How Do I get a Mortgage In Florida With No Tax Returns? Read More »

- Airbnb No Income Verification Deltona Florida Mortgage Lenders // Bank Statement Mortgage Lenders in Deltona Florida

- Stated Income Deltona Florida Mortgage Lenders // Self Employed No Tax Return Deltona Bank Statement FL Mortgage Lenders-

- Manufactured Home Deltona Florida No Tax Return Mortgage Lenders-

Serving All Cities near and Around Deltona, Florida: Sanford, FL – DeLand, FL – Lake Mary, FL – Winter Springs, FL- Longwood, FL Casselberry, FL- Oviedo, FL Wekiva Springs, FL- Altamonte Springs, FL- Fern Park, FL- Forest City, FL- Maitland, FL- Goldenrod, FL- Winter Park, FL- Apopka, FL-

No Doc And Stated Deltona Florida Mortgage Lenders

Florida No Income verification mortgage programs. No No Doc, Florida No income verification mortgage program used to purchase a primary residence home or refinance your Read More »

Self-Employed Deltona Florida Mortgage Lenders

Self-Employed Florida Mortgage Lenders As the economy for self-employed and other small-business economies more, business owners are in need of self-employed financing but are often Read More »

No Income Verification Deltona Florida Investor Loans

Investment Income Florida Mortgage Lenders Florida No Income Verification Investor Loans — No Income Verification Florida Investor Loans Debt service coverage ratio Florida mortgage lenders Read More »

No Income Verification Deltona Florida Mortgage Lenders

No Income Verification Florida Mortgage Lenders No Income Florida Mortgage Lenders Requirements Of Florida No Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten Read More »

Deltona Florida No Income Verification Investor Loans

Florida Investor Mortgage – Use the rental income to qualify for Investment homes! No Income Verification Florida Investor Loans= Income / Payment = 1 or Read More »

Self-Employed Florida No Tax Return Mortgage Lenders

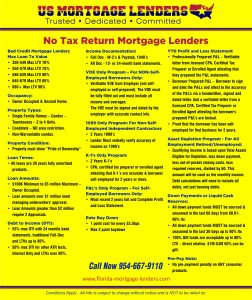

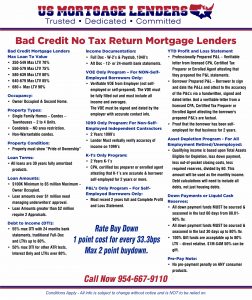

NO TAX RETURN FLORIDA MORTGAGE LENDER’S Cash – Minimum 10% Down + Closing Cost + Reserves.Credit – Minimum 350 Credit score.Capacity – Maximum 55% Collateral – Read More »

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were Read More »

Bank Statement loans for self-employed borrowers who cannot qualify for a traditional bank loan because of business expenses. Self-employed Florida mortgage Lenders are perfect because while most Broward county Florida self-employed borrowers earn a solid income, they show a smaller net income on their tax returns. Our Florida mortgage team is well-versed in these bank statement-only loans and placing the borrowers where they can get the optimal loan to fit their needs

Self Employed NO Tax Return Mortgage Lenders // Florida Bank Statement Mortgage Refinance

Why Choose a Bank Statement Loan?

Bank statement loans have pros and cons, like all other mortgage loans. If you’re self-employed consider the bank statement loan for these benefits:

- You can get mortgage financing without using your tax returns and/or you’ve been denied by your bank or credit union.

- You can continue to claim your business write-offs without losing your mortgage eligibility.

- You don’t need perfect credit

- You can buy a home with just 10% down

- Sellers can help you with up to 6% of the sales price in closing costs (2% for investment homes)

What Are the Downsides?

- If you don’t make your mortgage payments you can lose your home

- You’ll need at least 10 Down + Closing costs + Reserves.

- You need 3-6 months of reserves in your account at closing.

Bank statement loans have flexible guidelines and let you qualify without typical tax returns. It’s a nice reprieve for self-employed borrowers who already face so many different regulations and expenses since they don’t work for someone else.

Bank Statement Self Employed Florida Mortgage Lenders

When determining the appropriate qualifying income for a self-employed borrower, it is important to note that business income reported on an individual IRS Form 1040 may not necessarily represent income that has actually been distributed to the borrower. No Tax return bank statement Florida mortgage lenders use bank statements along with a questionnaire to determine the amount of income that can be relied on by the borrower in qualifying for their personal mortgage obligation. When underwriting these borrowers, it is important to review business income distributions on the bank statements to determine the viability of the underlying business. This analysis includes assessing the stability of business income and the ability of the business to continue to generate sufficient income to enable self-employed mortgage applicants to meet their monthly payment obligations.

Florida No Tax Return Mortgage Lenders Options

-

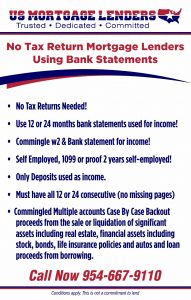

- Use Personal Bank Statements: You can qualify using 12 or 24 months bank statements and use Up To 100 percent of deposits if they came from a business Bank Account.

- Use Business Bank Statements: You can qualify with 12 or 24 months of bank statements and count up to 90% percent of the deposits. A self-employment questionnaire is usually required to determine your income. For example, if you are a 1099 realtor with no money rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: Some lenders will allow 2 years of 1099s and 2 months of recent bank statements along with a bank statement questionnaire to understand your expenses.

- Use Lease Agreements: As long as the lease agreements are enough to cover the mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

Like any mortgage loan, we’ll evaluate your qualifying factors to determine if you’re a good candidate for the bank statement loan before you go searching for a home! And because we don’t ask for tax returns, you don’t have to worry about skipping certain deductions you’re entitled to as a business owner and increasing your tax liability just to get approved for a Florida mortgage.

What is a Bank Statement Mortgage Lender?

The name should explain it, Florida no tax return mortgage lenders can use bank statement deposits to average your income instead of tax returns. Bank statement mortgage lenders that sell your loan to Fannie Mae or Freddie mac all want to see your income after expenses. If your tax returns show less than enough income you will not qualify for the mortgage of your choice. Conventional Florida mortgage lenders can only use the income after all expenses claimed on your tax returns for qualifying. This FannieMae 1084 self-employed worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income after expenses that will be available for you to purchase a home.

Who Qualifies For A Bank Statement Mortgage?

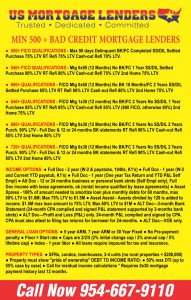

Our bank statement mortgage lenders provide funding for business owners throughout Florida. You must have a good pay history and good deposits but don’t have traditional income and wouldn’t qualify for standard bank loan financing. To qualify for our No Tax return bank statement mortgage you’ll need the following:

- Minimum of 1 years same line of work 2+ years.

- Minimum 550 middle credit score.

- Minimum 10% down payment+ Closing Cost + Reserves. reserves are defined as the total mortgage payment PITI in your account after closing.

- Minimum 3-6 Months Reserves.

- Minimum 12 months since any housing events ( Foreclosure, Bankruptcy Discharge, Short Sale )

- Maximum DTI 55% Bank statement only mortgage lenders will allow the self employed to qualify up to 55% of their total income for housing and all other monthly payments on their credit report.

Deltona Florida No Tax Return Mortgage Lenders Options

-

- Use Personal Bank Statements: You can qualify using 12 or 24 months bank statements and use Up To 100 percent of deposits if they came from a Business Bank Account.

- Use Business Bank Statements: You can qualify with 12 or 24 months of bank statements and count up to 90% percent of the deposits. A self-employment questionnaire is usually required to determine your income. For example, if you are a 1099 realtor with no money rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: Some lenders will allow 2 years of 1099s and 2 months of recent bank statements along with a bank statement questionnaire to understand your expenses.

- Use Lease Agreements: As long as the lease agreements are enough to cover the mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

Avg. 24 Months Bank or 12 Months Bank Statements For Income Read More »

When determining the appropriate qualifying income for a self-employed borrower, it is important to note that business income reported on an individual IRS Form 1040 may not necessarily represent income that has actually been distributed to the borrower. No Tax return bank statement Florida mortgage lenders use bank statements along with a questionnaire to determine the amount of income that can be relied on by the borrower in qualifying for their personal mortgage obligation. When underwriting these borrowers, it is important to review business income distributions on the bank statements to determine the viability of the underlying business. This analysis includes assessing the stability of business income and the ability of the business to continue to generate sufficient income to enable self-employed mortgage applicants to meet their monthly payment obligations.

Who Qualifies For A Deltona FL Bank Statement Mortgage?

Our bank statement mortgage lenders provide funding for business owners throughout Florida. You must have a good payment history and good deposits but don’t have traditional income and wouldn’t qualify for standard bank loan financing. To qualify for our No Tax return bank statement mortgage you’ll need the following:

- Minimum of 1+ years same line of work but usually 2+ years.

- Minimum 550 middle credit score.

- Minimum 10% down payment+ Closing Cost + Reserves. reserves are defined as the total mortgage payment PITI in your account after closing.

- Minimum 3-6 Months Reserves.

- Minimum 12 months since any housing events ( Foreclosure, Bankruptcy Discharge, Short Sale )

- Maximum DTI 55% Bank statement only mortgage lenders will allow the self-employed to qualify up to 55% of their total income for housing and all other monthly payments on their credit report.

Like any mortgage loan, we’ll evaluate your qualifying factors to determine if you’re a good candidate for the bank statement loan before you go searching for a home! And because we don’t ask for tax returns, you don’t have to worry about skipping certain deductions you’re entitled to as a business owner and increasing your tax liability just to get approved for a Florida mortgage.

Allowable Properties Types Include:

- Single-family homes /Townhomes / Villas

- Condos / Condominiums

- Condotels

- Multifamily Up To 8 Units

- Manufactured Home No Tax Return Florida Mortgage Lenders

Stated Income Deltona Florida Mortgage Lenders

Stated Income Florida Mortgage Lenders No Doc and Stated income Florida mortgage lenders are used to purchase a primary residence home or refinance your current Read More »

Self Employed No Tax Return Deltona Bank Statement FL Mortgage Lenders

Self-Employed Bank Statement Florida Mortgage Lenders When calculating the qualifying income for a self-employed borrower, it is important to note that business income reported on Read More »

Manufactured Home Deltona Florida No Tax Return Mortgage Lenders

Manufactured Home – Florida No Tax Return Mortgage Lenders Business Statements: Qualify Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Read More »

Serving All Cities near and Around Deltona, Florida: Sanford, FL – DeLand, FL – Lake Mary, FL – Winter Springs, FL- Longwood, FL Casselberry, FL- Oviedo, FL Wekiva Springs, FL- Altamonte Springs, FL- Fern Park, FL- Forest City, FL- Maitland, FL- Goldenrod, FL- Winter Park, FL- Apopka, FL-

Deltona FL No Income Verification Mortgage Lenders

Airbnb No Income Verification Deltona Florida Mortgage Lenders

Airbnb No Tax Return Florida Mortgage Lenders Using Rent Rolls For Income! Florida Mortgage Lenders Purchase/Refinance Use 75% Of Lease Agreements Income! Owning an Airbnb Read More »

Bank Statement Mortgage Lenders in Deltona Florida

Bank Statement Mortgage Lenders in Florida Personal or Business Bank Statement mortgage Lenders Average 12 or 24 months! If you are self-employed in Florida or Read More »