypto holdings. Current valuation, within 30-days of the loan Note date, can only be determined from the Coinbase exchange. 60%

of the current valuation will be considered eligible funds.

Credit – Required By ITIN Florida Mortgage Lenders

Standard: 3 tradelines reporting for 12+ mo’s or 2 tradelines reporting for 24+ mo’s with activity in the last 12 mo’s; Limited: N/A

• The primary wage-earner must meet the minimum tradeline requirements listed above.

• To qualify as an acceptable tradeline, the credit line must be reflected on the borrower’s credit report. The account must have activity in the past 12 months

and may be open or closed. Accounts with delinquencies are allowed when the account is no more than 30-days past due at time of application. An acceptable

12- or 24-month housing history not reporting on credit may also be used as a tradeline.

• Credit lines on which the borrower is not obligated to make payments are not acceptable for establishing a minimum history. Examples of unacceptable

tradelines include loans in a deferment period, collection or charged-off accounts, accounts discharged through bankruptcy, and authorized user accounts.

Student loans can be counted as tradelines as long as they are in repayment and are not deferred.

• Any non-mortgage account can be no more than 30-days delinquent at time of application. Any delinquent account must either be brought current or paid off

at closing.

• All accounts must be current at the time of closing except as noted below.

• Consumer Debt – Max 1×30 on nonmortgage debt, no rolling lates* & no open collections, no charge offs within the last 24-months

• Collections/Charge Offs – Charge offs must be seasoned at least 24 months and collections must be paid in full

• LOE(s) required for all adverse credit and must reflect extenuating circumstances that have been cured

Tradeline Requirements:

• 2 tradelines reporting for 12+ months with activity in last 12 months or 1 tradeline reporting for 24+ months with activity in last 12 months; Required for

loans with a LTV > 75%

• Non-Traditional Credit Accepted for LTVs <= 75% – See Non Traditional Credit section

Asset Requirments – Florida ITIN Mortgage Lenders

Checking and Savings Accounts

• The two (2) most recent, consecutive months’ statements for each account are required.

• Large deposits inconsistent with monthly income or other deposits must be verified.

Marketable Securities

• Two (2) most recent, consecutive month’s stock/securities account statements are required.

• 70% of stock accounts can be considered in the calculation of assets for closing and reserves.

• Non-vested or restricted stock accounts are not eligible for use as down payment or reserves.

Earnest Money Deposit (EMD)

Earnest money deposit (EMD) must be sourced and verified on all loans

Retirement Accounts

• Most recent retirement account statement covering a minimum two (2) month period.

• Evidence of liquidation is required when funds are used for down payment or closing cost

• 60% of the vested value of retirement accounts, after reduction of any outstanding loans, may be considered toward the required reserves.

• Excluding 401k’s & IRA’s, verification of the terms of liquidation if funds are used for reserves

• Retirement accounts that do not allow any type of withdrawal are ineligible for use as reserves.

Business Funds

• The borrower’s withdrawal of cash from a business may not have a severe negative impact on the business’ ability to continue operating. If a borrower

is trying to use business funds for closing/down payment or reserves, an analysis must be completed by the underwriter to ensure the cash

withdrawal will not impact the business.

Borrower(s) must be 100% owner and the following is required:

• Cash flow analysis required using 3 months of business bank statements to determine no negative impact to business based on withdrawal of funds

• A letter from the borrower(s) accountant must include the following statements or comments:

• The borrower has access to the funds.

• The funds are not a loan.

• The accountant may not be related to the borrower or be an interested party to the transaction.

Ineligible Assets:

• Gift of Equity • Grant Funds • Pooled Funds • Builder Profits • Cash on Hand • Unsecured loans • No Employer Assistance Assets • Sale of an asset

other than real property or publicly traded securities

Bankruptcy Waiting Times Required – Florida ITIN Mortgage Lenders

Chapter 7 and 11: Chapter 7 and Chapter 11 bankruptcies must be discharged for a minimum of 36 months from the closing date. Seasoning is measured from the month and year of

discharge.

Chapter 13: Chapter 13 bankruptcies must be discharged for a minimum of 36 months from the closing date. Seasoning is measured from the month and year of discharge. If

the Chapter 13 bankruptcy was dismissed, 36 months’ seasoning is required from the date of the dismissal.

Eligibility For Florida ITIN Mortgage Lenders

Eligible:

• Must have a Valid ITIN

In-Eligible:

• Irrevocable or Blind Trusts

• Inter-Vivos Revocable Trust

• Borrower(s) with more than one (1) owned

• Limited partnerships, general partnerships, corporations

Gift Fund Requirments For Florida ITIN Mortgage Lenders

• Allowed for purchase transactions after a minimum contribution of 5% from the borrower’s own funds

• Gift funds must not be used to meet reserve requirements.

• Donor must be an immediate family member, spouse, or domestic partner living with the borrower.

• An executed gift letter with the gift amount, donor’s name, address, and telephone number, and relationship is required.

• Proof of donor’s ability to cover the gift funds

• Transfer of funds or evidence of receipt must be documented

Income Requirements For Florida ITIN Mortgage Lenders

Full Documentation- A minimum of two (2) years of employment and income history

• Gaps in employment in excess of 30 days during the past two (2) years require a satisfactory letter of explanation and the borrower must be

employed with their current employer for a minimum of six (6) months to qualify.

• For a Borrower who has less than two-year employment and income history, the Borrower’s income may be qualifying income if the Mortgage file

contains documentation to support that the Borrower was either attending school or in a training program immediately prior to their current

employment history. School transcripts must be provided to document.

IRS Form 4506‐T / Tax Transcripts

• A completed, signed, and dated IRS form 4506-T must be completed for all borrowers at closing whose income is used to qualify for the mortgage.

• The 4506-T must be processed and tax transcripts obtained (for each year requested) to validate against all tax returns used for qualifying and/or W-

2 forms. For self-employed borrowers, this applies to both personal and business returns (for businesses where borrower(s) has 25% or more

ownership) regardless of whether or not income is used to qualify, a separate form must be filled out for each business entity.

Documentation requirements:

• Pay Stub – 1 full month with YTD earnings

• W-2’s and/or 1099’s – prior two (2) years for all borrowers

• 1040’s – prior two years, including all pages, schedules, statements

• Year to date Profit and Loss Statements and Balance Sheets are required for all self-employed borrowers (in addition to two years of tax returns)

• K-1’s on all corporations and Schedule E-business entities prior two years

• Business returns on all Corporations and Schedule E for business entities prior two years if ownership is > 25%, including all pages, schedules,

statements

• 1120S, 1120 and 1065’s – prior two (2) years if General Partner and/or percentage of ownership is > 25%, including all pages, schedules,

statements.

Mortgage And Rental Housing History Verification

• 24 months housing payment history required on all loans.

• 0X30 in the past 24 months’ mortgage/rental

• If 24-month housing history is not available due to borrowers owning their current residence Free and Clear, proof of Taxes and Insurance (and HOA – if

applicable) can be provided in lieu of mortgage history.

Note: If the source of verification for a borrower’s rental housing payments is a party other than a professional management company, 24 months of canceled

checks and copy of the Lease is required. Private mortgages require canceled checks and VOM.

Maximum Payment Shock For ITIN Mortgage Applicants

Payment shock is 150%

Payment Shock Calculation: Payment shock is a function of the percentage of the pay increase of a new payment when compared to a prior payment.

ITIN Mortgage With Non-Traditional Credit

Only allowed for LTVs <=75%

The credit history must include three (3) credit references, including at least one from Group I (below) covering the most recent 12 months of activity from the date of

application.

Group I references should be exhausted prior to considering Group II (below) for eligibility purposes, as Group I is considered more indicative of a borrower’s

future housing payment performance.

Group I:

– Rental housing payments. This includes payments made to a landlord or management company. Also included are payments made on a privately-held

mortgage loan that is not reported to the credit bureaus, contract for deed payments and other similar arrangements, provided the payments are related

to the borrower’s housing

– Utilities, such as electricity, gas, water, telephone service, television, and internet service providers. If utilities are included in the rental housing

payment, they cannot be considered a separate source of nontraditional credit. Utilities can be considered a source of nontraditional credit only if the

payment history can be separately documented.

Group II:

– Insurance coverage, i.e., medical (excluding payroll deductions), auto, life or renter’s insurance; payment to child care providers; school tuition; retail

stores — department, furniture, appliance stores or specialty stores; rent-to-own; payment of medical bills not covered by insurance; Internet/cell phone

services; a documented 12-month history of saving by regular deposits, resulting in an increasing balance to the account; automobile leases, or a

personal loan from an individual with repayment terms in writing and supported by canceled checks.

Reserve Requirements

• Non-vested or restricted stock accounts are not eligible for use as down payment or reserves.

Retirement Accounts:

• 60% of the vested value of retirement accounts, after reduction of any outstanding loans, may be considered toward the required reserves.

• Excluding 401k’s & IRA’s, verification of the terms of liquidation if funds are used for reserves

• Retirement accounts that do not allow any type of withdrawal are ineligible for use as reserves.

• Gift funds must not be used to meet reserve requirements.

ITIN Mortgage Lenders Income Documentation

• The utilization of financial assets will be considered as borrower income to qualify for their monthly payments. The unrestricted liquid assets can be

comprised of stocks/bonds/mutual funds, vested amount of retirement accounts and bank accounts

• If the assets or a portion of the assets are being used for down payment or costs to close, those assets should be excluded from the balance before

analyzing a portfolio for income qualification. The monthly income calculation is as follows: Net documented assets (70% of the remaining value of

stocks/bonds, 60% for all retirement assets) and utilization draw schedule of 10 years

• Borrowers must have a minimum of the lesser of (i) 1.25 times the loan balance or (ii) $1mm in qualified assets, both of which must be net of down payment

and closing costs to qualify

Assets Eligible for Utilization

Assets must be liquid and available with no penalty; Source and types to Fannie Mae guidelines; Additional documentation may be requested to validate the

origin on the wealth:

• Marketable securities (i.e. CD’s, money market accounts);

• Checking;

• Savings;

• Stocks;

• Bonds;

• Mutual Funds;

• Retirement Assets: Eligible if the borrower is of retirement age (at least 59 1⁄2).

Assets In-Eligible for Utilization

• Equity in Real Estate;

• Privately traded or restricted/non-vested stocks;

• Retirement Assets: Ineligible if the borrower is not of retirement age (at least 59 1⁄2);

• Any asset which produces income already included in the income calculation.

Maximum Payment Shock ITIN Florida Mortgage Lenders

Primary, Residence Only – The Payment shock should not exceed 300% of the borrower’s current housing payment unless DTI is less than or equal to 36%. If payment shock exceeds this limit

the underwriter must provide justification of borrower’s ability to handle the increased payment.

Payment Shock = (Proposed Housing Payment /Present Housing Payment) * 100

Payment shock is not considered for borrowers who do not have a current housing payment or own a home free and clear

Appraisal For ITIN Florida Mortgage Lenders

Full Interior / Exterior appraisal required. Fannie Mae/Freddie Mac Forms 1004/70, 1025/72, 1073/465 or 2090 must be used. All Fannie Guidelines apply to

appraisal process and value determination, in addition an Appraisal Management Company must be utilized for appraiser selection.

The Appraisal should be dated no more than 120 days prior to the Note Date. After a 120 day period, a new appraisal is required. Re-certification of value is not

acceptable. Minimum Square Footage 700 Sq. Feet for SFR and 500 Sq. Feet for Condominium.

Not eligible: Properties for which the appraisal indicates condition ratings of C5 or C6 or a quality rating of Q6, each as determined under the Uniform Appraisal

Dataset (UAD) guidelines. GreenBox will consider if issue has been corrected prior to loan funding with proper documentation.

APPRAISAL REVIEW PRODUCTS: An enhanced desk review product, (such as an ARR from ProTeck or CDA from Clear Capital), from a GreenBox Approved

AMC is required on all transactions.

In lieu of an enhanced desk review product, a field review or second appraisal from a ITIN Florida Mortgage Lenders s AMC is acceptable.

If the Appraisal Review Product value is more than 10% below the appraised value a second appraisal is required.

When a second appraisal is provided, the transactions “Appraised Value” will be the lower of the two appraisals.

Appraisal Transfers Allowed with ITIN FL Mortgage Lenders review and approval. Missing documents and information will disallow transfer of appraisal.

To transfer an appraisal, a transfer letter must be executed by the original Lender that ordered the appraisal and must be signed by an authorized member of the

company. Appraisal transfer letters signed by loan officers or loan processors will not be acceptable. The letter must include the following:

Prepared on Letterhead of the original Lender

Current Date

Borrower Name

Property Address

A statement that the appraisal was prepared in compliance of Appraisal Independence Requirements

Signed by an Authorized Representative

The appraisal must be dated within 45 days of submission to ITIN FL Mortgage Lenders

The following documents are required with a transfer:

Executed Appraisal Transfer Letter

First generation appraisal report

“Subject to ….” are in-eligible

Copy of the invoice submitted to the original lender

Proof that the original report was provided to the borrower

ITIN Mortgage Information

Tax return requirement: All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement.

Expanded discussion of Allowable Tax Benefit: The discussion of allowable tax benefits has been expanded. For more information see Allowable Tax Benefits in the Instructions for Form W-7PDF.

Child and Dependent Care Credit (CDCC): An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441). The Form 2441 must be attached to Form W-7 along with the U.S. federal tax return. See Publication 503PDF for more information.

What is an ITIN number?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

Do I need an ITIN?

Does the following apply to you?

- You do not have an SSN and are not eligible to obtain one, and

- You have a requirement to furnish a federal tax identification number or file a federal tax return, and

- You are in one of the following categories:

- Nonresident alien who is required to file a U.S. tax return

- U.S. resident alien who is (based on days present in the United States) filing a U.S. tax return

- Dependent or spouse of a U.S. citizen/resident alien

- Dependent or spouse of a nonresident alien visa holder

- Nonresident alien claiming a tax treaty benefit

- Nonresident alien student, professor or researcher filing a U.S. tax return or claiming an exception

If so, then you must apply for an ITIN.

Important Reminders

Expired ITINs: If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2018, 2019, and 2020, your ITIN will expire on December 31, 2021. ITINs with middle digits (the fourth and fifth positions) “70,” “71,” “72,” “73,” “74,” “75,” “76,” “77,” “78,” “79,” “80,” “81,” “82,” “83,” “84,” “85,” “86,” “87,” or “88” have expired. In addition, ITINs with middle digits “90,” “91,” “92,” “94,” “95,” “96,” “97,” “98,” or “99,” IF assigned before 2013, have expired.

Note: If you previously submitted a renewal application and it was approved, you do not need to renew again. Otherwise, you should submit a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, US federal tax return, and all required identification documents to the IRS.

Information returns: If your ITIN is only being used on information returns for reporting purposes, you don’t need to renew your ITIN at this time. However, in the future, if you need to use the ITIN to file a U.S. federal tax return, you will need to renew the ITIN at that time.

Change of address: It’s important that the IRS is aware of your current mailing address. This address is used to mail notices about your Form W-7, including notification of your assigned ITIN, and return your original supporting documentation. If you move before you receive your ITIN, notify us of your current mailing address immediately, so we may update our records.