How To Cash Out Refinance Mortgage With No Tax Returns?

No Tax return Florida mortgage lenders to refinance or purchase a Florida primary, second home, or investment property. We have many ALT DOC Florida mortgage options for a variety of Florida self-employed mortgage applicants.

No Income Verification Florida Mortgage Lenders

There are many reasons why a borrower may not be able to document their income. A perfect example with being a business owner who just sold their business and now has no income or a person whose income is based on cash Examples include Coffee Shops, Bakery, Bars, Restaurants, Nail Salons, Vending Machines, Laundromats, and Auto Servies, and they do not deposit the cash into their personal bank account.

What Is A No Income Verification Cash Out Florida Mortgage Lender?

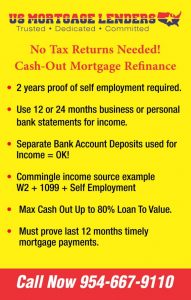

A no-tax return cash-out mortgage refinance replaces your existing Florida mortgage with a new mortgage loan for more than you currently owe on your house. The difference goes to you in no tax return cash-out refinance you can use bank statements, 1099, or even stated income or No Income verification to cash out the equity to down debt, make home upgrades or repairs, debt consolidation, or to spend how you wish. Lenders usually will not extend must more than 80% of the value of your home so you need a lot of equity built up in your house to accomplish a cash-out refinance.

How Does A Income Verification Cash Out Florida Mortgage Lender Work?

A no-income verification Florida mortgage lender provides mortgage loans to self-employed borrowers who want to cash out refinance but cannot document enough income through traditional means by the way of tax returns, W2s, 1099, or bank statements. Our No income verification mortgage lenders use Assets, Credit, and payment history to qualify your cashout mortgage to refinance!

Category: NO Tax Return Florida Cashout Florida Mortgage Lenders

Self Employed No Tax Return Bank Statement FL Mortgage Lenders

Self-Employed Bank Statement Florida Mortgage Lenders When calculating the qualifying income for a self-employed borrower, it is important to note that business income reported on

Manufactured Home Florida Cash Out Mortgage With No Tax Returns

Manufactured Home – Florida No Tax Return Mortgage Lenders Business Statements: Qualify Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire.

Self-Employed Florida Mortgage Cash Out With No Tax Returns!

Self-Employed Florida Mortgage-No Tax Returns! Self-Employed Florida Mortgage Lenders Self-Employed As the economy for self-employed and other small-business economies more, business owners are in

ITIN Florida Cash OUt Bank Statement No Tax Return Mortgage Lenders

How To Get A Florida Mortgage With ITIN Number and No Tax Returns? Some Florida ITIN Mortgage Lenders Allow Multiple SS Numbers OK! Mismatch SS

No Income Verification Cash Out Florida Investor Loans

Investment Income Florida Mortgage Lenders Florida No Income Verification Investor Loans — No Income Verification Florida Investor Loans Debt service coverage ratio Florida mortgage lenders

No Income Verification Cash Out Florida Mortgage Lenders

No Income Verification Florida Mortgage Lenders No Income Florida Mortgage Lenders Requirements Of Florida No Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten

Florida No Income Verification Cash Out Investor Loans

Florida Investor Mortgage – Use the rental income to qualify for Investment homes! No Income Verification Florida Investor Loans= Income / Payment = 1 or

No Doc And Stated Cash Out Florida Mortgage Lenders

Florida No Income verification mortgage programs. No No Doc, Florida No income verification mortgage program used to purchase a primary residence home or refinance your

Self Employed Florida Cash Out Mortgage Lenders

Self-Employed Florida Mortgage Lenders As the economy for self-employed and other small-business economies more, business owners are in need of self-employed financing but are often

Asset Based Florida Mortgage Lenders

Florida Asset Based Mortgage Lenders Qualifications Florida Asset Based Mortgage Lenders offers two Alt Doc programs where the borrower’s assets can be used to assist

Stated Income Cash Out Florida Mortgage Lenders

Stated Income Florida Mortgage Lenders Requirements Of Florida Stated Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten Based on LTV, FICO, and Liquidity

Bad Credit Cash Out Florida No Tax Return Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were

Jumbo Florida No Tax Return Cash Out Mortgage Lenders

Florida Jumbo Mortgage Lenders No Tax Returns Yes, you heard correctly! This jumbo Florida mortgage does not require Tax Returns! You simply provide your most

1099 Cash Out Florida Mortgage Lenders

How do I Qualify For A Florida Mortgage Using 1099’s For Income? You must be employed in the same line of work or business for

24 Months Bank Statement Cash Out Florida Mortgage Lenders

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements:

12 Months Bank Statement Cash Out Florida Mortgage Lenders

12 Months Bank Statement Florida Mortgage Lenders Business Statements: Qualify 12 months’ Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire.

DSCR Cash Out Florida Mortgage Lenders-

DSCR Florida Mortgage Lenders – No Income Verification Investor LoansUse the rental income to qualify Florida Investment homes. To Calculate the DSCR Take Total income

How Do I get a Cash Out Mortgage In Florida With No Tax Returns?

FLORIDA NO TAX RETURN MORTGAGE LENDERS How Do I get a Mortgage In Florida With No Tax Returns? If you are looking for a Florida

No Income Verification Cash Out Florida Mortgage Lenders

No Income Verification Florida Mortgage Lenders No Income Verification Mortgage Lender Requirments Primary Residence & Second Homes Credit Underwritten Based on LTV, FICO, and Liquidity

Florida Cash Out Mortgage Lenders Using Bank Statements For Income!

Florida Mortgage Lenders Use Bank Statements For Income! The Bank Statement Only mortgage is often the only option for self-employed borrowers to get the funding

Self Employed Florida No Tax Return Cash Out Mortgage Lenders

NO TAX RETURN FLORIDA MORTGAGE LENDER’S Cash – Minimum 10% Down + Closing Cost + Reserves.Credit – Minimum 350 Credit score.Capacity – Maximum 55% Collateral –