- Bad Credit Fort Myers Florida Mortgage Lenders

- No Tax Return Bad Credit Fort Myers Florida Mortgage Lenders

About Bad Credit Tax Return Fort Myers Florida Mortgage Lenders

Florida bad credit bank statement mortgage lenders were created for self-employed borrowers that write off all of their income. Bank statement mortgage lenders use 12 or 24 months of bank statements and average a borrower’s income for mortgage qualifying. These alt doc mortgage loans allow self-employed business owners and independent contractors who take too many deductions to qualify for a Florida mortgage.

No Tax Return Fort Myers FL Bad Credit Mortgage Lenders

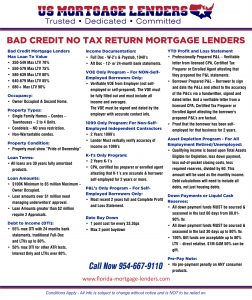

Bad Credit Mortgage Lenders Max Loan To Value

•350-549 Max LTV 70% •550-579 Max LTV 75% •580-639 Max LTV 80% •640-679 Max LTV 85% •680+ Max LTV 90%

Occupancy:

• Owner Occupied & Second Home.

Property Types:

• Single Family Homes – Condos – Townhouses – 2 to 4 Units.

• Condotels – NO area restriction.

• Non-Warrantable condos.

Property Condition:

• Property must show “Pride of Ownership”.

Loan Terms:

• All loans are 30 years fully amortized products.

Loan Amounts:

• $100K Minimum to $5 million Maximum – Owner Occupied.

• Loan amounts over $1 million need managing underwriters’ approval.

• Loan Amounts greater than $2 million require 2 Appraisals.

Debt to Income (DTI):

• 55% max DTI with 24 months bank statements, traditional Full-Doc and LTVs up to 80%.

• 50% max DTI for other ATR tests, Interest Only and LTVs over 80%.

Income Documentation:

Full Doc – W-2’s & Paystub, 1040’s

Alt Doc – 12- or 24-month bank statements.

VOE Only Program – For NON-Self-Employed Borrowers Only:

• Verifiable VOE from Employer (not self-employed or self-prepared). The VOE must be fully filled out and must include all income and averages.

The VOE must be signed and dated by the employer with accurate contact info.

1099 Only Program: For Non-Self-Employed Independent Contractors

• 2 Years 1099’s

• Lender Must verbally verify accuracy of income on 1099’s

K-1’s Only Program:

• 2 Years K-1’s

• CPA, certified tax preparer or enrolled agent attesting that K-1’s are accurate & borrower self-employed for 2 years or more.

P&L’s Only Program – For Self-Employed Borrowers Only:

•Most recent 2 years full and Complete Profit and Loss Statement.

YTD Profit and Loss Statement

• Professionally Prepared P&L – Verifiable letter from licensed CPA, Certified Tax Preparer or Enrolled Agent attesting that they prepared the

P&L statements.

• Borrower Prepared P&L – Borrower to sign and date the P&Ls and attest to the accuracy of the P&L’s via a handwritten, signed and dated

letter. And a verifiable letter from a licensed CPA, Certified Tax Preparer or Enrolled Agent attesting the borrower prepared P&L’s are factual.

• Proof that the borrower has been self-employed for that business for 2

years.

Asset Depletion Program – For All Employment Retired/Unemployed:

• Qualifying income is based upon Total Assets Eligible for Depletion, less down payment, less out of pocket closing costs, less required reserves,

divided by 60. This amount will be used as the monthly income. Debt calculations will need to include all debts, not just housing debts.

Down Payments or Liquid Cash Reserves:

• All down payment funds MUST be sourced & seasoned in the last 60 days from 80.01-90% ltv.

• All down payment funds MUST be sourced & seasoned in the last 30 days up to 80% ltv.

• 100% Gift funds are acceptable up to 80% LTV – direct relative. $1M-$4M 50% can be gift.

Pre-Pay Note:

• No pre-payment penalty on ANY consumer products. Rate Buy Down – 1 point cost for every 33.3bps – Max 2 point buydown. Conditions Apply – All info is subject to change without notice and is NOT to be relied on.

NO Tax Return Bad Credit Fort Myers Florida Mortgage Lenders

Bad Credit Florida No Tax Return Fort Myers FL Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were

Jumbo Bad Credit Fort Myers Florida No Tax Return Mortgage Lenders

Florida Jumbo Mortgage Lenders No Tax Returns Yes, you heard correctly! This jumbo Florida mortgage does not require Tax Returns! You simply provide your most

1099 Bad Credit Fort Myers Florida Mortgage Lenders

How do I Qualify For A Florida Mortgage Using 1099’s For Income? You must be employed in the same line of work or business for

24 Months Bad Credit Bank Statement Fort Myers Florida Mortgage Lenders

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements:

12 Months Bank Statement Bad Credit Fort Myers Florida Mortgage Lenders

12 Months Bank Statement Florida Mortgage Lenders Business Statements: Qualify 12 months’ Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Fort Myers

DSCR Bad Credit Fort Myers Florida Mortgage Lenders-

DSCR Florida Mortgage Lenders – No Income Verification Investor LoansUse the rental income to qualify Florida Investment homes. To Calculate the DSCR Take the Total income

Self Employed No Tax Return Bank Statement FL Bad Credit Mortgage Lenders

Self-Employed Bank Statement Florida Mortgage Lenders When calculating the qualifying income for a self-employed borrower, it is important to note that business income reported on

Manufactured Home Florida Bad Credit No Tax Return Mortgage Lenders

Manufactured Home – Florida No Tax Return Mortgage Lenders Business Statements: Qualify Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire.

Self-Employed Florida Bad Credit Mortgage-No Tax Returns!

Self-Employed Florida Mortgage-No Tax Returns! Self-Employed Florida Mortgage Lenders Self-Employed As the economy for self-employed and other small-business economies more, business owners are in

ITIN Fort Myers Florida Bad Credit Bank Statement No Tax Return Mortgage Lenders

How To Get A Florida Mortgage With ITIN Number and No Tax Returns? Some Florida ITIN Mortgage Lenders Allow Multiple SS Numbers OK! Mismatch SS

No Income Verification Bad Credit Fort Myers Florida Investor Loans

Investment Income Florida Mortgage Lenders Florida No Income Verification Investor Loans — No Income Verification Florida Investor Loans Debt service coverage ratio Florida mortgage lenders

No Income Verification Florida Bad Credit Fort Myers Florida Mortgage Lenders

No Income Verification Florida Mortgage Lenders No Income Florida Mortgage Lenders Requirements Of Florida No Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten

Fort Myers Florida Bad Credit No Income Verification Investor Loans

Florida Investor Mortgage – Use the rental income to qualify for Investment homes! No Income Verification Florida Investor Loans= Income / Payment = 1 or

No Doc And Stated Bad Credit Fort Myers Florida Mortgage Lenders

Florida No Income verification mortgage programs. No No Doc, Florida No income verification mortgage program used to purchase a primary residence home or refinance your

Self-Employed Fort Myers Florida Mortgage Lenders

Self-Employed Florida Mortgage Lenders As the economy for self-employed and other small-business economies more, business owners are in need of self-employed financing but are often

Asset Based Bad Credit Fort Myers Florida Mortgage Lenders

Florida Asset Based Mortgage Lenders Qualifications Florida Asset Based Mortgage Lenders offers two Alt Doc programs where the borrower’s assets can be used to assist

Stated Income Bad Credit Fort Myers Florida Mortgage Lenders

Stated Income Florida Mortgage Lenders Requirements Of Florida Stated Income Mortgage Lenders Primary Residence & Second Homes Credit Underwritten Based on LTV, FICO, and Liquidity